Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

REITs’ Modest Rebound

Real estate investment trusts are an asset class in which investors can own shares in an entity that owns and operates income-generating real estate. US REITs in particular are popular with income-oriented investors as these REITs distribute 90% of their taxable income as dividends. In the early days, most REITs were generalists that owned a wide range of real estate assets including office space, hotels, retail and residential. However, REITs have grown more specialized over time; there are REITs for datacenters, timber, self-storage, healthcare and factory outlets. REITs that make money by owning and renting out real estate are referred to as equity REITs. Mortgage REITs, on the other hand, lend money to real estate owners, either directly or through mortgages. Due to certain changes in society accelerated by the COVID-19 pandemic, including online shopping and remote work, REITs have experienced higher volatility in valuation and dividends in the last three years. But many US and Canadian REITs have undergone a modest return to form in the last few months.

The value of US REIT capital offerings more than tripled month over month in September after a slow August. While a positive development, this was about half the value of US REIT capital offerings a year earlier. Communications-related REITs experienced most of the growth in September. This reflected an ongoing trend of specialty REITs, including advertising, casino, communications, datacenter, energy infrastructure, farmland and timber real estate, receiving the lion’s share of capital raised in 2023.

Canadian REITs enjoyed a strong third quarter. Capital offerings raised a healthy C$987.7 million, higher than the C$721.3 million raised in the second quarter and more than six times the offerings raised in the same quarter of 2022. Retail REITs were far and away the best performers in Canada.

Given the importance of dividend payments for income-focused REIT investors, 2023 has shown improvement. As of Sept. 30, 61 US REITs had announced dividend increases, accounting for about 39% of US REITs, and seven Canadian REITs had announced dividend hikes. Industrial, residential and self-storage REITs led the way on dividend increases, while office REITs have been notable laggards.

Short sellers have noted the weaker performance of office REITs. As of the end of September, office REITs led all other sectors in short positions, followed by hotels. Shopping center REITs experienced the biggest month-over-month increase in short positions, but there was very little interest in short selling energy infrastructure REITs.

One explanation for the popularity of short positions in shopping center REITs is the high-profile bankruptcy and closure of some prominent retailers. On Oct. 15, Rite Aid filed for Chapter 11 bankruptcy and announced a plan to close underperforming stores to reduce the company's rent expense and strengthen its overall financial performance. According to S&P Global Market Intelligence data, 80 Rite Aid locations are in REIT-owned properties. When Rite Aid published its initial store closure list of 154 stores, 12 REIT-owned properties were affected.

Today is Thursday, November 2, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Global Credit Markets Update Q4 2023: Hanging By A Thread

The global downgrade ratio increased to 54% from 52% in the previous quarter — driven more by a drop in upgrades rather an increase in downgrades. While the US and Asia-Pacific saw many downgrades early in 2023, the third quarter downgrade ratio increase was more pronounced for Europe and emerging markets.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: IR In Focus | Episode 9: The Retail Investor Sweet Spot

In this episode, host Carmen Lilly takes a closer look at retail investors, how they behave and their strengths and explores top tips for engaging with this diverse investor base. Carmen is joined by special guest Matt Joanou, CEO and co-founder of Stakeholder Labs. Their conversation dives into institutional investors' relationship with the retail investor community and what opportunities exist to leverage retail investor sentiment, participation and growth.

—Listen and subscribe to IR in Focus, a podcast from S&P Global Market Intelligence

Access more insights on capital markets >

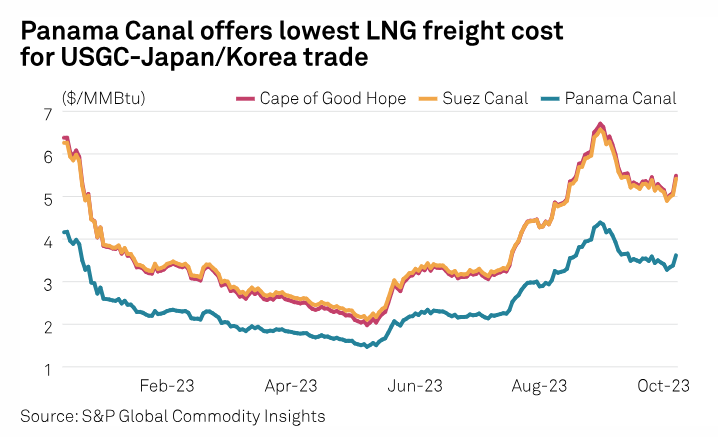

Panama Canal Faces Prolonged Impact From El Nino, Climate Change

The Panama Canal is facing an unprecedented drought with warming effects of El Nino potentially exacerbated by climate change, which could hit the key waterway's transit volume in the months to come, its top executive told S&P Global Commodity Insights. Water levels at Gatun Lake, the largest artificial lake feeding into the canal system, have been generally below 80 feet, or around its record low, since this summer, prompting the Panama Canal Authority to progressively tighten restrictions on the number and size of ships allowed to pass through.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

