Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Mar, 2025

By Malik Ozair Zafar and Tyler Hammel

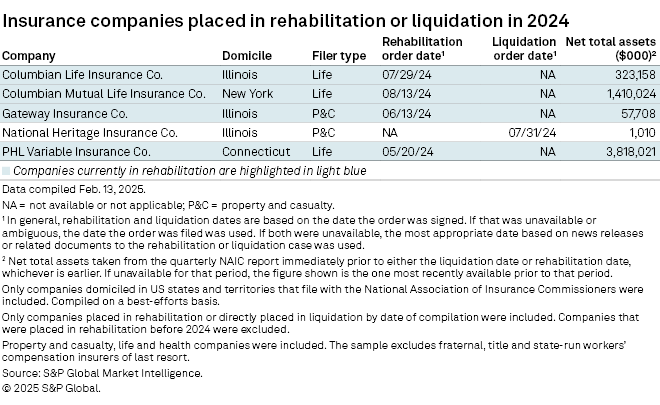

The number of US insurers placed into receivership in 2024 fell significantly from the previous year, with life insurers surpassing property and casualty carriers for the first time in eight years.

Regulators placed four insurers into rehabilitation and one into liquidation in 2024, down from 13 going into liquidation in 2023, according to an S&P Global Market Intelligence analysis.

Three of the insurers placed into receivership were life and health companies, and two focused on property and casualty (P&C).

Illinois overrepresented

Only one of the five companies placed into receivership was liquidated: Illinois-based P&C insurer National Heritage Insurance Co. Inc.

National Heritage Insurance was placed in liquidation by the Circuit Court of Cook County, Illinois, on July 31, 2024, according to court documents. Its assets totaled about $1 million at the time of its liquidation, a Market Intelligence analysis shows.

Three of the five companies placed into receivership in 2024 were domiciled in Illinois.

Another P&C insurer, Gateway Insurance Co., was placed in rehabilitation by the Circuit Court of Cook County, Illinois, in June 2024, according to court documents. Its assets totaled approximately $57.7 million when it entered rehabilitation.

The third Illinois-based insurer, Columbian Life Insurance Co.., was placed in rehabilitation in July 2024. The company's assets totaled $323.2 million at the time.

Life insurer Columbian Mutual Life Insurance Co. was placed into receivership in New York a few days later in August 2024. Its assets totaled roughly $1.41 billion.

A notice on Columbian Mutual Life Insurance's website detailed the receivership process and reassured customers that their policies remain intact.

"Upon entry of the Rehabilitation Order, the [Superintendent of the Department of Financial Services] will commence a review of the company's financial condition, and if possible, will develop a plan to return the Company to financial health," the notice reads.

Connecticut out front

The largest insurer placed in rehabilitation in 2024 was PHL Variable Insurance Co., which had assets totaling $3.82 billion when it entered receivership in May 2024.

A November 2024 court filing detailed the Connecticut rehabilitator's investigation so far and indicated that a plan of rehabilitation would be ready to be presented to the court by mid-2025.

"The first several months of the receivership focused on stabilizing [PHL Variable Insurance's] financial condition through the Moratorium and addressing related operational issues and [PHL Variable Insurance's] complex reinsurance program," the filing reads.