Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

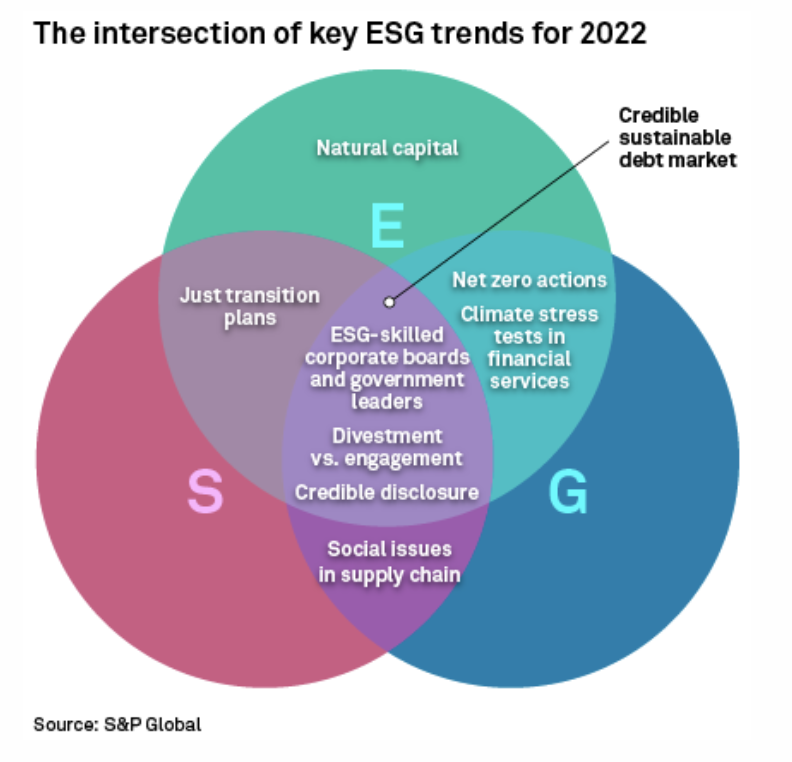

ESG is no longer a buzzword. As investors increasingly base decisions with regard to the environmental, social, and governance challenges of today, their actions could stimulate more accountability, greater regulatory scrutiny, and credible disclosure backed by better data.

After 2020 solidified how companies need strong engagement with ESG principles, the momentum continued through 2021. Last year saw improved quality and quantity of ESG data in response to demand and regulatory drivers. The Biden Administration reinvigorated ESG policies and climate urgency. Global conversations about the energy transition became increasingly nuanced and shifted from focusing on climate mitigation to climate resilience. Social and governance issues gained traction with investors and with global policymakers. Looking ahead, investors, corporate boards, and government leaders will likely face a number of intersecting pressures and challenges in 2022 that will advance their transparency, disclosures, and actions, according to S&P Global Sustainable1.

Corporate boards and government leaders may need to do more to demonstrate that they are adequately equipped to understand, oversee, and integrate ESG issues and principles in the face of heightened shareholder activism and public pressure over whether to divest from poor ESG performers. New ESG regulation may also see increased convergence from companies on ESG data, metrics, and reporting requirements and measures of success.

Calls for companies to realize their net-zero commitments will likely grow louder and include social issues alongside environmental ones. Market participants may flock together to evaluate the importance of natural capital and biodiversity risks, as well as social issues in supply chains, while financial institutions in particular prioritize climate stress testing.

The sustainable debt market is poised for continued growth this year—but will need to confront the challenge to manage this growth against rising concerns about greenwashing.

These are the “key ESG trends that we think will drive the conversation in 2022. Critically, these trends exhibit overlaps and interactions that will have a direct influence on the prospects for meaningful progress on ESG issues in 2022,” S&P Global Sustainable1 President Richard Mattison and S&P Global Ratings Global Head of Sustainable Finance Bernard de Longevialle said in S&P Global’s 2022 ESG trends outlook. “The E, S, and G trends we have identified should not be considered in isolation, but rather we believe they should be understood in relation to each other.”

