Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

If Recession Comes, Whither Banks?

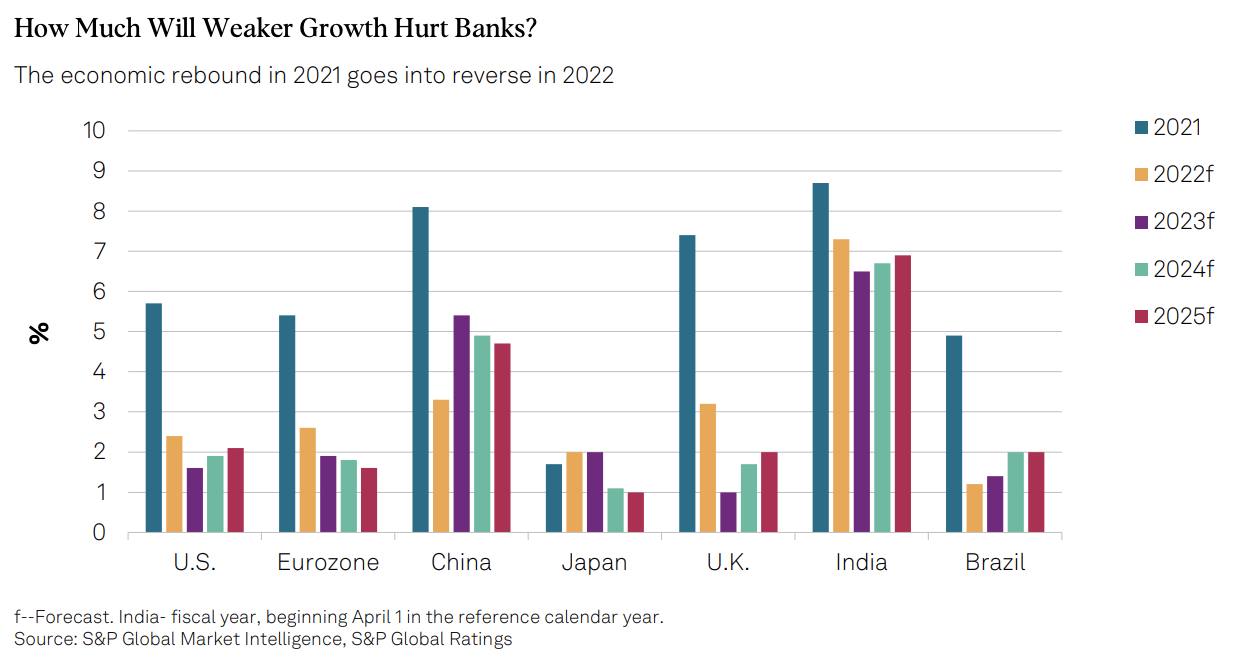

Economic growth is slowing. Interest rates remain stubbornly high. Estimates of the risk of recession or even stagflation creep upward and questions persist on whether central banks are under- or over-reacting in pursuit of monetary normalization. But conditions for the global banking sector may not be as dire as they appear, at least in the near-term.

Overall, banking executives expect a recession. According to a recent survey conducted by KPMG, 77% of banking executives surveyed expected a recession to occur within the next year. However, executives continue to project confidence at industry events by focusing on low unemployment, the persistent strength of credit, and the ability of banks to overcome challenges, according to S&P Global Market Intelligence.

However, not everyone is so sanguine. In a recent midyear outlook on global banking, titled “Here Comes the Rain Again,” S&P Global Ratings outlined a range of key risks facing banks. Those risks include a worse-than-expected recession, the potential for higher corporate insolvencies exacerbated by leverage, high government leverage, and a weaker property sector.

“The debt spike is tapering in 2022, but high corporate leverage affords corporates less buffer in a stress scenario; this in turn could hinder banks' asset quality,” the report says. “Higher government leverage could ultimately diminish the capacity of sovereigns to provide extraordinary support to their economies or certain banking sectors if needed.”

On the positive side, the report points out that higher capital reserves in the global banking sector should allow for greater resilience unless corporate defaults spike. In addition, the immediate effect of higher interest rates for most banks is positive because of the benefit to their net interest income.

