Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 08, 2022

India’s new DSM regulations: Wind plants may become unviable as their cost of deviation increases four folds

The deviation settlement mechanism (DSM) regulation has undergone various changes since its launch in January 2014. The first major update was introduced in November 2015, when a separate deviation structure and pricing structure were implemented for the renewable generators. Further, the fourth amendment in 2019, linked the deviation charges to the daily average market prices discovered in the day-ahead market (DAM) segment on the power exchanges.

While, recently, in March 2022, the Indian central regulator (CERC) notified the new DSM regulations, which links the deviation charges to the time block-wise market prices including new market segments on the power exchange. Although the regulations have been notified, they have not been implemented yet because of the preparatory work on the several changes identified.

The new regulations link deviation charges to market prices, thereby increasing market price risk for the power plants. The new DSM regulations links deviation charges to time-block wise prices discovered in the day-ahead market (DAM), real-time market (RTM), and ancillary services market (ASM), instead of average day prices in the DAM. At one hand, the deviation bands have been tightened, because of which plants will be penalized more with the same level of deviation as before. On the other hand, the deviation penalties have been linked to market prices (instead of the PPA price, a predetermined and controllable parameter), which has exposed power plants to market price risk.

Existing wind plants may become unviable as their cost of deviation is expected to increase. The new regulations have been made applicable to all plants, including the existing renewable capacity. For existing wind plants, the cost of deviations could potentially increase to 5-6% of the total revenue (from current levels of 1-2%).

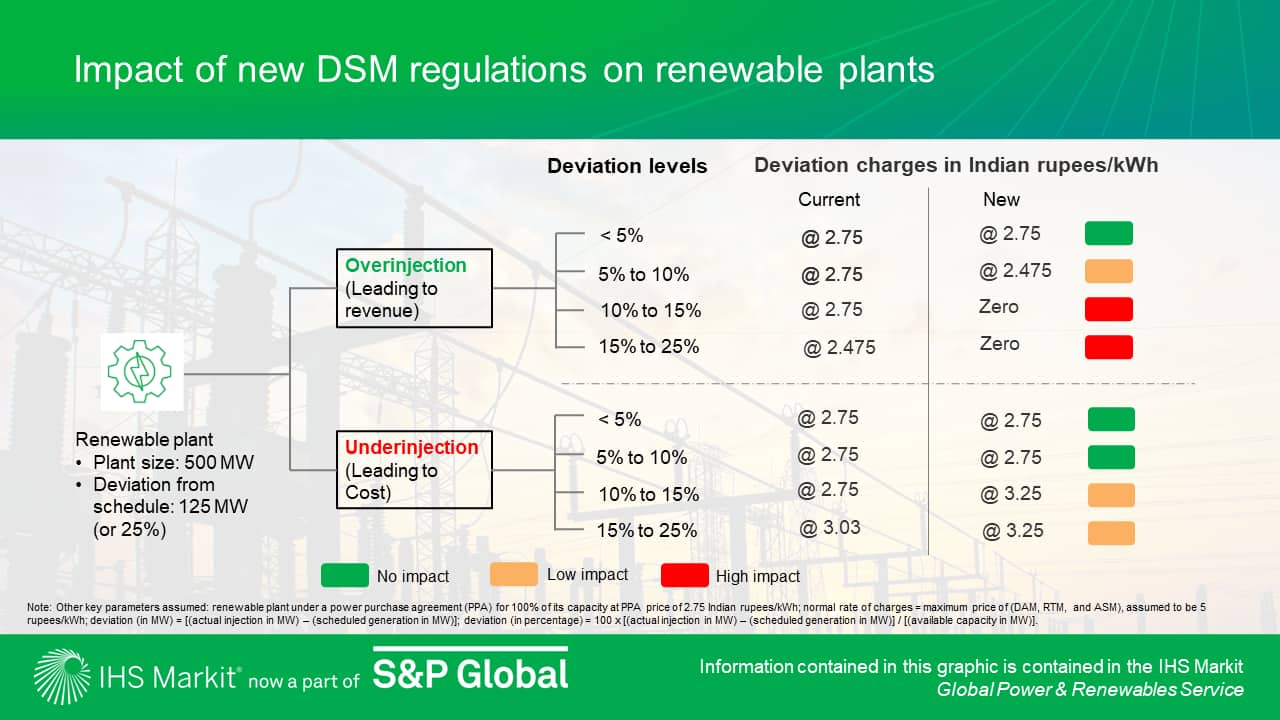

Figure illustrates the impact of the change in DSM regulations on a wind power plant (of 500 MW) with a deviation of 125 MW (or 25%) in a particular time block where DAM prices are 5 Indian rupees per kWh. For overinjection, the average revenue declines from 2.64 Indian rupees per kWh (based on current regulations) to 1.05 Indian rupees per kWh (based on new regulations). This is a significant loss of revenue for a wind plant. Similarly, for underinjection its average cost would increase from 2.86 Indian rupees per kWh to 3.05 Indian rupees per kWh.

Further, the central regulator intends to uniformize the deviation structure between conventional and nonconventional capacity in the future. This would mean that deviation bands for power plants will be tightened even further. This signals that existing plants will face greater regulatory risk in the future as well.

To avoid these impacts, wind plants will be required to invest in better forecasting technologies or install battery storage systems. This additional cost will cut directly into the project internal rates of return (IRRs) and returns on equity (ROEs). On the other hand, new renewable plants that are still under bidding would need to recalibrate their bidding strategies and account for the increased regulatory risk. This could potentially impact the tariffs in future bids.

So far, the central regulator has not indicated any intentions to provide relief to existing capacity on these accounts. Further, currently the renewable lobby is opposing the new DSM framework for the want of keeping existing renewable plants out. Therefore, the implementation is likely to be delayed.

Learn more about our research into the global power and renewable energy markets.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2findias-new-dsm-regulations-wind-plants-may-become-unviable.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2findias-new-dsm-regulations-wind-plants-may-become-unviable.html&text=India%e2%80%99s+new+DSM+regulations%3a+Wind+plants+may+become+unviable+as+their+cost+of+deviation+increases+four+folds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2findias-new-dsm-regulations-wind-plants-may-become-unviable.html","enabled":true},{"name":"email","url":"?subject=India’s new DSM regulations: Wind plants may become unviable as their cost of deviation increases four folds | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2findias-new-dsm-regulations-wind-plants-may-become-unviable.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=India%e2%80%99s+new+DSM+regulations%3a+Wind+plants+may+become+unviable+as+their+cost+of+deviation+increases+four+folds+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2findias-new-dsm-regulations-wind-plants-may-become-unviable.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}