S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Mar, 2025

By Yuvraj Singh and Uneeb Asim

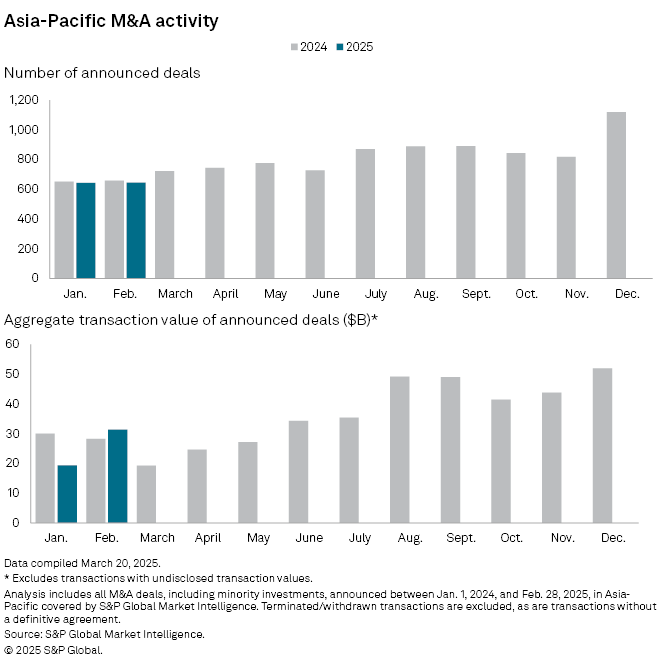

M&A activity in Asia-Pacific, measured by the aggregate value of deals, increased in February, indicating growing optimism for bigger deals as interest rates stabilize.

Deals totaling $31.36 billion were reported in the region in February, an 11% year-over-year increase from the same month in 2024, according to data compiled by S&P Global Market Intelligence on a best-efforts basis. The aggregate deal value increased 70% compared to the previous month. However, the number of transactions was flat, the data shows.

"Capital is flowing again, but dealmakers remain very selective," Mazlee Junid, director, corporate finance at Pitcher Partners in Perth, Australia, told Market Intelligence via email. "Large-cap transactions, including platform acquisitions and carve-outs, and smaller bolt-ons are dominating the Asia-Pacific M&A, while midsized deals continue to lag."

Growth drivers

Pitcher Partners, an advisory firm, expects greater cross-border strategic activity, particularly from sovereign wealth funds and multinational companies seeking to grow their footprint, as well as a higher interest in divestitures and geo-splits as companies look to unlock trapped value from underperforming or noncore assets, Junid said.

"Stabilizing interest rates and narrowing valuation gaps are encouraging more actionable conversations. That said, the outlook remains mixed depending on geography and sector," Junid added.

Dealmaking picked up after August 2024 as it became clear that the global interest rate cycle had turned and major central banks started easing monetary policy. It hit a snag after US President Donald Trump took office in January and announced a raft of tariffs that upset global trade sentiment. Amid the uncertainty, the M&A transaction amount in Asia-Pacific dropped to $18.51 billion in January from an average of $47.12 billion in the last five months of 2024.

The decline in deals was not a homogeneous trend throughout the region. M&A activity in China decreased by 8% year over year, totaling 99 transactions, while Australia experienced a 23% decline. In contrast, activity grew in India and Japan. Deals in India increased 7% year over year to 120 and rose 23% in Japan to 174, according to Market Intelligence data.

According to Deloitte's Asia Pacific Private Equity 2025 Almanac published Feb. 24, hot markets such as India and Japan are attracting strong interest. India remains a top choice due to its stronger economic growth, while Japan has become more accessible to overseas investors. Geopolitical tensions and slowing growth in China have been a drag on deal activity in the world's second-biggest economy, according to the report.

Major deals

South Korea-based Careena Transportation Group Ltd.'s acquisition of LOTTE rental co.ltd. from a group of investors in a $3.81 billion deal was the biggest M&A transaction in February.

Bain Capital Pvt. Equity LP's takeover of Japanese pharmaceutical company Mitsubishi Tanabe Pharma Corp. from Mitsubishi Chemical Group Corp., worth $3.36 billion, was the other major deal.