Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Mar, 2025

By Ranina Sanglap and Uneeb Asim

Australia's largest banks reduced their at-risk loans in 2024, reflecting a resilient customer base and an improving economic outlook.

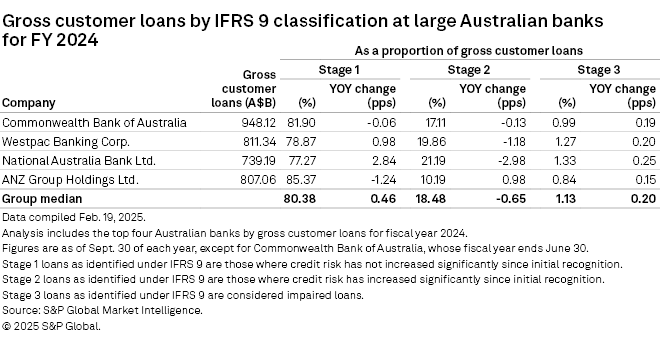

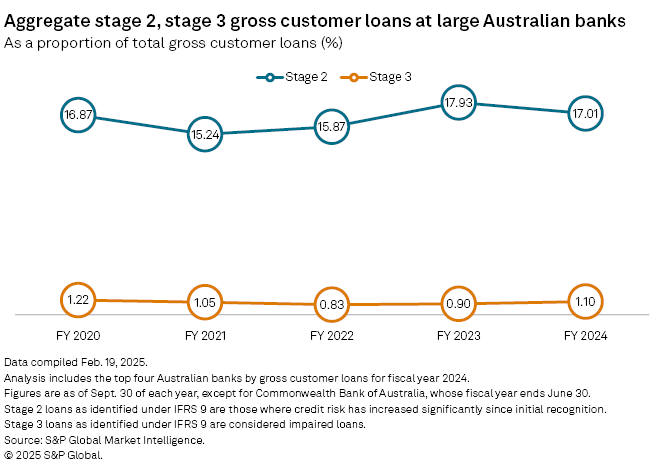

Stage 2 loans, which have seen a significant increase in credit risk since initial recognition but are not classified as credit-impaired, declined at Commonwealth Bank of Australia (CBA), ANZ Group Holdings Ltd., National Australia Bank Ltd. and Westpac Banking Corp. Aggregate stage 2 loans under International Financial Reporting Standard 9 (IFRS 9) fell to 17.01% as of Sept. 30, 2024, from 17.93% a year earlier, according to S&P Global Market Intelligence data.

Meanwhile, stage 3 loans, considered credit-impaired under IFRS 9, at the four biggest Australian banks rose to 1.10% in 2024 from 0.90% in 2023, Market Intelligence data showed.

Resilient customers

Households and businesses have shown greater resilience to higher interest rates than banks expected, aided by low unemployment and prudent lending practices. "Mortgage arrears and business loan defaults remain low, leading banks to reduce their stage 2 (underperforming) and stage 3 (credit-impaired) provisions," said Nico De Lange, a banking analyst at S&P Global Ratings, in an email to Market Intelligence.

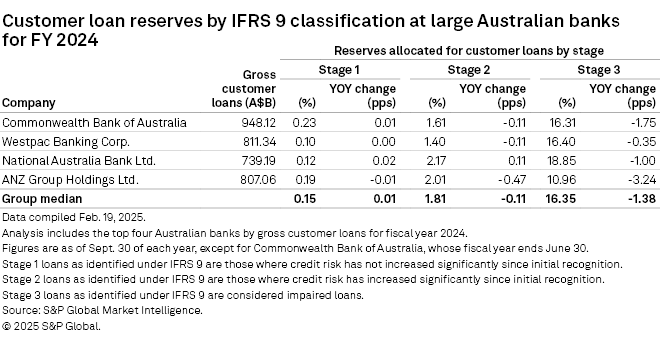

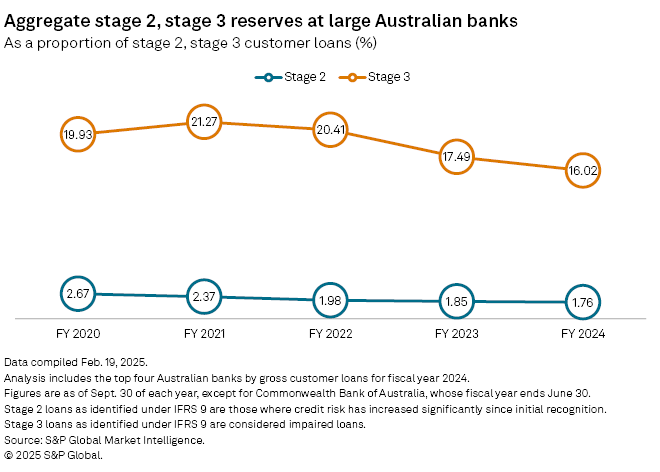

The four banks' aggregate reserves for stage 3 loans fell to 16.02% in 2024 from 17.49% in 2023, while reserves for stage 2 loans declined to 1.76% from 1.85%, according to Market Intelligence data.

Provisions declined as IFRS 9 follows a forward-looking model that requires banks to estimate and set aside funds for potential future loan losses, De Lange said. "Future economic scenarios therefore matter. Changes in macroeconomic forecasts and weighting of scenarios used in the [expected credit loss] models can lead to lower provisions if the outlook improves."

Stable outlook

Australia's economic outlook has largely stabilized, with the Reserve Bank of Australia expecting GDP growth to accelerate in 2025, driven by higher household consumption, according to its February monetary policy statement. The central bank projects underlying inflation to remain slightly above the midpoint of its 2%-3% target range by late 2025.

Australia's GDP grew 0.6% in the December quarter of 2024 and 1.3% for the year, the Australian Bureau of Statistics reported March 5.

Bank executives have also noted household and business resilience. ANZ Group CEO Shayne Elliott said in the bank's Nov. 8, 2024, full-year results that customers are "holding up better than expected" despite a rise in hardship support requests.

CBA CEO Matt Comyn said during the bank's fiscal half-year results Feb. 12 that while Australia's economy has slowed due to cost-of-living pressures, underlying inflation is easing toward the target range. "We expect Australia will follow offshore economies with an easing cycle starting in 2025. This should provide some relief to many households and improve business confidence," Comyn said.

CBA's total provisions for impairment losses rose 3% in the half to A$6.03 billion from A$5.91 billion. The other three major banks, which report earnings on a fiscal year ending Sept. 30, also increased their total provisions.

"We're forecasting that major banks' credit losses should remain low over the next two years — at about pre-pandemic levels of 15 basis points of total outstanding loans," said De Lange. "We believe that relatively low unemployment, modest economic growth and a change in spending patterns will shield borrowers against a high interest burden."