Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Mar, 2025

Global private equity and venture capital investments in fossil fuels are gaining momentum as major players in the oil and gas industry streamline their portfolios and divest assets.

Private equity investment in fossil fuel companies increased 131% year over year to $15.31 billion in 2024 and deal value for renewables rose about 64% to $25.91 billion, according to S&P Global Market Intelligence data.

The momentum for the sector was strong over the last two quarters of 2024, when private equity investment in oil and gas companies reached $10.17 billion, surpassing the $5.14 billion of private capital inflow to renewables companies.

The asset sell-off by large oil and gas companies is driving private equity acquisitions in both fossil fuels and renewables, according to Hargreaves Lansdown PLC environmental, social and governance analyst Joshua Sherrard-Bewhay.

"As the big oil and gas companies streamline portfolios, there will be opportunities for private markets," Sherrard-Bewhay wrote in emailed comments to Market Intelligence. "This period of divestment has also included a sizable chunk of renewable projects, so there should be opportunities there too."

It is unclear whether the deal momentum will continue in 2025. In January and February, private equity-backed oil and gas company deals reached $930 million across 11 deals, compared with $3.07 billion from 10 deals in renewables.

However, the nascent generative AI industry's demand for energy cannot be addressed by weather-dependent renewable energy, putting the investment spotlight on other energy sources such as fossil fuels.

Top oil and gas deals

The largest private equity deal in oil and gas in the first two months of 2025 was KKR & Co. Inc.'s $615.6 million planned acquisition of a 5% stake in Enilive SpA from Italian oil and gas major Eni SpA. The purchase adds to the 25% stake in Enilive that KKR agreed to acquire in 2024.

The second-largest deal was a Brookfield Asset Management Ltd.-led $281.6 million series C round for US-headquartered synthetic fossil fuels producer Infinium Holdings Inc. The company, which also received funding from technology giant Amazon.com Inc., plans to use the proceeds to expand its offerings in advanced energy solutions.

– Download a spreadsheet with data featured in this article.

– Learn more about private capital inflows to aerospace and defense.

– Read up on private equity trends in hydrogen.

Top renewables deals

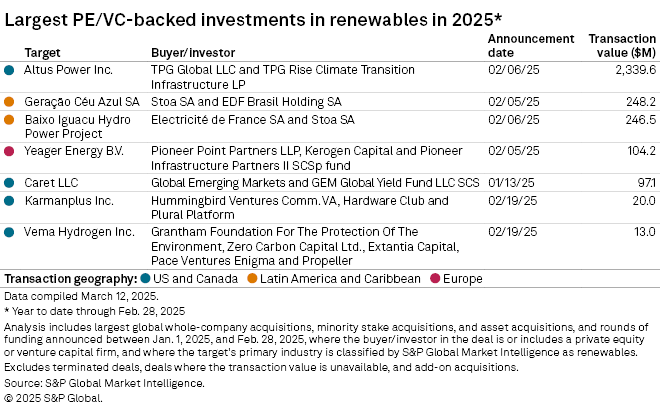

The largest private equity deal in renewables was TPG Global LLC's $2.34 billion proposed buyout of US solar energy company Altus Power Inc. TPG, through its TPG Rise Climate Transition Infrastructure fund, plans to take the company private.

The second-largest was Stoa SA and EDF Brasil Holding SA's $248.2 million deal to acquire Brazilian hydroelectric power plant operator Geração Céu Azul SA.