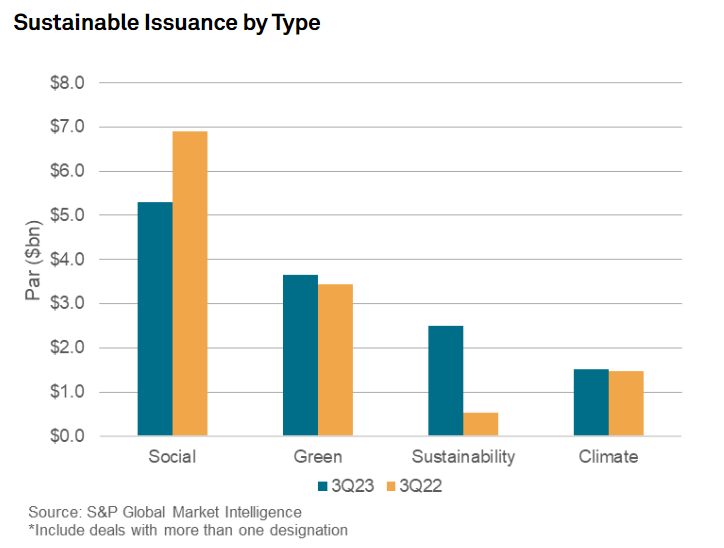

Q3 2023 Sustainability Muni Recap

S&P Global Market Intelligence Global Markets Group's municipal bond analysts have reviewed Q2 2023 municipal bond new issue data and analytics to identify the quarter's sustainable issuance trends. During the third quarter of 2023, sustainable municipal bonds issuance (including corporate issues) declined 8% from $12.4B in Q3 2022 to $11.4B in Q3 2023 while the overall muni issuance grew by 2% Y/Y, from $100.0B in Q3 2022 to $101.6B in Q3 2023, resulting in the second consecutive quarter of deceleration of sustainable municipal issuance.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

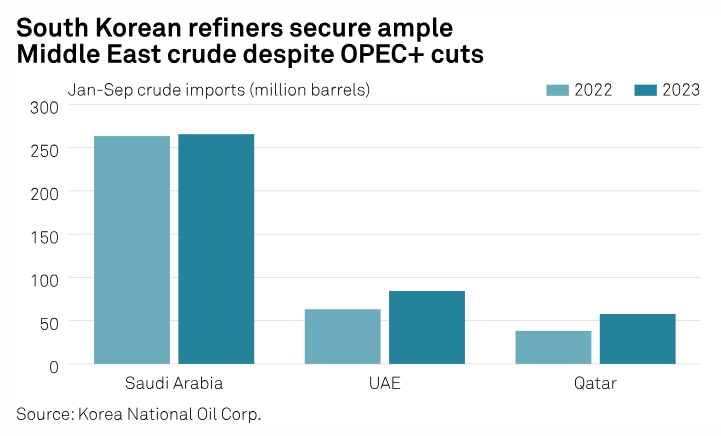

South Korea's Confidence In Crude Supply Security Grows Amid Ample Saudi, UAE Shipments

South Korea may shrug off OPEC crude production cuts and geopolitical jitters in the Middle East, as refiners and government officials expressed strong confidence in their trade and business relationships with top Persian Gulf producers, with more sour crude shipments arriving from Saudi Arabia, the UAE and Qatar so far this year. The world's fourth biggest crude importer received 30.5 million barrels of crude from Saudi Arabia, 12.2 million barrels from the UAE and 6 million barrels from Qatar in September, up 2.3%, 45.1% and 94.3% year on year, respectively, latest data from state-run Korea National Oil Corp. showed.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Power Of AI: How Artificial Intelligence Is Changing The Energy And Mining Sectors

Energy Evolution and Capitol Crude join forces to co-host this episode, all about artificial intelligence being deployed in the energy and mining sectors. This episode’s guests are some of the journalists from the S&P Global Commodity Insights newsroom who worked together to write an expansive series of articles on the impact of AI. The pieces look at predictions around how much electricity demand AI will generate, the ways AI is improving productivity, resource discovery and trading and more. In addition to the co-hosts and regular contributors to Energy Evolution, the podcast features Commodity Insights reporters Jared Anderson and Kip Keen.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Commodity Insights