Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

16 Jan, 2020

By Qing Li and Michael Orzano, CFA

In recent years, the U.S. real estate sector expanded to include a wide range of companies that own and operate a diverse set of assets. As recently as 2010, the sector was dominated by companies that owned traditional commercial properties such as office buildings, apartment complexes, warehouses, and shopping centers. However, the recent growth of specialized REITs—like those that own cell towers, data centers, and timberland, among other non-traditional real estate assets—has transformed the sector into a complex array of companies that derive income from highly distinct assets. While all REITs share certain characteristics such as offering relatively high dividend yields, the fundamental differences in the underlying assets owned by REITs across sectors have led to different investment characteristics and patterns of returns and volatility.

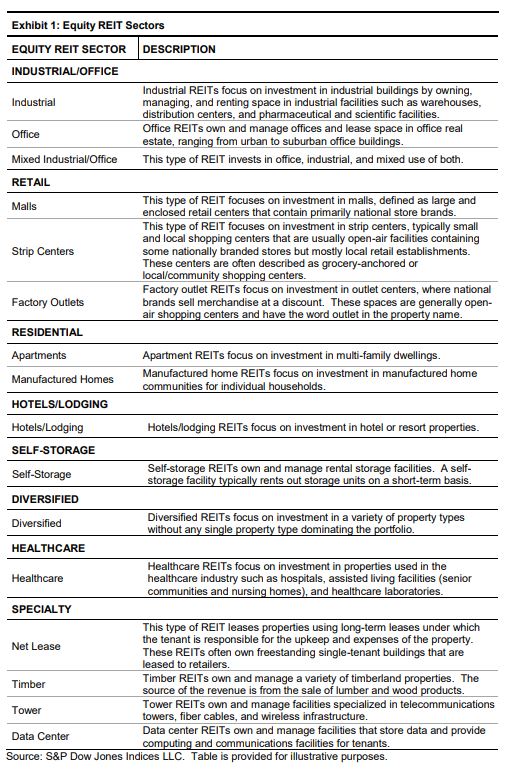

There are two main types of REITs: equity REITs and mortgage REITs. Equity REITs own and operate income-producing real estate and typically earn income through rents. Mortgage REITs lend money directly to real estate owners and operators, or indirectly through the purchase of mortgages or mortgage-backed securities, and they earn income from the interest on these investments. Based on the property type each equity REIT owns, we can further categorize it by its sector. Most REITs specialize in a single property type, while some manage portfolios that include multiple types of properties. Exhibit 1 provides an overview of the main equity REIT sectors.

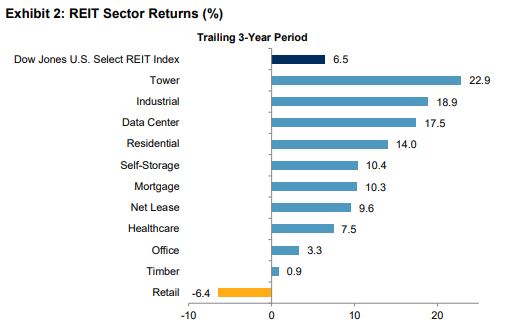

REIT sectors exhibited significant performance differentation over the shortand long-term periods studied (see Exhibit 2). Variation in returns across sectors increased significantly in recent years. Retail REITs underperformed considerably due to the shift toward online shopping, while certain specialty sectors such as tower and data center delivered exceptional returns. One of the primary beneficiaries of the shift to online shopping were industrial REITs, which have been near the top of the sector leader board. Tower REITs benefited from strong demand for infrastructure to support rapidly growing wireless data usage, while data center REITs boomed from the growing need for high-quality space to store IT infrastructure such as servers and other computing equipment.