Today is Monday, January 31, 2022, and here is today’s essential intelligence.

Listen: The Essential Podcast, Episode 53: On The Glass Cliff – Women CEO's During The Pandemic

Gabriel Morin of Paris University 2 and Daniela Brandazza of S&P Global join the Essential Podcast to talk about joint research into the differences between male and female CEO communication styles during the early months of the pandemic.

—Listen and subscribe to the Essential Podcast, a podcast from S&P Global

Access more insights on the global economy >

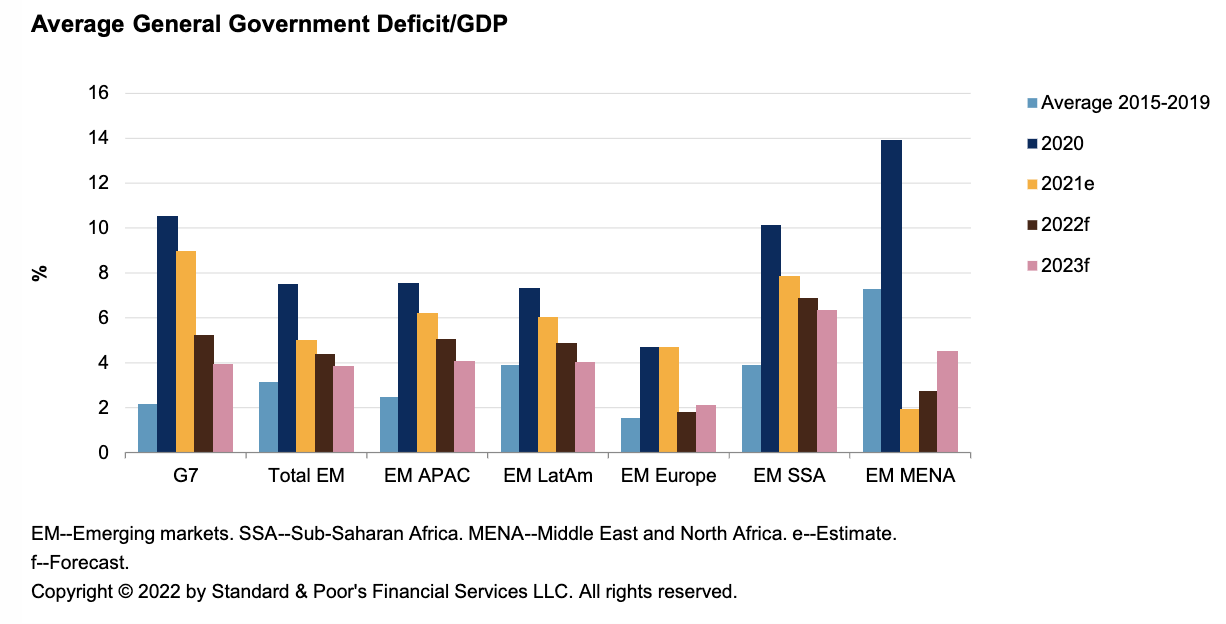

Global Sovereign Rating Trends 2022: Despite Stabilization, The Pandemic Threatens The Recovery

The evolution of the pandemic continues to be the main risk for sovereign ratings. A more fragile social context and political polarization will limit governments' capacity to implement revenue and spending rebalancing measures. This year is likely to be one of transition in terms of fiscal consolidation, which, if further delayed, could become a drag on ratings. Rising global interest rates will pose an additional challenge for emerging markets, more so for those heavy reliant on external funding.

—Read the full report from S&P Global Ratings

Access more insights on the capital markets >

Indonesia's Clampdown On Key Commodity Exports Mount Supply Concerns

The recent reemergence of resource nationalism in Indonesia has sparked price gains in several commodities and raised global supply concerns. A renewed emphasis on ensuring low domestic raw material prices and developing higher value-added downstream industries is expected to further drive price volatility in sectors such as coal, LNG, metals, and agriculture. The country is a major metals and LNG producer and is also the world's top exporter of thermal coal and palm oil.

