Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The coronavirus pandemic has created a COVID-19 economy—defined by changed consumer behavior, accelerated digitalization, renewed urgency to combat climate change, and a heightened awareness of future market risks. This has transformed the global insurance industry by reinforcing the importance of technology and the need for preparedness in the face of unprecedented events.

“As greater visibility emerges into a post-pandemic world, insurers will be challenged to reevaluate how they interface with customers, distributors, investors, and other key constituencies. New expectations regarding the industry’s leadership in driving transformational change from environmental, social, and governance perspectives will continue to build across geographies,” S&P Global Market Intelligence said in its 2022 outlook for the insurance industry. “These changes come against a backdrop of new and evolving financial, geopolitical, legal, technological, and climate-related risks—many of which will require developing and implementing different pricing structures, underwriting, reserving, and distributing. It is an environment that will reward the nimble, penalize the ill-prepared, and threaten the continued relevance of those unwilling to shatter their status quo.”

2022 is likely to bring forth robust capital market and deal activity, slower growth but stable credit quality, and a stronger emphasis on underwriting for the insurance industry as it continues to navigate the pandemic’s challenges and prepare for new operating conditions and future risks, according to S&P Global Ratings. More insurance companies may to turn to technological transformation to expand their market share, whether to offer coverage for new decentralized finance assets or utilize data to price for severity and frequency in business interruption coverage.

Last year saw insurers regain strong market capitalization growth, raise billions from capital markets, and enjoy a jump in premium gains and rise in revenues—but battle historic losses in the aftermath of extreme weather events. In 2020, global insurance markets largely endured asset risks, volatility in capital markets, and weaker premium growth prospects.

After the insurance industry adapted to the plethora of unprecedented events that have roiled markets over the last three years, market participants are warning against complacency. Constructing insurance solutions for extreme risks "gives you the illusion of a certainty that you cannot have, that the world just does not offer," Peter Giger, Zurich Insurance Group’s chief risk officer, told S&P Global Market Intelligence in an interview.

Today is Friday, January 21, 2022, and here is today’s essential intelligence.

