Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 30, 2022

International renewable energy credits are emerging as transitional option to virtual PPAs in India

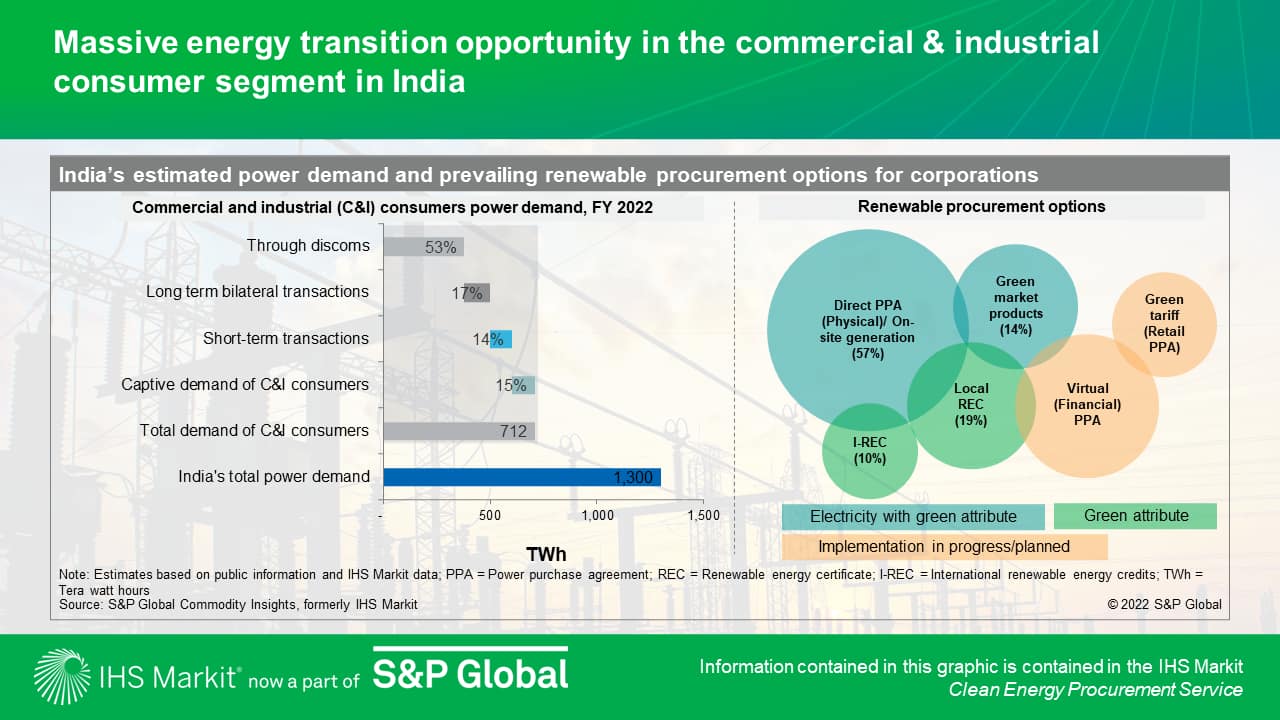

Corporate renewable contracts are rising in India as the sustainability targets and favorable economics of wind and solar drive procurement decisions. Overall, the current corporate renewable market is estimated to be more than 14 GW dominated by physical procurement of electricity through captive or open access route. In the first six months of 2022, more than 4.5 GW of renewable power purchase agreements (PPAs) were announced from commercial and industrial (C&I) consumers from various sectors including materials, manufacturing, and services.

C&I consumers offer an opportunity of more than 700 TWh for energy transition. IHS Markit estimates that the total renewables demand for renewables from C&I sector could range between 40 to 100 GW by 2030 increasing by an average 13%-25% annually across policy, moderate, and high renewables scenarios. Current procurement options are dominated by direct/physical PPAs, and the developers are offering hybrid wind-solar solutions to increase load share supplied by renewables. Even so, direct PPAs can allow corporations to meet only up to 30 to 40% of their demand, they are complex layered with high regulatory risk at federal and states level and hence remain the biggest bottlenecks for direct PPAs.

To address the corporate demand different modes of procurement are emerging such as short-term green open market, green tariffs, and I-RECs. The short-term market segment currently represents about 2% of India's renewable generation but is expected to grow with market maturity and improved market liquidity. However, the price volatility and supply uncertainty risks associated with these options make them a fallback option compared to securing green electricity through long-term contracts. While the current structure of green tariff does not track unique green attributes thereby fails to fulfil the additionality requirement to meet the sustainability targets.

Globally VPPAs have emerged as a popular procurement option for corporate to meet the sustainability goals while in India they are at very nascent stages and lack of clarity on market instruments. VPPAs have a strategic advantage over physical procurement options as they can provide the consumers a hedge from the market volatility and avoid the high regulatory risks of physical PPAs. However, a partially regulated market raises apprehensions among the financial regulators limiting the growth of VPPAs. Further reforms required to expedite the introduction of financial instruments in electricity market along with the ongoing market transformations to enable adoption of virtual PPAs at scale. In the meantime, I-RECs are emerging as transitional option for Indian IPPs to tap residual renewable demand of corporations with 100% corporate renewable targets.

Learn more about our clean energy procurement research as well as our broader energy research in Asia Pacific.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2finternational-renewable-energy-credits-are-emerging.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2finternational-renewable-energy-credits-are-emerging.html&text=International+renewable+energy+credits+are+emerging+as+transitional+option+to+virtual+PPAs+in+India+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2finternational-renewable-energy-credits-are-emerging.html","enabled":true},{"name":"email","url":"?subject=International renewable energy credits are emerging as transitional option to virtual PPAs in India | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2finternational-renewable-energy-credits-are-emerging.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=International+renewable+energy+credits+are+emerging+as+transitional+option+to+virtual+PPAs+in+India+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2finternational-renewable-energy-credits-are-emerging.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}