Recent Federal Reserve stress tests of banks in the United States have revealed that Bank of America Corp., Citigroup Inc. and JPMorgan Chase & Co. face higher-than-anticipated increases in their stress capital buffers. While these capital reserves are part of the reason that the banking sector is expected to be resilient in a downturn, they may come at the cost of stock buy-back programs, which adds pressure on bank equity valuations.

Beyond longer-term risks to the corporate debt banks hold, rising interest rates and inflation impact the real estate market and the mortgages banks offer. Recent PMI data from S&P Global Market Intelligence reveals a steep contraction in demand for real estate amid tightening financial conditions and the rising cost of living. In addition, geopolitical risks may weigh on bank performance in some regions. As interest rates rise to fight the effects of inflation, banks will look to lock in low cost, long-term funding to ride out any instability.

While many market participants are predicting a recession, the determining factors of the fate of the global banking sector are a potential recession’s severity and its impact on asset quality.

Today is Friday, July 22, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Global Banking Outlook—Midyear 2022: Here Comes The Rain Again

The global banking sector is bracing for tougher tests as economic growth weakens and higher-for-longer inflation affects borrowers. The Global Banking Outlook—Midyear 2022 contains our view of the key risks facing banks globally as well as 84 country banking outlooks.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

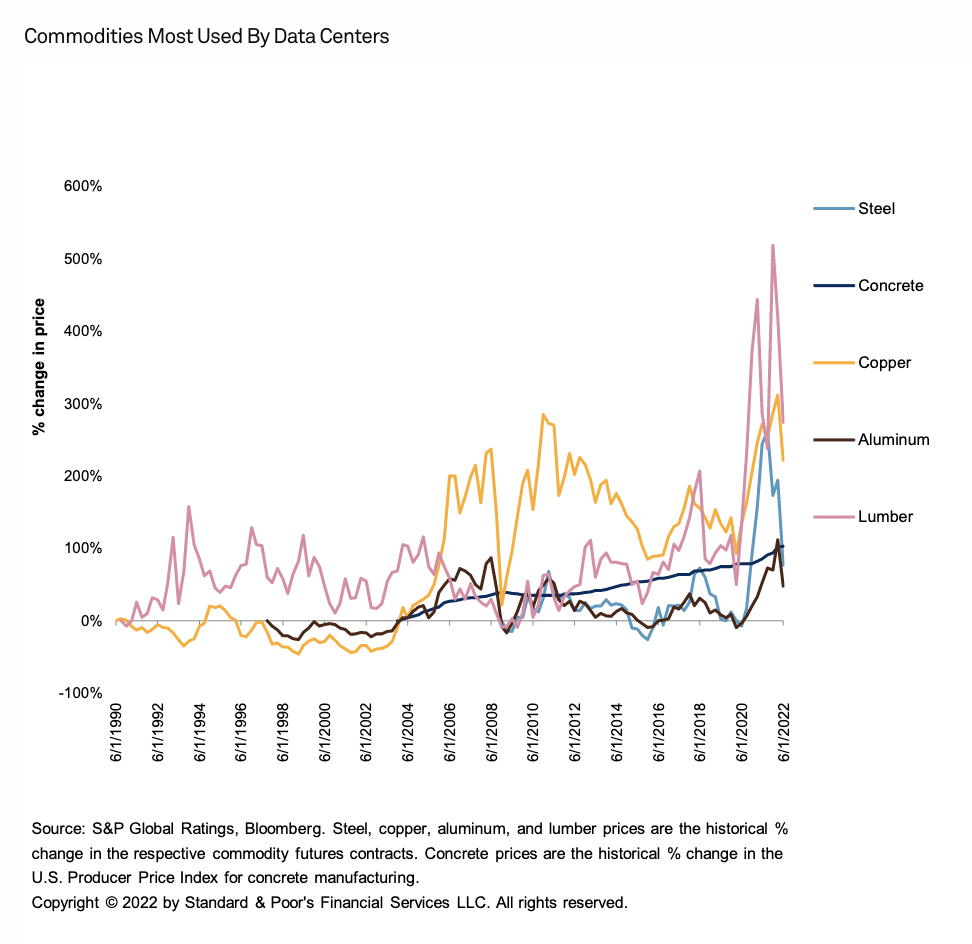

Credit FAQ: How U.S. Data Centers Are Navigating Inflation And Recession Risks

Financial markets have grown increasingly volatile this year spurred by several recent developments including the rising risks of recession and inflation, as well as reverberations from the Russia-Ukraine conflict. S&P Global Ratings has been monitoring the impact of these factors on rated U.S. data centers such as Equinix Inc., Digital Realty Trust Inc., Switch Ltd., Cyxtera Technologies Inc., as well as several smaller providers and examining how they've been dealing with the precarious macro and geopolitical environments.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