Economic Research: Macroeconomic Update

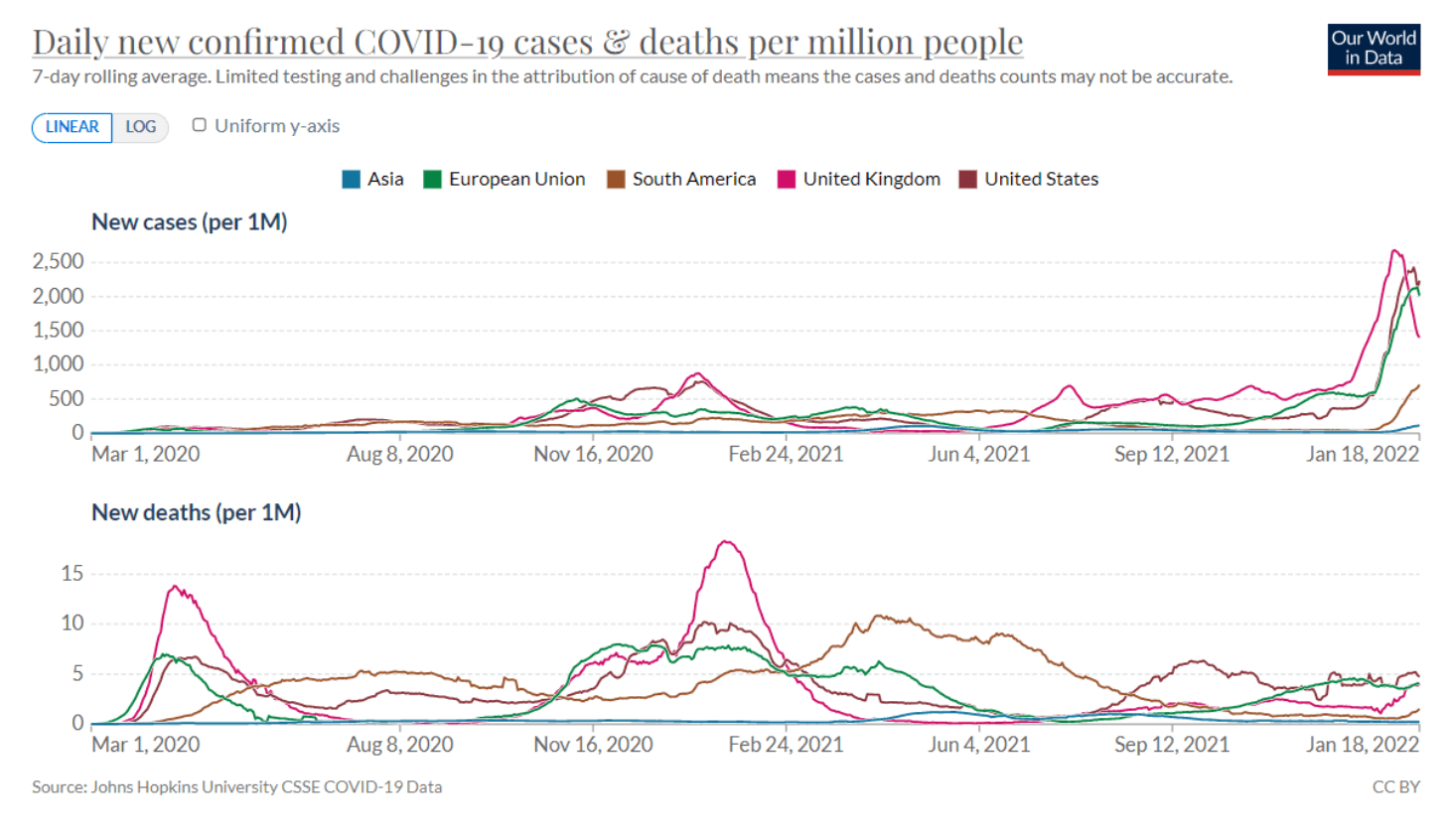

The omicron variant of COVID-19 has spread quickly but its economic impact appears limited. The link from the virus to economic activity has been weakening throughout the pandemic as policymakers and economic agents adjust. Moreover, the omicron variant is less lethal than earlier variants and appears to be shorter-lived. Cases are already declining in some areas.

—Read the full article from S&P Global Ratings

Access more insights on the global economy >

Watch: Capital Markets View - January 2022

In the first Capital Markets View of 2022, Taron and Chris recap a record year and make some predictions for the coming year. Loan issuance beat many 2007 records globally, and the issuance mix was strong with a high percentage of M&A-driven deals. The pipeline continues to look strong in the near-term, including some large transactions. They also talk about the continued rise of direct lending, strong secondary loan market returns, a record year for CLO issuance with again a good pipeline, and finally how investment into non-CLO funds may increase in 2022.

