Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Mar, 2025

By Maricor Zapata and Hussain Shah

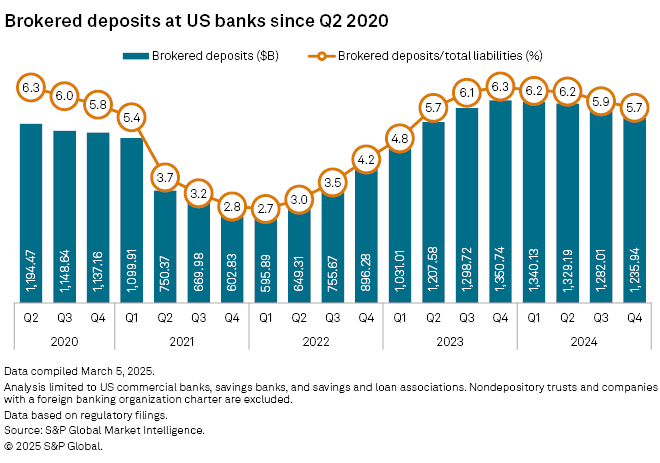

Brokered deposits at US banks decreased consistently throughout 2024 as a now-withdrawn proposal to limit them as a source of funds hovered over the industry.

US banks' brokered deposits fell to $1.236 trillion in the fourth quarter of 2024 from $1.282 trillion in the previous quarter and $1.351 trillion a year earlier, according to an S&P Global Market Intelligence data analysis.

The ratio of brokered deposits to US banks' total liabilities also fell to 5.7%, from 5.9% in the linked quarter and 6.3% in the year-ago quarter.

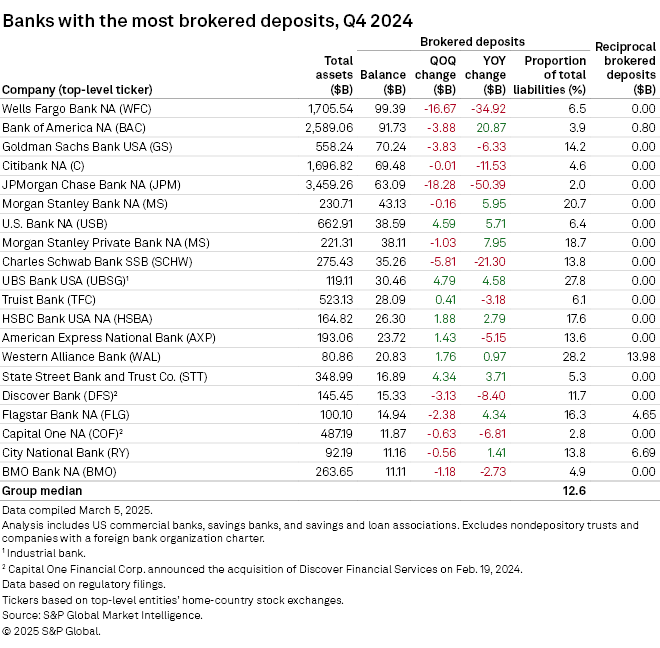

Wells Fargo still leads

Wells Fargo Bank NA still had the most brokered deposits among its peers in the fourth quarter of 2024 — $99.39 billion — although the amount was $16.67 billion less than the previous quarter's balance and down $34.92 billion from a year earlier.

Bank of America NA remained second with $91.73 billion, down sequentially by $3.88 billion but higher than the year-ago balance by $20.87 billion. Goldman Sachs Bank USA recorded the third-largest brokered deposit total, $70.24 billion, which was down by $3.83 billion sequentially and by $6.33 billion from a year earlier.

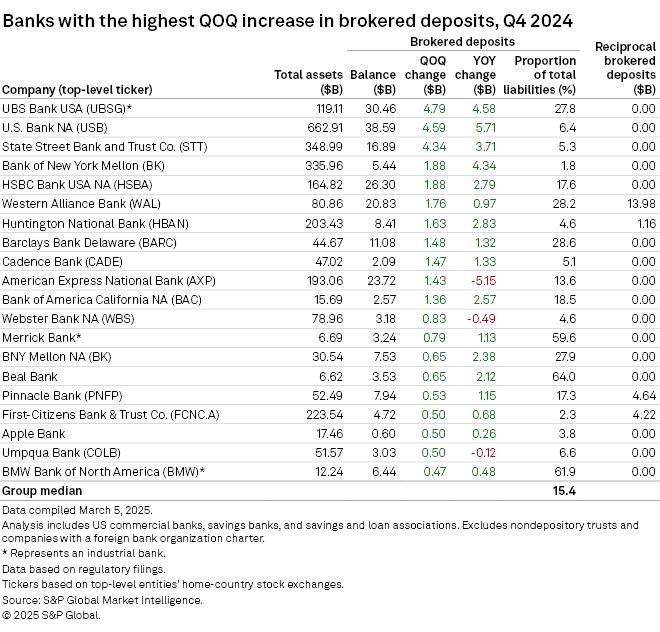

UBS Bank USA posts highest QOQ growth

UBS Bank USA, a US subsidiary of Swiss lender UBS Group AG, posted the largest sequential increase in brokered deposits in the fourth quarter of 2024, of $4.79 billion. It was followed closely by U.S. Bank NA with a $4.59 billion increase and by State Street Bank and Trust Co. with a $4.34 billion rise.