Slowdown in climate tech deals

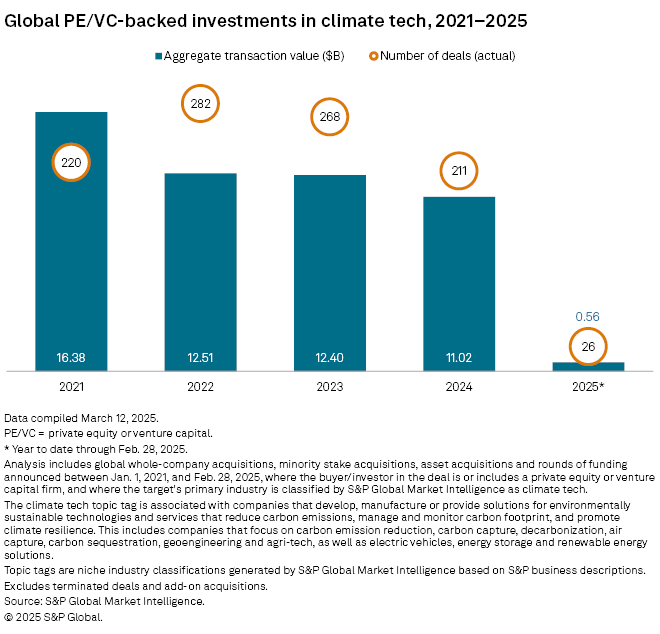

Private equity deal value in climate tech, a category of technologies aimed at mitigating climate change through emissions reduction, carbon sequestration and other methods, was $560 million across 26 deals in the first two months of 2025, according to Market Intelligence data.

However, the value of climate tech deals has been in a multiyear decline since 2021, when the segment attracted $16.38 billion.

Climate tech may slow further due to uncertainty in the US, which has placed the Inflation Reduction Act on hold.

Europe, by comparison, is expected to maintain regulatory stability, offering more opportunities, said Dörte Hirschberg, general partner at Climentum Capital Management ApS, in an interview with Market Intelligence. Hirschberg cited agriculture as a segment to watch as the industry shifts from fertilizers and pesticides, as well as battery technology companies.

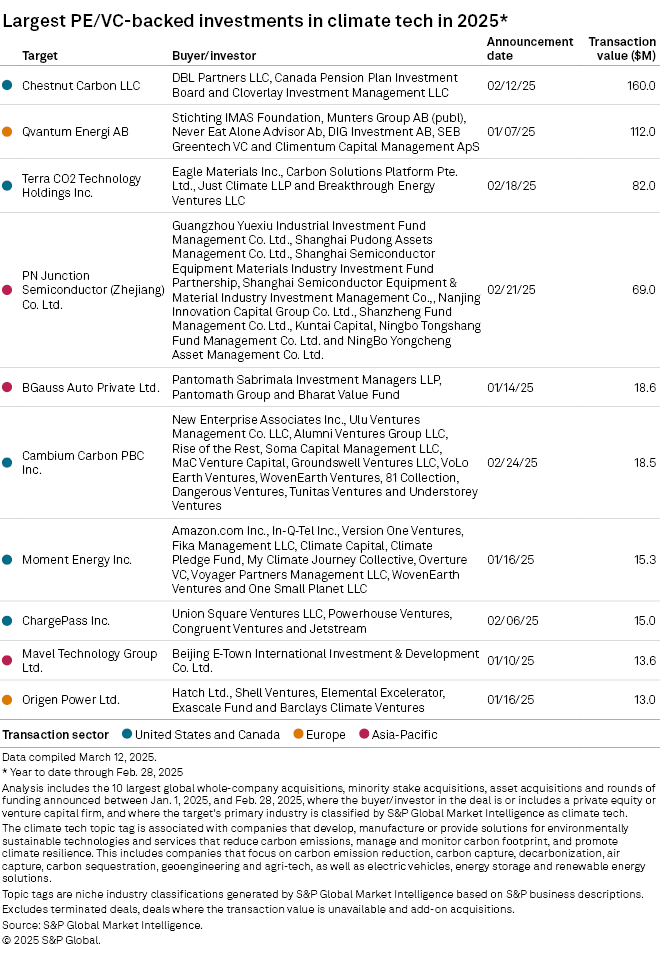

The largest private equity-backed climate tech deal in the first two months of 2025 was a $160 million series B round for reforestation company Chestnut Carbon LLC, with participation from Canada Pension Plan Investment Board and Cloverlay Investment Management LLC.

Hargreaves Lansdown believes policy is the largest driver in energy markets and that the new US administration's shift is already influencing the stability of the global energy industry.

"Uncertainty surrounding the energy transition largely stems from inconsistent policy, which in turn affects the entire energy supply chain," Sherrard-Bewhay wrote. "The US has been the loudest voice in this shift and we are experiencing the ripple effects of that."