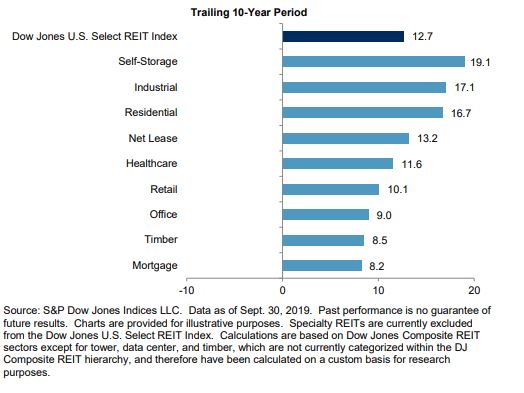

Exhibit 3 illustrates the correlation between REIT sectors over the trailing five-year period ending Sept. 30, 2019. Traditional commercial real estate sectors such as office, industrial, and residential were highly correlated in comparison with specialty sectors such as timber and tower REITs, which experienced relatively low correlations to traditional real estate sectors. Unsurprisingly, mortgage REITs also posted low correlations to equity REITs. A relatively low correlation between traditional core property types and specialty REITs indicates that the different fundamental drivers of these sectors strongly influenced the differing returns.

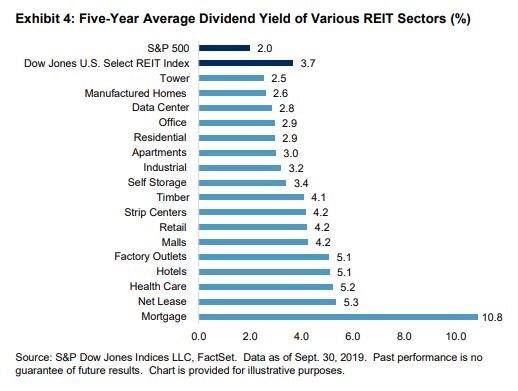

U.S. REITs are required to distribute at least 90% of their taxable income as dividends, making them attractive to income-oriented investors. Our study shows that over the past five years, the Dow Jones U.S. Select REIT Index provided average dividend yields of 3.7%, well above the 2.0% yield of the S&P 500® (see Exhibit 4).

There has been meaningful variation in dividend yields across REIT sectors. Over the five-year period ending Sept. 30, 2019, mortgage REITs averaged much higher yields than equity REITs. However, mortgage REITs did not offer any participation in property price appreciation, and their yields were much more volatile compared with equity REITs. Net lease REITs—known for their stable payouts fueled by long-term lease arrangements—averaged a yield of 5.3%, while data center and tower REITs produced relatively low yields of 2.8% and 2.5%, respectively.

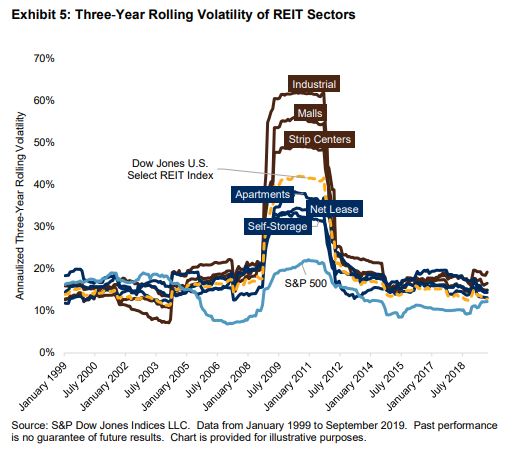

Historically, REITs exhibited modestly higher volatility compared with the broader U.S. equity market, with the exception of the Global Financial Crisis (GFC) period when REITs experienced exceptionally high volatility.

Exhibit 5 illustrates the annualized three-year rolling volatility of the S&P 500, the Dow Jones U.S. Select REIT Index, and the most- and least-volatile REIT sectors. Outside of the GFC period, volatilities of different REIT sectors were generally within a close range. During the GFC, certain sectors such as industrial, malls, and strip centers experienced high volatility, while apartments, net lease, and self-storage REITs had much lower volatility. We attribute the difference largely to the more cyclical nature of the retail and industrial sectors. The volatility of the net lease sector was also buffered by these companies’ high dividend yields linked to lengthy lease terms.