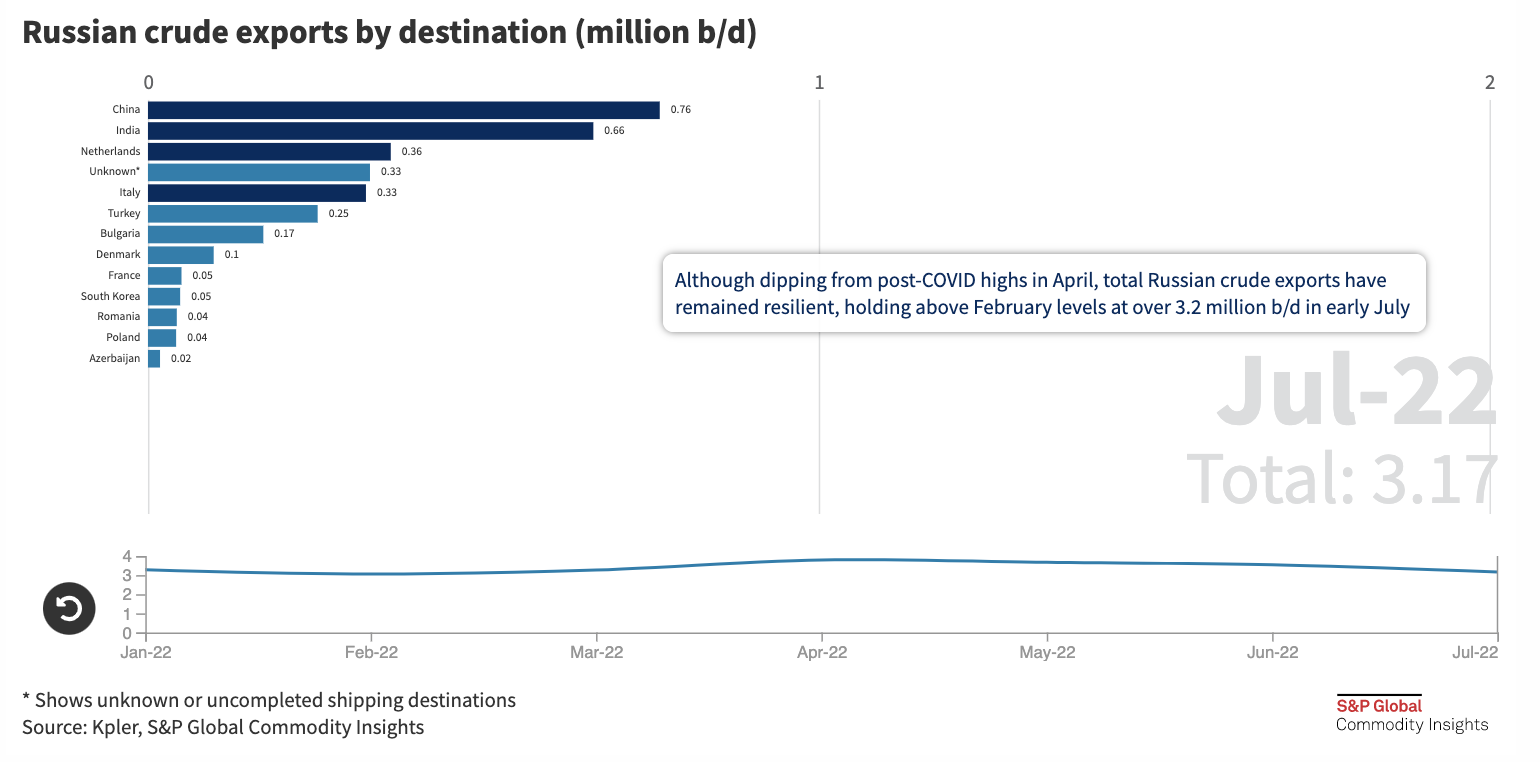

Interactive: Global Oil Flow Tracker

Russia's war in Ukraine has trigged a major upheaval in the global oil markets, forcing Moscow to find alternative buyers and Europe to source new supplies as Western sanctions seek to clamp down on Moscow's vital oil revenues. Russian seaborne crude exports have fallen below post-pandemic highs set in April and May but continue to flow above pre-war levels. This tracker highlights the key trade movements and oil flow trends as the fallout of the war unfolds.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

