S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Sep, 2022

In paying a high price for an attractive target, Adobe Inc. is making a very 2021 move in late 2022, and investors are dubious amid turbulent times.

The creative software company on Sept. 15 reported mixed quarterly results and announced the $20 billion acquisition of Figma Inc., a small private company operating in the same segment.

Adobe will pay an eye-popping premium for the target at about 50x Figma's expected 2022 annual recurring revenue and 2x its most recent pre-money valuation. Such high valuations may have been less surprising during the record technology M&A run in late 2020 and through 2021, but it is less congruent with the increasingly cautious market of 2022.

On earnings, Adobe posted modest profit beats and a slight miss on revenue compared to analyst forecasts, according to S&P Capital IQ consensus estimates. But those metrics also underscored a dramatically decelerating business for the company, with revenue growth decelerating by 58% compared to the prior year.

Ultimately, investors were displeased, selling off 16.8% of Adobe's stock in a day.

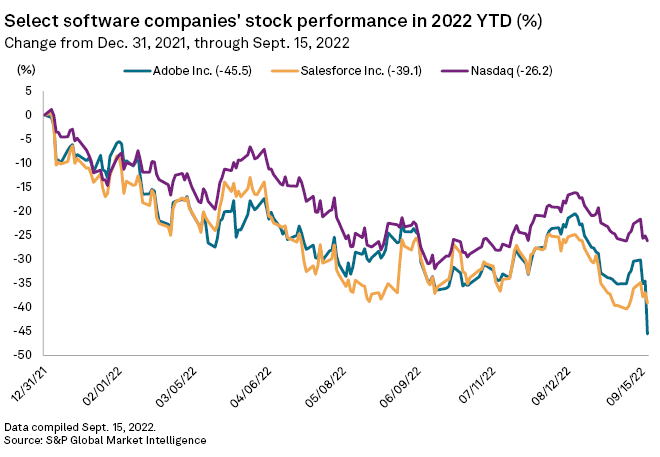

Traders seem particularly skeptical of mature software-as-a-service, or SaaS, companies. For example, Salesforce Inc. is one of Adobe's most comparable peers by market capitalization and financial performance. Year-to-date through Sept. 15, Salesforce shares are down 39.1%. Adobe's shares have dipped 45.5% over the same period, including the drop after the Figma deal announcement.

The bearish turn for SaaS equities comes despite generally upbeat analyst commentary about the low-expense, high-margin business. For example, average analyst ratings for both Adobe and Salesforce are in the "buy" and "outperform" range, according to S&P Global Market Intelligence.

Figma runs gross margins in the 90% range, Adobe CFO Daniel Durn said during a Sept. 15 earnings call. Adobe itself holds more cash and short-term investments than it does debt, making it one of the few publicly traded technology companies with negative net debt, according to Market Intelligence data. The company will pay Figma's gold-plated price tag with cash, stock and possibly a short-term term loan, so even its largest acquisition to date will not stir Adobe's serene balance sheet.

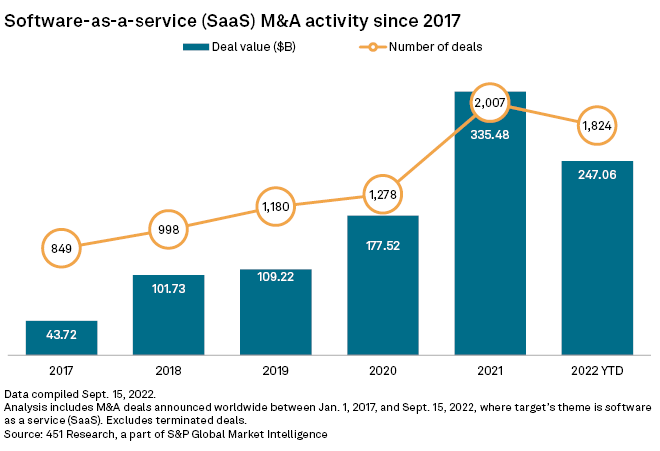

While investors may have turned negative on high-profile SaaS stocks, M&A buyers have seen considerable value.

Deal volumes and values for SaaS vendors have been climbing steadily over the years, and 2022 is keeping pace with records set in 2021. For M&A transactions targeting an SaaS company, deal volumes grew to 2,007 transactions in 2021 from 849 in 2017. Deal values skyrocketed to $335.48 billion from just $43.72 billion over the same period, up over 7x. Year-to-date, SaaS deal volumes reached 1,824 transactions and aggregate values were at $247.06 billion, according to 451 Research.

Illustrating the exploding investment interest on the part of corporate buyers, the 10 largest strategic SaaS transactions over the past 20 years have been announced since 2019, and only two carried trailing revenue multiples under 10x. The Figma acquisition is the sixth-largest SaaS deal, and Adobe is paying its premium at a time when other corporate buyers are putting their M&A strategy on ice. The average price-to-revenue multiple for technology transactions involving a strategic buyer dropped to 1.8x in July and early August, according to 451.

One of the highest SaaS M&A valuations came from Salesforce, which bid 36.4x trailing revenue for Slack Technologies in 2020. The largest SaaS transaction of all time, Broadcom Inc.'s $61.00 billion bid for VMware Inc., carried a trailing revenue multiple of 5.3x.

Adobe did not provide specific trailing-revenue metrics for Figma in its acquisition announcements, but the buyer did indicate that Figma will cross $400 million in annual recurring revenue in 2022 after adding $200 million since 2021. That puts the price tag at about 50x 2022 annual recurring revenue and 100x 2021 annual recurring revenue.

That implies an easy frontrunner for the highest trailing-revenue valuation among the top 10 SaaS transactions since 2002.

451 Research is part of S&P Global Market Intelligence.