Though conventional wisdom has it that REIT performance suffers during rising interest rate environments, there is little evidence for it. As prior S&P DJI research1, 2 has demonstrated, REITs historically fared well on an absolute basis and relative to the broader U.S. equity market during full rising interest rate cycles.

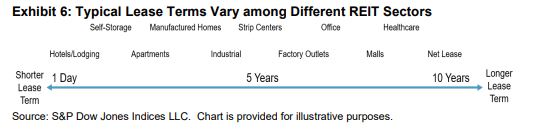

Both theory and empirical evidence suggest that REIT sectors do not react evenly to rising rates. The key fundamental driver of interest rate sensitivity for REITs is the average lease term of the underlying property type. Hotel REITs can reprice their rental agreements nightly. Self-storage and apartment REITs also have relatively short-term lease structures of less than one year, allowing them to quickly adjust rental rates as interest rates rise. On the other hand, healthcare and net lease REITs typically have long-term leases in excess of 10 years, making them less able to adapt to interest rate changes.

1 Q. Li, “Rising Rates Environment Doesn't Hurt All REITs,” March 2017.

2 M. Orzano and J. Welling, “The Impact of Rising Interest Rates on REITs,” July 2017

Exhibit 6 illustrates the length of the typical average lease agreements by REIT sector, with the shortest lease terms on the left and the longest on the right. Based on the average lease durations, Dow Jones U.S. Select Short-, Medium- and Long-Term REIT Indices3 were launched on Aug. 22, 2016. The Dow Jones U.S. Select Short-Term REIT Index comprises hotels, apartments, manufactured homes, and self-storage REITs. These REITs typically own underlying properties with lease terms of less than 12 months. The Dow Jones U.S. Select Long-Term REIT Index includes REITs that own property types with typical lease terms in excess of 10 years. Malls, office, and healthcare REITs fall in this category, while net lease REITs are treated as specialty REITs and therefore are excluded from this index series.

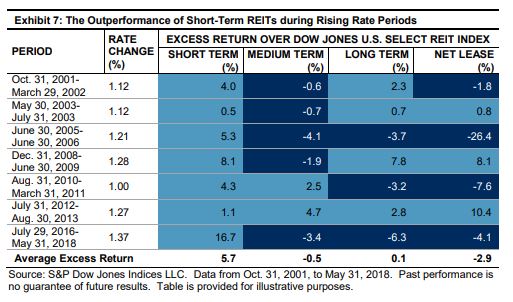

Exhibit 7 illustrates the performance of the short-, medium-, and long-term REIT indices along with net lease REITs during periods since 2001 when the U.S. 10-year Treasury yield increased by more than 100 bps. Short-term REITs showed a clear trend of outperforming the broader REIT market during rising rate environments, as the Dow Jones U.S. Select Short-Term REIT Index outperformed in all seven periods by an average of nearly 6%. Net lease REITs generally underperformed during these rising rate environments.

Although REITs share many common investment characteristics, the U.S. REIT industry includes a diverse set of companies that own a wide range of assets. In many cases, the underlying property types owned by REITs operating in different sectors respond to highly distinct supply and demand drivers and are affected by macroeconomic factors in different ways. These differences tend to be more pronounced for REITs operating in nontraditional sectors such as cell towers and timberland.

However, there is significant variability even within traditional commercial real estate sectors such as residential, industrial, and retail. For example, REIT sectors that tend to have short-term lease durations, such as apartments and hotels, outperformed during rising rate episodes compared with REITs with long-term lease structures such as net lease and healthcare. Likewise, more economically sensitive sectors such as retail and industrial experienced significantly greater volatility during times of economic stress compared with less cyclical sectors such as apartments and self-storage.