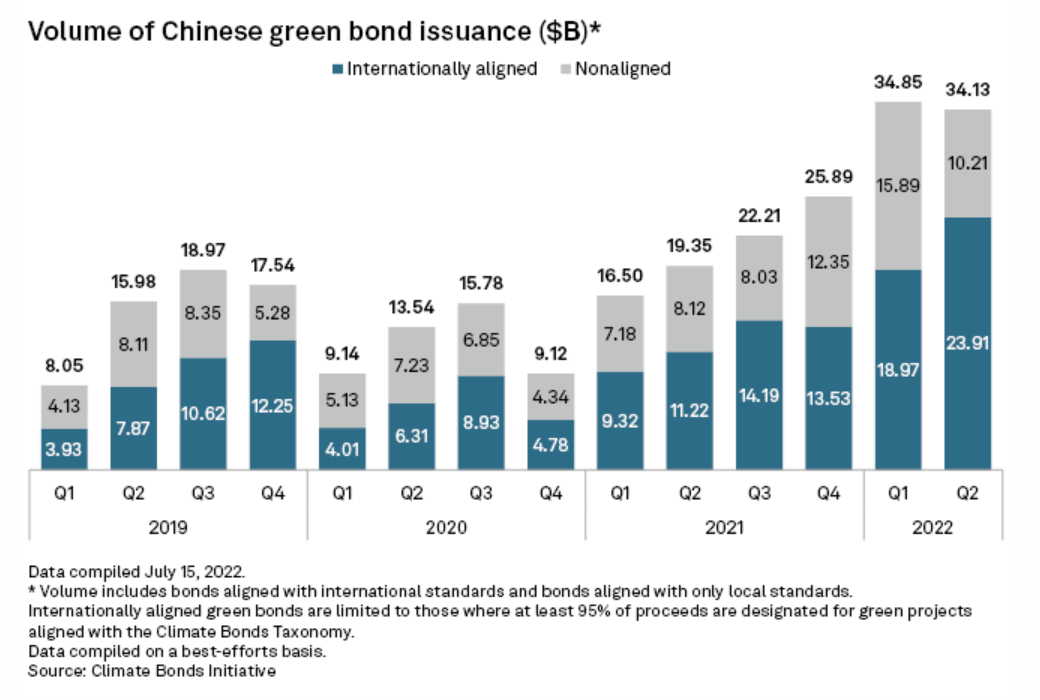

Labeled Bonds To Drive China Green Debt Market As Harmonization Continues

China is poised to issue more labeled green bonds, driven by the country's push to align sustainable debt with international standards and growing demand from global investors. The volume of labeled, or internationally aligned, green bonds that meet the criteria acceptable to global green investors, such as the use of proceeds and the types of projects, is likely to rise further and become the biggest driver of green financing in China, analysts said.

