Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Mar, 2025

By Yuzo Yamaguchi and Uneeb Asim

Japan Post Bank Co. Ltd. is expected to explore building a lending business after its parent, Japan Post Holdings Co. Ltd., relinquishes majority control of the deposit-taking institution, a move that will challenge the quasi-government entity’s transition to a full-fledged bank.

Japan Post Bank will be free to pursue growth through new businesses once its parent's equity stake falls below 50% from the current 60%. The reduction is expected by the end of May.

But analysts anticipate challenges, including competition from well-established private-sector banks and Japan Post Bank's continued focus on rural areas. Although the bank will gain autonomy over major decisions that previously required government approval, it currently operates as a deposit-taking institution and primarily invests in domestic and foreign government securities.

"Japan Post Bank's true intention is to start lending services because they are a bank," said Eiji Taniguchi, senior economist at Japan Research Institute. "But entering this market means diving into a red ocean."

Fierce competition

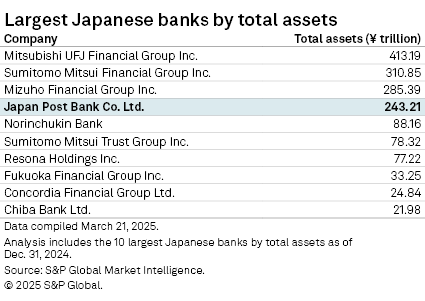

Japan Post Bank will face intense competition from incumbent megabanks — Mitsubishi UFJ Financial Group Inc. (MUFG), Sumitomo Mitsui Financial Group Inc. (SMFG) and Mizuho Financial Group Inc. — as well as regional banks already vying to attract deposits and issue loans amid rising local interest rates.

The bank must also contend with aging and declining populations in rural areas where most of its 24,000 outlets are located. This number is nearly double the total of all Japanese banks combined. Establishing a lending business would require Japan Post Bank to hire skilled bankers and invest in building necessary systems.

Rivals have expressed concerns about the potential new entrant.

"We strongly hope Japan Post Bank will ensure fair competition with other banks," the Japanese Bankers Association said in a Feb. 28 statement. As a government-backed institution, Japan Post Bank "receives more confidence from depositors than private banks," a spokesperson for the association said March 13, without elaborating.

A representative for MUFG declined to comment, while spokespeople for SMFG and Mizuho did not respond to emails from Market Intelligence.

Earlier attempt

Japan Post Bank applied to enter the mortgage loan business in 2012 but withdrew its application five years later after facing opposition from private-sector banks. A spokesperson declined to comment on the possibility of launching lending services, saying only it "may be an option to consider in the future."

Japanese banks have been competing aggressively for corporate and mortgage loans since the Bank of Japan ended its negative interest rate policy in March 2024. Lenders have also raised deposit rates to attract more funds and expanded lending to improve net interest margins.

MUFG increased its outstanding loans in and outside Japan by 6% year over year to ¥125.6 trillion as of December 2024. SMFG's global lending rose 9.3% to ¥106.7 trillion, while Mizuho's climbed 6.5% to ¥97 trillion during the same period. Regional banks reported a 3.7% year-over-year increase in outstanding loans in February, January and December 2024, according to Bank of Japan data.

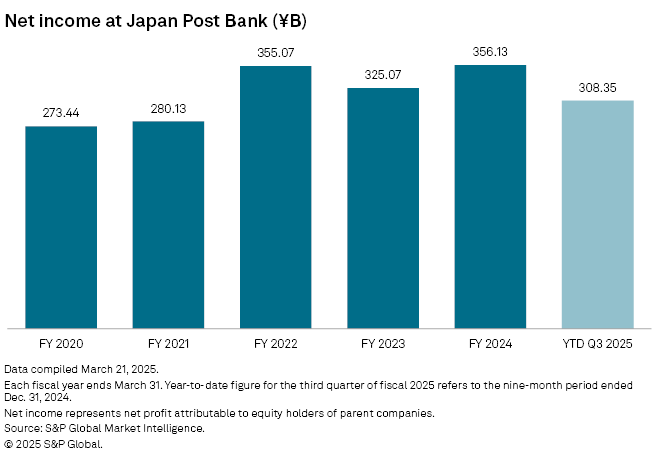

But Japan Post Bank posted a decline in outstanding deposits, which fell to ¥192.1 trillion in December 2024 from ¥194.9 trillion a year earlier. The bank has set a net income target of more than ¥400 billion for the fiscal year starting April 1, up from over ¥365 billion estimated for the year ending March 31.

Limited options

Japan Post Bank relies on investments in Japanese government bonds and foreign fixed-income securities for income. As of the fiscal year ended March 2024, it allocated nearly 50% of its ¥192 trillion in deposits to overseas fixed-income securities and 23% to Japanese government bonds.

"The [Japanese] government bonds would be risky to bet as interest rates are trending higher," said Toyoki Sameshima, a senior analyst at SBI Securities Co. "[Japan Post Bank] may make a latent loss from them."

It may take time for Japan Post Bank to enter the lending market and deliver results, Sameshima said.

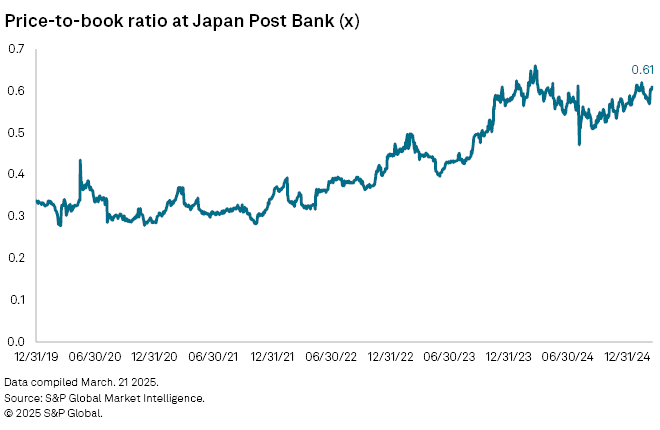

The lender's price-to-book ratio has remained around 0.6 since the beginning of 2025, well below the approximately 1.0 level for the three megabanks. Its share price has declined since announcing a share sale Feb. 27, erasing any positive sentiment about its business expansion.