S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Mar, 2025

By Brian Scheid

Continued spending by the wealthiest US consumers has kept inflation relatively heated, frustrating the Federal Reserve's efforts to slow price increases, but the recent equity market slide could provide a long-sought remedy.

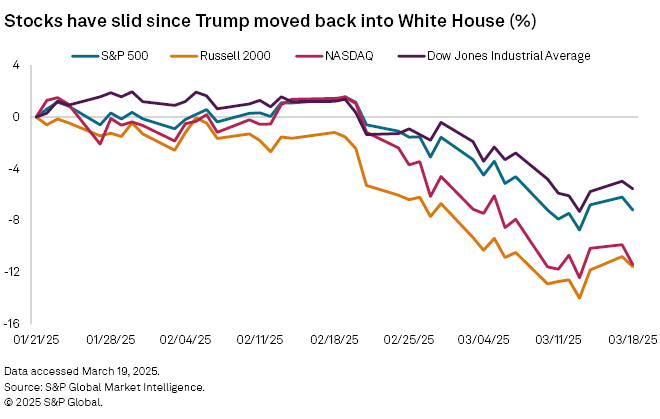

The S&P 500 in mid-March fell more than 10% from its all-time high reached Feb. 19, a market drop likely hurting the highest-earning households. That drop could cause inflation to make long-awaited progress toward the Fed's goal of a 2% annual increase, economists said.

"These households hold an outsized stake in the equity market, so the recent market slump will have a disproportionately large impact on their consumption spending," said Paul Gruenwald, global chief economist at S&P Global Ratings. "If this lower spending moves the demand and growth needle sufficiently, then inflation pressures are likely to be lower and the Fed is more likely to reduce its policy rates at a faster than expected pace."

Animal spirits

At play is an economic theory known as the wealth effect, where consumers with homes and investment portfolios increasing in value perceive themselves as more financially secure and start to spend more as their confidence in their wealth grows.

"Wealthier households are financially more secure and thus more able and willing to spend from their income," Mark Zandi, chief economist at Moody's Analytics, wrote in a recent paper. "That is, they save less than they would otherwise."

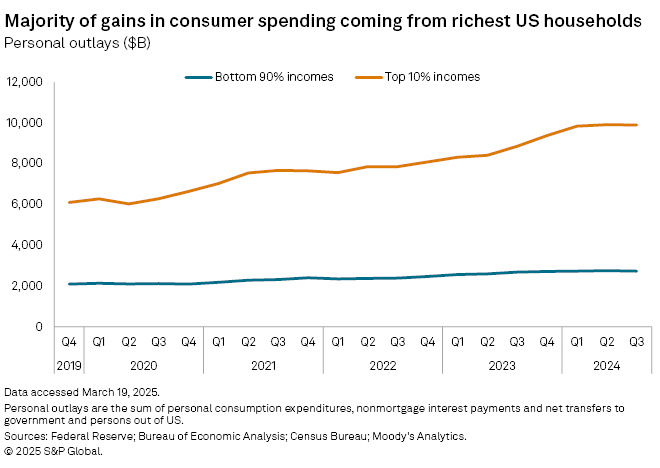

In an analysis of the latest government data, Zandi found that personal outlays by US households with the top 10% of incomes increased by nearly 26% from the third quarter of 2022 to the third quarter of 2024. Spending by American households in the bottom 90% of incomes increased only 14% over the same two-year stretch.

Much of the spending spike was propelled by the stock market rally. The S&P 500 climbed almost 175% to its February 2025 high from a March 2020 low set as the COVID-19 pandemic took hold.

"Strong markets make people more confident," said Paul Schatz, president of Heritage Capital. "That absolutely impacts the economy."

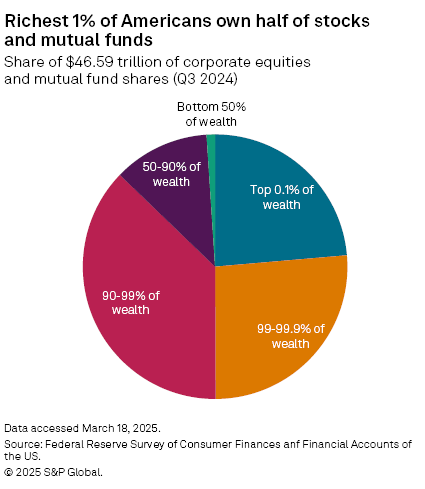

While consumer spending increased as confidence soared, the chief beneficiaries of the stock market rally were the most well-to-do American households, which hold outsized stakes in equities.