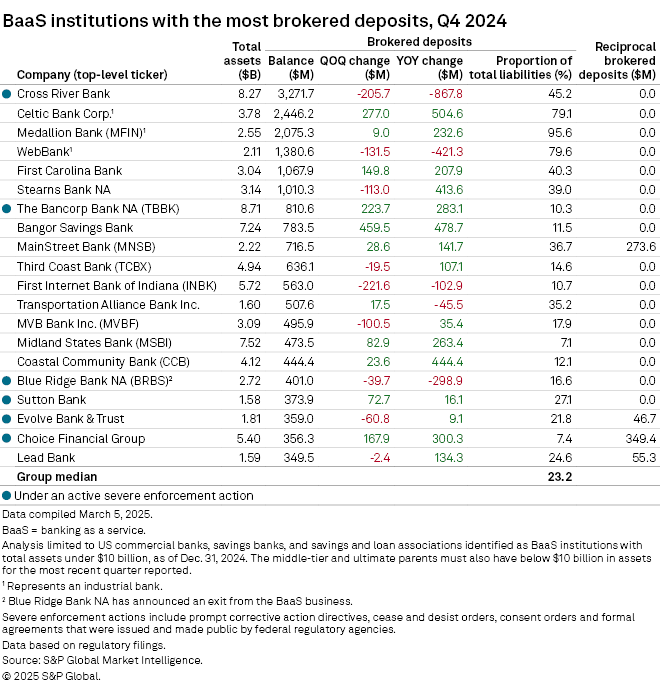

Brokered deposits at BaaS institutions rise

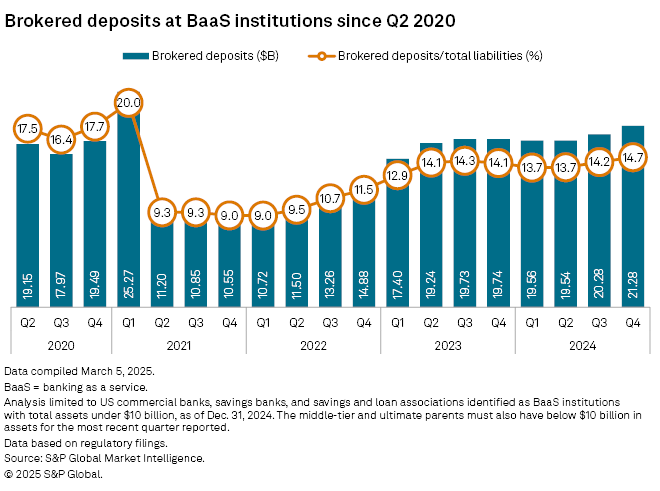

Brokered deposits at banking-as-a-service institutions rose in the fourth quarter of 2024. The sector posted a brokered deposit balance of $21.28 billion, up from $20.28 billion in the previous quarter and from $19.74 billion a year before.

The ratio of brokered deposits to the sector's total liabilities also edged higher to 14.7% from 14.2% in the previous quarter and from 14.1% in the year-ago quarter.

BaaS institutions with most brokered deposits

Among banking-as-a-service institutions with total assets under $10 billion, Cross River Bank still had the highest amount of brokered deposits at the end of 2024. The Fort Lee, New Jersey-based consumer lender posted a brokered deposit balance of $3.27 billion, which was down by $205.7 million from the third quarter of 2024 and by $867.8 million from the year-ago quarter. Brokered deposits accounted for 45.2% of Cross River's total liabilities in the fourth quarter of 2024.

Salt Lake City, Utah-based Celtic Bank Corp. had the second-highest brokered deposits in the group, with $2.45 billion. The total, which accounted for 79.1% of total liabilities, was up by $277.0 million from the previous quarter and by $504.6 million from the year-ago quarter.

Medallion Bank, also based in Salt Lake City, Utah, booked the third-largest dollar amount of brokered deposits in the fourth quarter of 2024 among fintech sponsor banks. The Medallion Financial Corp. subsidiary recorded brokered deposits of $2.08 billion, up by $9 million sequentially and by $232.6 million year over year. Brokered deposits accounted for 95.6% of Medallion Bank's total liabilities.