S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Mar, 2025

By Tim Siccion and Shambhavi Gupta

Private equity investors are favoring Europe-based hydrogen opportunities over those in the US as the two regions' investment prospects diverge.

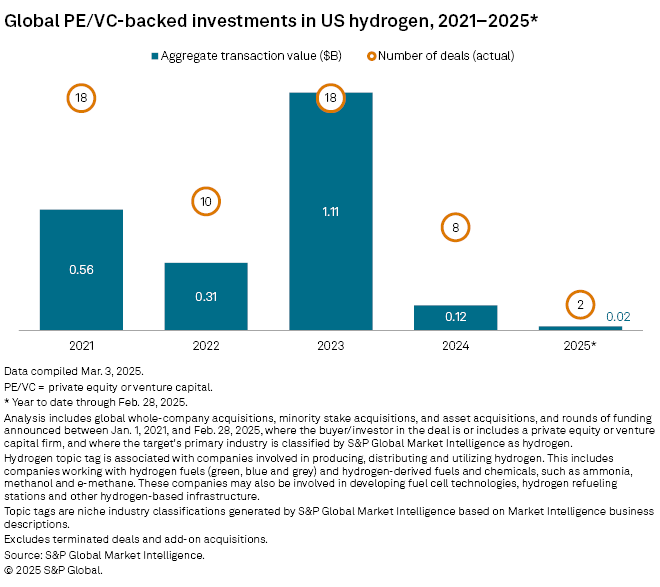

Private investment in US hydrogen plunged nearly 90% to $120 million across eight deals in 2024 from $1.11 billion across 18 transactions the year before, S&P Global Market Intelligence data shows. The drop coincided with rising concerns about US energy transition goals before the presidential election in late 2024.

"Following the executive orders, the US is not anymore an investable place for green hydrogen," said CEO of private equity firm Hy24 Pierre-Etienne Franc, referring to the US administration's Jan. 20 order to pause tax credits for renewable energy producers and investors.

Conversely, Europe's regulatory environment is a tailwind for the hydrogen industry's potentially strong growth.

"Europe is the number one favorable market right now for hydrogen," McKinsey & Co. Inc. Senior Partner Bernd Heid said, citing Europe's emissions trading system scheme and carbon border adjustment mechanism as supportive policies.

As of Feb. 28, seven global private equity-backed hydrogen deals worth an aggregate $80 million had been reported for the year to date, of which just two, worth a combined $20 million of the total, were US-based.

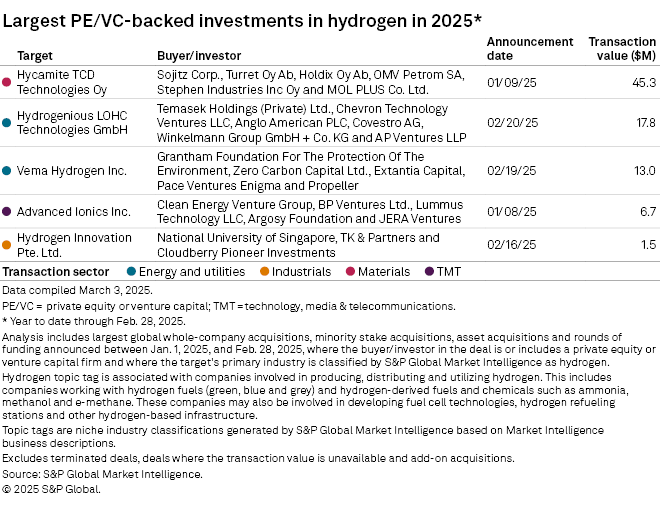

The $45.3 million series A round for Finnish hydrogen-producing technology developer Hycamite TCD Technologies Oy by an investor group including Stephen Industries Inc. Oy and MOL Plus Co. Ltd. is the largest private equity hydrogen deal in 2025 to date. Hycamite will use the proceeds to industrially scale its business.

The second-largest deal is a $17.8 million investment in German hydrogen storage container developer Hydrogenious LOHC Technologies GmbH by an investor group including Temasek Holdings (Pvt.) Ltd. and Chevron Technology Ventures LLC.

Globally, private equity investment in hydrogen deals fell by 40.4% in 2024, when 50 deals pulled in a combined $960 million. Deal value totaled $1.61 billion in 2023, Market Intelligence data shows.

In it for the long haul

Hydrogen is not typically classed as renewable energy, and not all production methods provide a reduction in emissions. But if it is produced using only renewable energy such as wind, solar or hydroelectric power, it is called "green hydrogen" and is considered renewable.

Hydrogen's commercial uses include refining petroleum and producing ammonia. It is also considered a potential substitute for fossil fuels in emissions-heavy industries including aviation and steel manufacturing.

Several auto manufacturers have launched hydrogen fuel cell cars, but the carbon-free variants, green hydrogen and blue hydrogen, have struggled to achieve mainstream adoption amid regulatory uncertainties and high production costs relative to conventional energy sources.

E-mobility, or electric-powered vehicles including bikes and scooters, along with heavy-duty trucking offer promising opportunities for investors willing to take a long-term view rather than the typical three- to five-year investment holding period, Heid said.

"Hydrogen e-mobility and heavy-duty trucking are meaningful markets; however, we will see [significant volume] most likely in 2032 and onwards," Heid said.

– Download a spreadsheet with data featured in this article.

– Catch up on private equity trends in February.

– Check out the world's largest unicorns.

Japan and Korea's ammonia industries also offer a significant opportunity, Heid said. Ammonia is a hydrogen-rich chemical compound that can be broken down into usable hydrogen molecules.

"Japan and Korea are exposed to that because they are so energy-short," Heid said, pointing to their lack of fossil fuel reserves. "For them to have a source of power generation, ideally clean power is so important."

Global hydrogen demand is forecast to rise to 150 million metric tons by 2030, about 50% more than the nearly 100 MMt reached by year-end 2024, according to the International Energy Agency.