—Read the full article from S&P Global Ratings

Access more insights on capital markets >

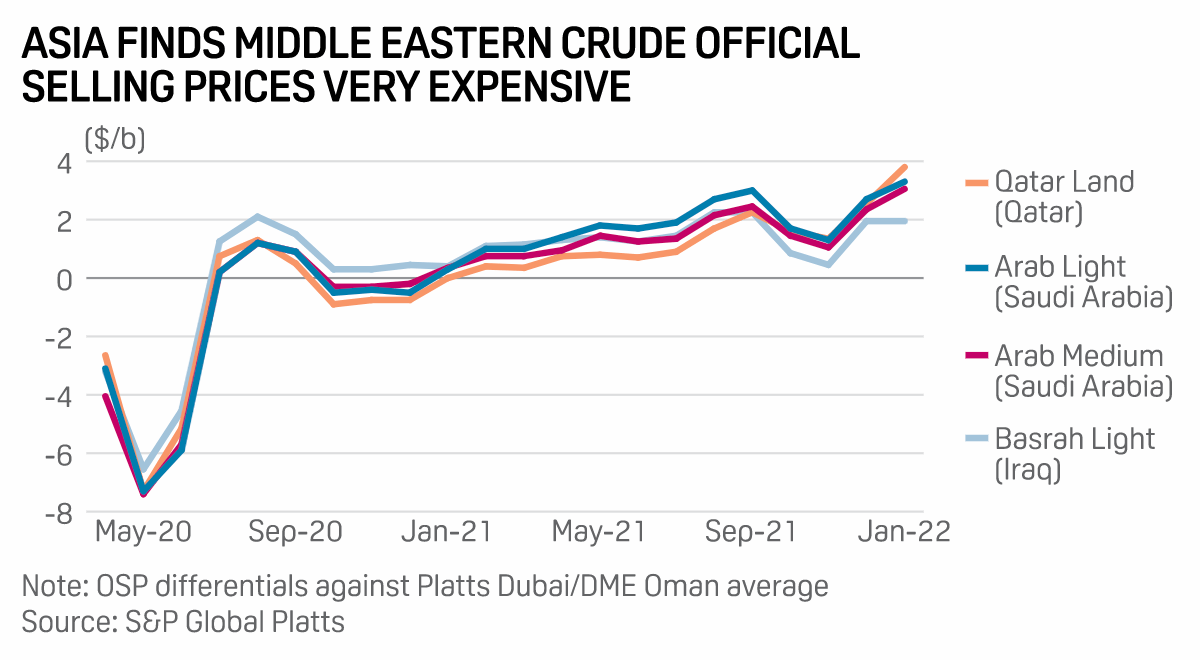

South Korea, GCC Agree To Discuss FTA To Reduce Crude Trading Costs

South Korea has agreed with the six-member Gulf Cooperation Council to resume talks on their free trade agreement, which could help the world's fifth biggest crude importer increase Middle Eastern sour crude purchases in a cost-effective way, the energy ministry said Jan. 20. Trade Minister Yeo Han-koo and GCC Secretary General Nayef Falah M. Al-Hajraf signed the joint statement in Riyadh, under which the two sides will start negotiations within the first quarter of this year with an aim to reach a formal FTA deal "as early as possible," according to the Ministry of Trade, Industry, and Energy.

—Read the full article from S&P Global Platts

Access more insights on global trade >

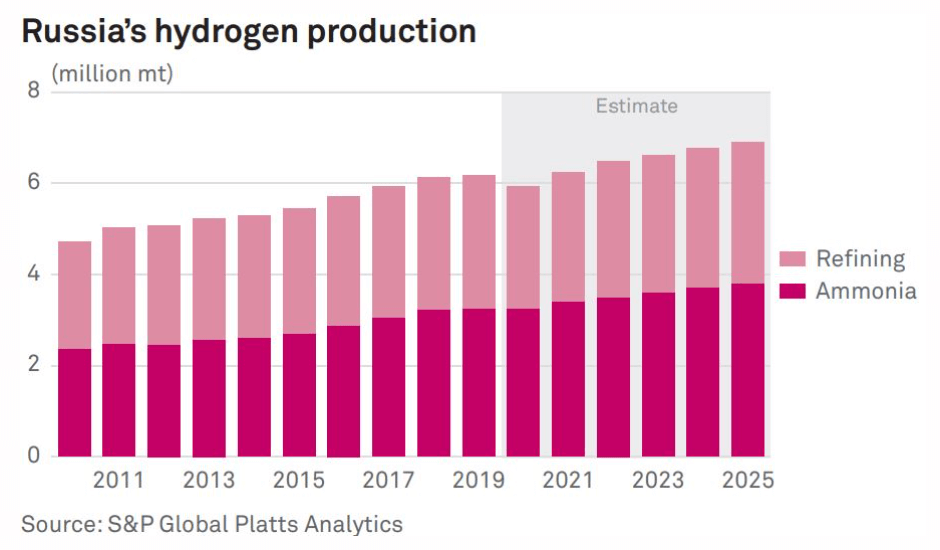

Insight From Moscow: Russia Aiming To Take Major Role In Global Hydrogen Markets

Russia plans to leverage its large natural gas reserves, existing infrastructure, and cooperation with foreign partners to take a major stake in the global hydrogen market. Targeting 20% of market share by 2030, Russia is set to ramp up production over the next five years. S&P Global Platts Analytics forecasts Russian hydrogen production at 3.4 million mt in ammonia and 2.7 million mt in refining in 2021. It expects these volumes to increase to 3.8 million mt and 3.1 million mt, respectively, by 2025.

