Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 05, 2021

E&P on trial: Climate litigation shaping upstream investment risk

This year's landmark rulings in Milieudefensie v Shell and Neubauer, et al. v. Germany show how quickly the legal risks to pursuing a moderately responsive climate strategy in the energy sector more broadly and the upstream in particular are shifting. Evolving climate science and enhanced country-level emissions reduction targets have provided grist for new legal arguments to be deployed in an expanded set of jurisdictions in a way that is starting to play into upstream strategy and investment calculations for governments and companies alike.

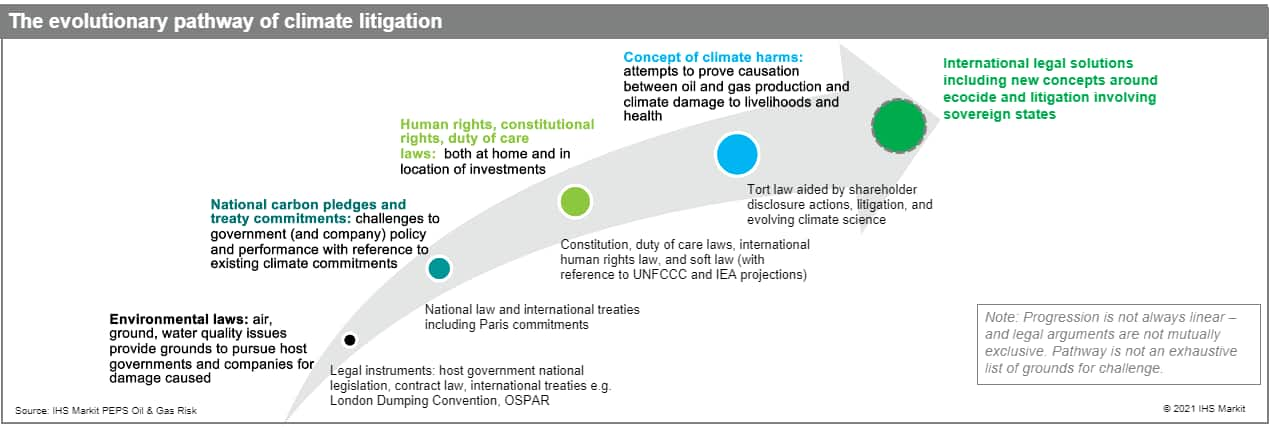

The legal justifications to scrutinise industry practices are

broad and expanding, stepping out from complaints focused on

specific instances of pollution or damage, into an examination of

the consistency of upstream and energy policies with national

environmental and net-zero pledges. Increasingly, suits attempt to

link the effects of fossil fuel use with fundamental human rights

as laid out in national constitutions and international treaties,

the premise of both Milieudefensie and Neubauer,

which resulted in initial rulings that will require increased

action on emissions by Royal Dutch Shell and the German federal

government respectively (the former has provisional enforceability,

although it is subject to appeal). The concept of climate harms and

damages for historic emissions seems a possible next staging post

in the evolution of litigation (see graphic), supported by evolving

climate science around attribution. International law may also come

into play in a more significant way - via advisory rulings from the

International Court of Justice and/or new climate emergency

concepts around ecocide.

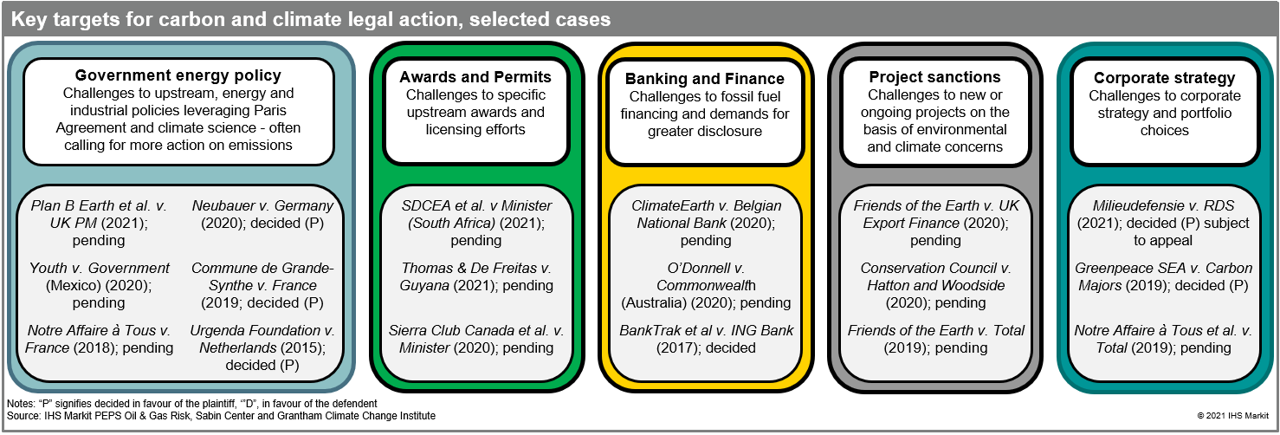

Our recent report "E&P on trial: Climate litigation shaping E&P investment risk in the global upstream" looks at these trends in more detail, seeking to map out how rulings might play into the upstream plans of different producing states, as well as those hosting upstream companies and providing energy finance. While government policy has featured the highest case-load to date, specific exploration awards, project sanctions, and finance are increasingly in the spotlight, along with the corporate strategy of major listed companies. Not all outcomes are favourable to plaintiffs, with the pushback on efforts to cancel Arctic licensing in Norway an example of where courts have so far been reluctant to tread: Responsibility for Scope 3 emissions from energy use has still to be definitively agreed. Where plaintiffs have achieved success, an echo effect is evident as NGOs and civil society groups in different jurisdictions adapt winning strategies and arguments to their own legal environments, supported by a growing body of case law including that from multilateral venues such as the European Court of Human Rights whose rulings have more widespread application.

Not surprisingly, the reach of climate litigation is not uniform, but where it is directly focused, we anticipate greater policy volatility, regulatory burden, and overall contract risk in producing states with active civil societies, strong rule of law, and/or exposure to investors and finance from countries where such dynamics are in play. Set against this, a belated industry pushback is in motion, albeit less visible, invoking investor protections and highlighting the role of oil and gas in socio-economic development, potentially creating challenges for countries minded to change course. The scope and intensity of these dynamics suggests that climate litigation will be a key factor shaping the trajectory of the energy transition and the investment impacts on oil and gas producing countries and companies that the IHS Markit PEPS group will continue to evaluate and monitor.

Screen upstream opportunities and above-ground risk with PEPS from IHS Markit - Learn More.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-litigation-and-upstream-investment-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-litigation-and-upstream-investment-risk.html&text=E%26P+on+trial%3a+Climate+litigation+shaping+upstream+investment+risk+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-litigation-and-upstream-investment-risk.html","enabled":true},{"name":"email","url":"?subject=E&P on trial: Climate litigation shaping upstream investment risk | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-litigation-and-upstream-investment-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=E%26P+on+trial%3a+Climate+litigation+shaping+upstream+investment+risk+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-litigation-and-upstream-investment-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}