Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Mar, 2025

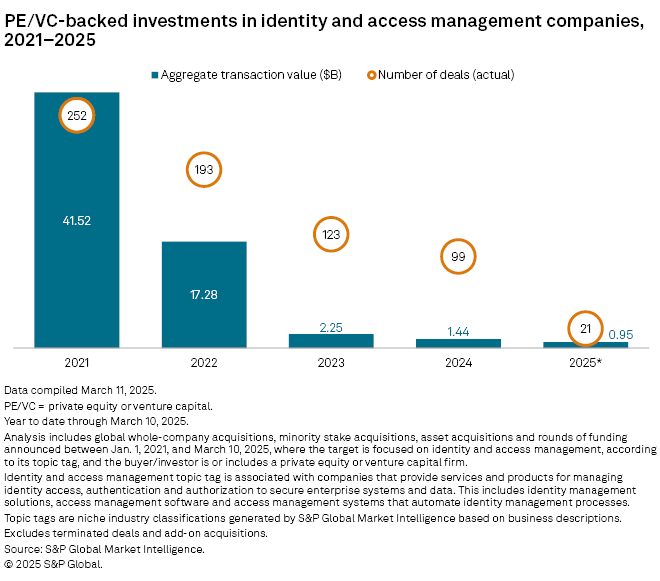

Global private equity and venture capital investments in cybersecurity have reached $950 million across 21 deals so far in 2025 and are well-positioned to exceed 2024 levels.

The aggregate transaction value in identity and access management — a key area in cybersecurity — as of March 10 already reached approximately 66% of the total transaction value recorded for the entire year of 2024, Market Intelligence data shows.

The analysis includes companies offering solutions for securing enterprise systems and data through identity access, authentication and authorization. Their products comprise identity management and access management software and systems.

Megadeal tailwind

Private equity interest in the sector could be amplified following the

Cyberstarts, Sequoia Capital Operations LLC, Index Ventures, Andreessen Horowitz LLC, Advent International LP and Greenoaks Capital Partners LLC were among the investors in Wiz expected to reap huge returns from their initial investments. Index Ventures, for example, is expected to receive a 250x return, or $4 billion on its initial $3.5 million investment, The Wall Street Journal reported.

"We are seeing a lot of venture capital and private equity continue to go into cybersecurity in general," Justin Lam, senior research analyst for information security at S&P Global Market Intelligence 451 Research, said in an interview.

"[V]aluations that are being commanded are still relatively high," Lam said. "Our current data show that funding rates are about 5x or 6x of revenues."

A key reason for high valuations is that clients tend to commit to one cybersecurity firm and stay for the long term.

"The percentage of recurring revenue and lower churn is much greater in cybersecurity companies," Lam said. "The fact that a company will stay around for a longer amount of time is also another attractive reason why people want to invest in cybersecurity."

As cyberattacks grow in sophistication and regulations become more stringent, organizations prioritize security and access management solutions. A Market Intelligence analysis indicates that cybersecurity was among the highest spending priorities of businesses in the fourth quarter of 2024.

– Download a spreadsheet with data featured in this article.

– Read about the top 15 global unicorns.

– Explore more private equity coverage.

The surge in investment value comes after a dismal 2024 for the sector, when global private equity and venture capital investments fell to $1.44 billion, down 36% year over year and continuing a three-year decline.

The multiyear decrease does not represent a lack of investment appeal but reflects an overall slide across most sectors since the peak activity in 2021, said Philippe Crochet, managing partner at Keensight Capital. Private equity's massive investment of $41.52 billion in 2021 resulted from a surge in worldwide demand for cybersecurity applications as most business was conducted remotely by virtual workers.

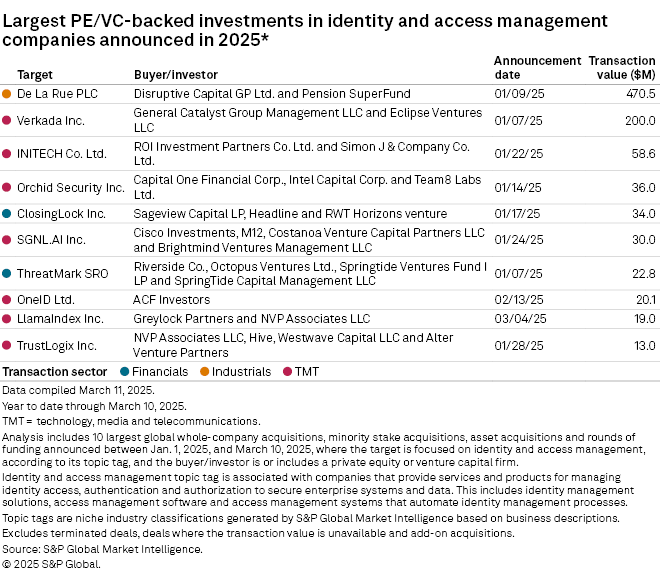

Top transactions

Disruptive Capital GP Ltd. and Pension SuperFund Capital's offer to acquire De La Rue PLC for $470.5 million was the year's largest transaction in the identity and access management space through March 10.

The second-largest transaction was the $200 million series E funding round for cloud-based building security systems developer Verkada Inc., led by General Catalyst Group Management LLC, with participation from Eclipse Ventures LLC and other existing investors.