—Read the full article from S&P Global Platts

Access more insights on global trade >

Key Trends That Will Drive The ESG Agenda In 2022

While many large companies set sustainability goals and published ESG-related data in 2021, investors, regulators, and the broader public are exercising greater scrutiny of corporate sustainability efforts. In 2022, corporate boards and government leaders will face rising pressure to demonstrate that they are adequately equipped to understand and oversee ESG issues—from climate change to human rights to social unrest.

—Read the full report from S&P Global Sustainable1

As Europe Seeks Alternatives To Russian Gas, Algeria Has Pipeline Capacity To Spare

In 1981, while trying unsuccessfully to block a Soviet natural gas pipeline during a chill in the Cold War, then-U.S. President Ronald Reagan warned Europe of its growing reliance on Russian energy, urging the continent to seek alternative suppliers, including from North Africa. 41 years later, a similar geopolitical play is unfolding as tensions between Russia and the West ratchet up, with President Joe Biden saying his administration is working with the EU to identify other sources of vital natural gas, including—once again—from North Africa.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

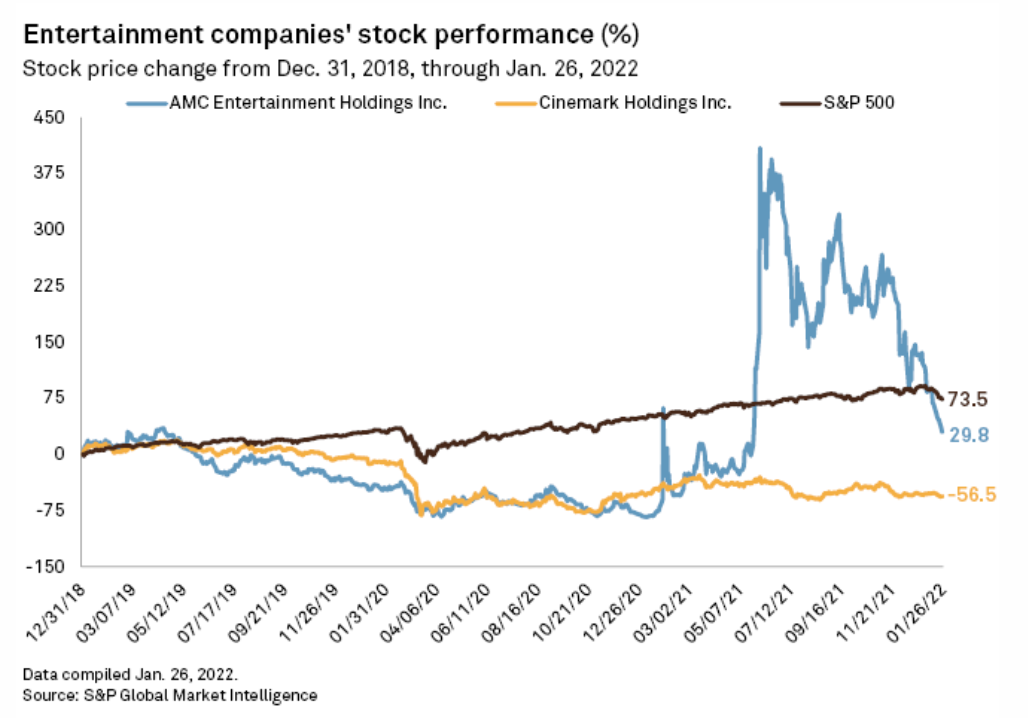

AMC Shares Fall From Grace As Company Looks To Refinance High-Rate Debt

In 2021, retail investors tagged AMC as a "meme stock." Thousands of armchair traders piled into the ticker out of appreciation for the 100-year-old business and to buck Wall Street short sellers. AMC took advantage of the gains, issuing both debt and stock to shore up cash. The company closed 2021 with almost 514 million shares outstanding, massively diluted compared to the 104 million shares trading at the end of 2019, according to S&P Global Market Intelligence data. However, the meme stock tsunami has receded through the first month of 2022, and the company is left with a debt-loaded balance sheet and market capital well below the high water mark from the prior year.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.

Content Type

Theme

Location

Language