—Read the full article from S&P Global Platts

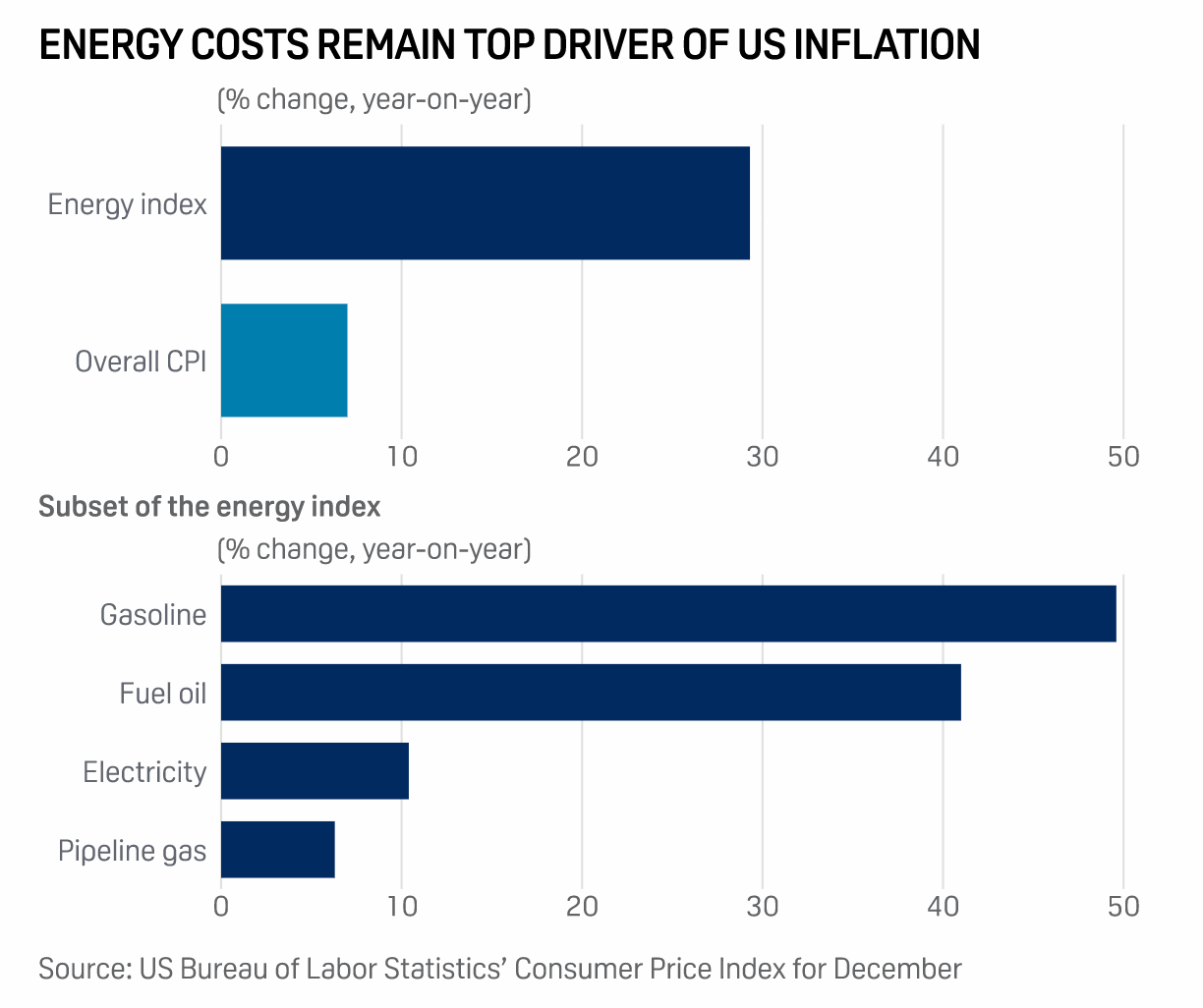

Biden White House Again Under Pressure As Oil Prices Race Toward $90/B

The White House once again faces few options to respond to high oil prices as they race toward $90/b just two months after the Biden administration tapped emergency crude stocks. Analysts expect the administration to consider the usual grab bag of policies and rhetoric that get brought out when domestic fuel prices rise, which include urging U.S. and OPEC drillers to pump more, tapping the Strategic Petroleum Reserve again, promoting anti-OPEC legislation in Congress, pushing the Federal Trade Commission to keep probing price gouging, and potentially bringing back talk of U.S. crude export restrictions.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

