Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Mar, 2025

By Brian Scheid

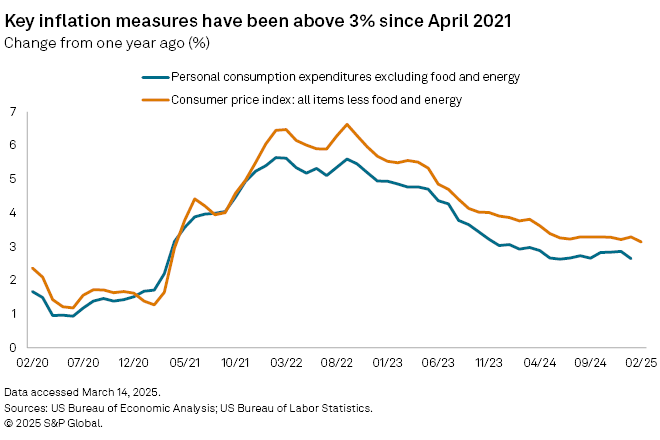

Faced with stubbornly steady inflation and a labor market that has begun to bend, Federal Reserve officials this week will almost certainly keep benchmark interest rates untouched while issuing a fresh perspective on the economic road ahead.

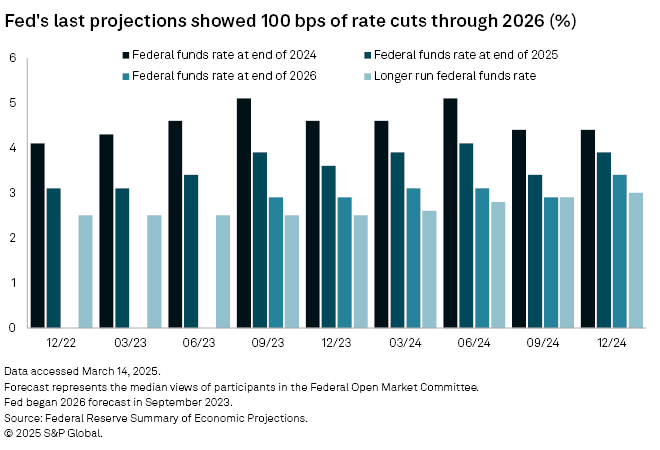

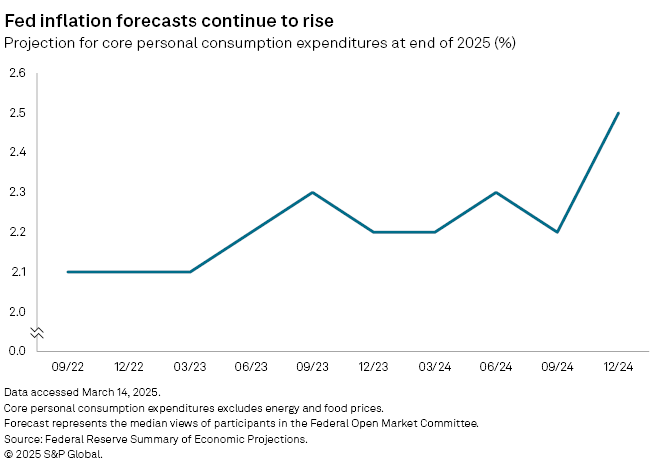

Fed officials will release a quarterly update March 19 summing up their expectations for economic growth, unemployment, inflation and benchmark rates for the next few years. The most recent predictions, released in December 2024, had a median projection of inflation slowly falling to the Fed's 2% target by 2027, with the joblessness rate slightly rising over that time, GDP growth cooling and the federal funds rate declining to about 3% in the long run.

However, with President Donald Trump unveiling billions of dollars worth of new tariffs every few days and ongoing efforts to gut federal government spending through unprecedented job cuts, economic uncertainty is spiking to levels last seen during the height of the COVID-19 pandemic. The path forward for interest rates is murkier than it has been in years.

"There's just too much concern about what could happen," said Patrick Leary, managing director with Loop Capital Markets. "It's a highly uncertain environment right now."

While Fed officials are expected to keep the benchmark federal funds rate steady within a target range of 4.25% to 4.5% at the next meeting, a slim majority of the futures market is betting that range will be lowered to 3.50% to 3.75% by the end of the year, according to CME FedWatch.

Fed Chairman Jerome Powell is poised to reiterate that US monetary policy will remain nimble with room to maneuver on rates as tariffs potentially multiply, immigration policy weighs on the labor market and inflation remains above the 2% target.

"If they need to cut because the economy shows more signs of weakness, they can do that," said Leary with Loop Capital Markets. "Certainly, no one's talking about rate hikes, but if there was a belief that there was going to be sustained levels of inflation, they could do that."

The Fed is facing mounting signs of stagflation — a mix of hotter inflation, rising unemployment and a recession — complicating the prospects of a soft landing.

"I think it's going to be a tough battle for them to get there without some kind of economic downturn," Leary said.

Fed officials this week will likely acknowledge a broader economic slowdown in the first quarter and could revise their interest rates forecast from December 2024's median view of 3.9% to as low as 3.7%, said Matthew Weller, global head of market research with StoneX and FOREX.com.

Powell said during a March 7 conference in New York that the Fed would take a "close look" at these projections and "compare ourselves to what other central banks around the world do."

Weller said Fed officials could also slash their median projections for US GDP, which was 2.1% for 2025 in the December 2024 projections, and increase inflation estimates, which was 2.5% for core personal consumption expenditures for 2025.

The new projections will represent a "mild downgrade" for economic growth and inflation, said Michael O'Rourke, chief market strategist with JonesTrading.

"Rates are expected to move lower, and I expect Chairman Powell to be more dovish due to the uncertainty created by policy changes such as tariffs and [federal job cuts]," O'Rourke said. "I believe the more dovish outlook and an assertion that the [Federal Open Market Committee] will respond to economic weakness will be the assurance that Chairman Powell provides."