The top 1% wealthiest households held more than half of corporate equities and mutual fund shares as of the third quarter of 2024, according to the latest Fed data. The top 10% of households hold nearly 88% of stocks and fund shares, the data shows. As equities weaken, many of the wealthiest households may reduce their spending.

A sell-off in equities, and the expected economic slowing it would bring, will curtail inflation a bit, even if there is a temporary uptick in prices due to the effects of President Donald Trump's tariffs against America's largest trading partners, said Michael O'Rourke, chief market strategist with JonesTrading.

The impact will probably not be particularly dramatic in light of the large wealth gap in the US, according to O'Rourke.

"I suspect these wealthier individuals are so far ahead of most of the country that their spending slowdown to be a minor factor," he said.

Stubborn inflation, declining confidence

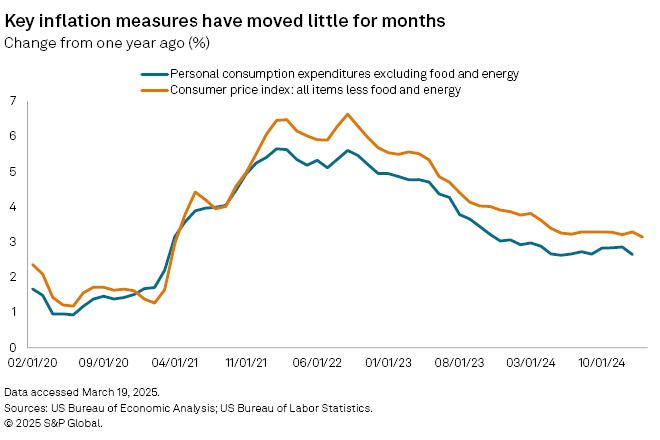

After year-over-year growth peaked above 6.6% in September 2022, the core consumer price index, which excludes volatile food and energy prices, tumbled more than 260 basis points to just over 4% in November 2023 as the Fed hiked rates aggressively.

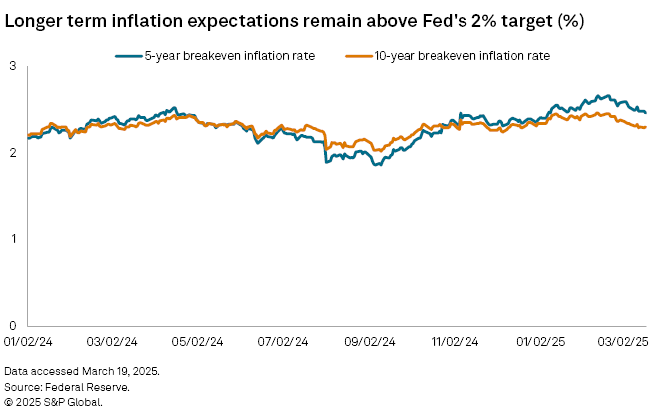

Since then, however, core inflation annual growth has dropped less than 90 basis points and has largely stayed within a range of 3.1% to 3.4%, making little progress toward the Fed's 2% goal.

The core personal consumption expenditures (PCE) index, the Fed's preferred inflation gauge, was at 2.6% in January, the lowest level since May 2024. Fed officials, in projections released March 19, estimated that annual core PCE growth would climb to 2.8% at the end of the year, largely due to the impact of tariffs.

While stock market performance may not be a true reflection of the state of the economy, slumping equities weigh on sentiment and confidence, said Bret Kenwell, a US investment and options analyst with eToro.

US investor sentiment in March slipped to its second-lowest reading in the monthly S&P Global Investment Manager Index survey, dating back to 2020. The Conference Board's Consumer Confidence Index in February registered its steepest decline since August 2021, the third consecutive monthly drop.

"Notable declines in investor sentiment, as well as consumer and business confidence, creates a fear that we could see a pullback in spending across the board," Kenwell said. "Whether that's from the C-suite level amid rising economic uncertainty or at the consumer level where individuals think of increased savings ahead of potentially harder times."

For now, investors, consumers and businesses all seem to be pulling back as they wait for more certainty from the broader economy.

"Increased certainty equals increased relief," Kenwell said. "But if uncertainty persists, so can the defensive posturing."