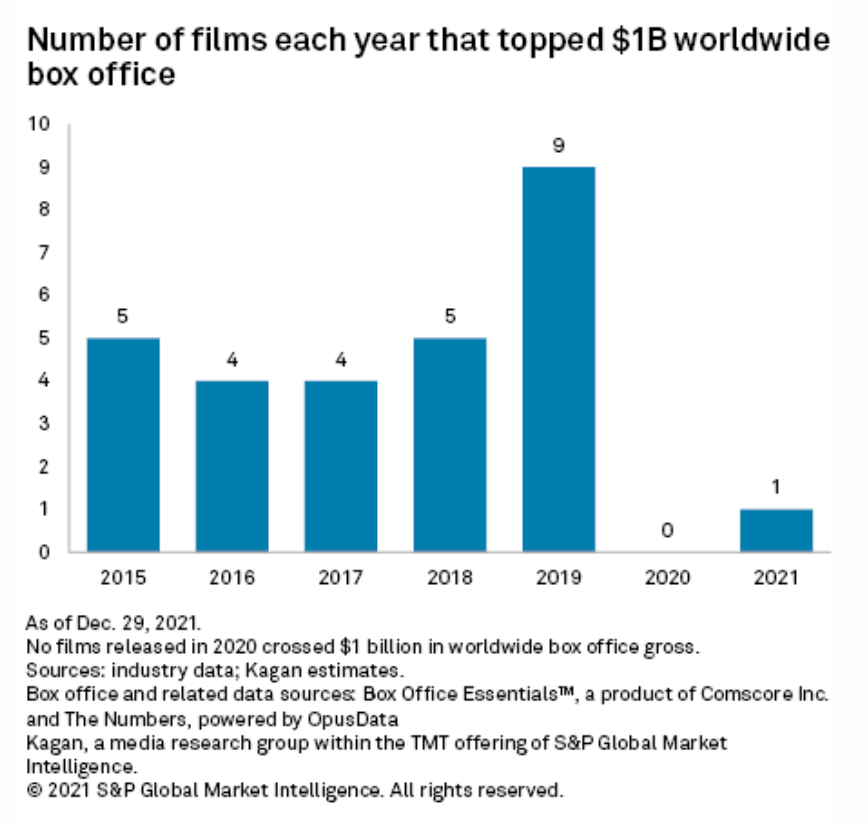

Billion-Dollar Movies Return, Signaling Shift In Studios' Streaming Strategy

The winter's return of a $1 billion-plus title to theaters proved that the box office is still as relevant as ever for big-budget franchises, even as distribution strategies for smaller films remain in flux. Sony Group Corp.'s "Spider-Man: No Way Home" was the first film in two years to cross the 10-figure benchmark. While it is an encouraging sign of recovery, that single success comes after several pre-pandemic years when studios and theaters split ticket sales on multiple $1 billion films per year.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.