—Read the article from S&P Global Market Intelligence

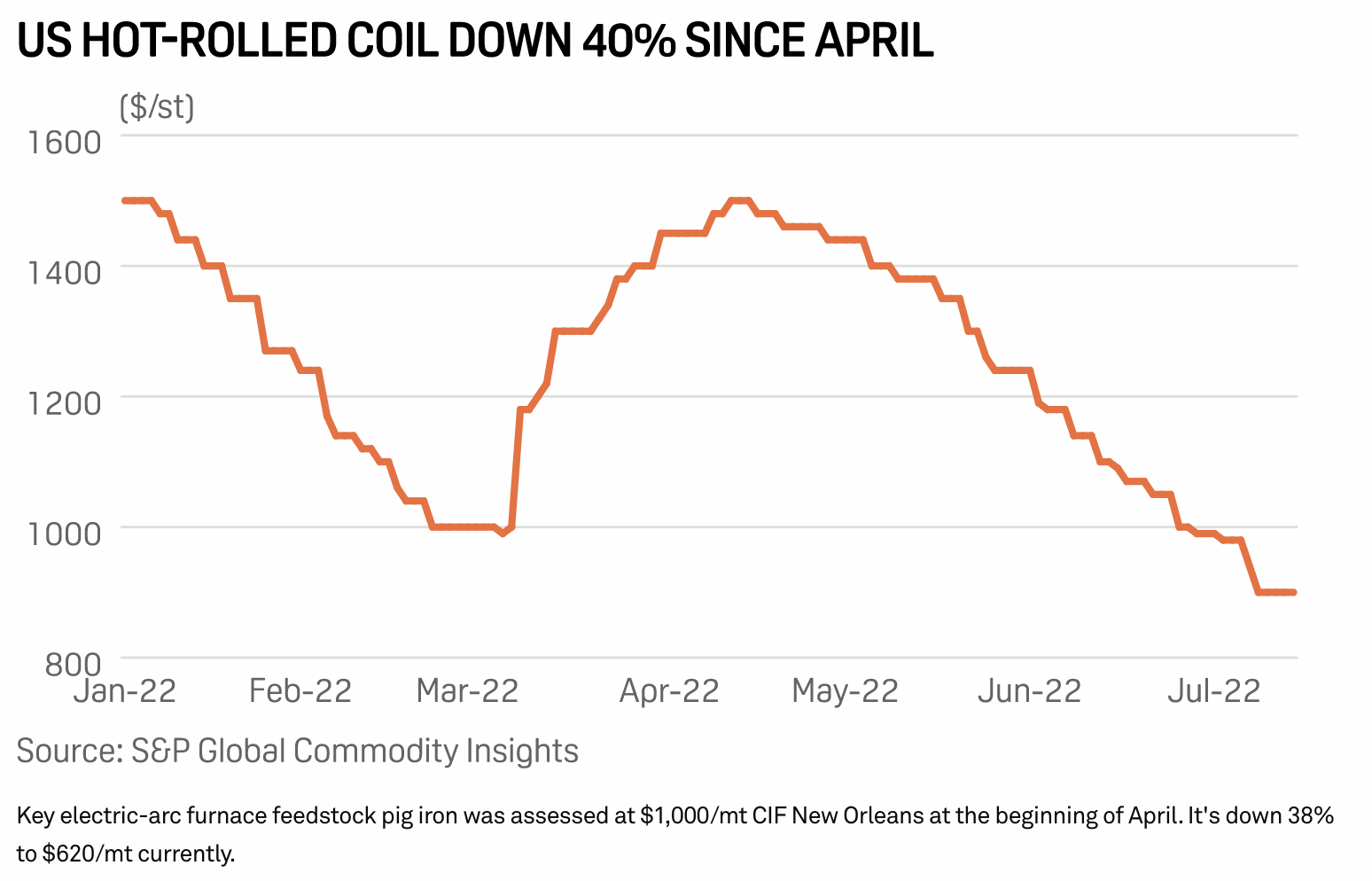

Recession Fears, Waning Confidence Make For Uneasy Summer In U.S. Metals Market

Summertime is supposed to be when the living is easy. At least that's how the old song goes. However, with recession concerns swirling, consumer confidence waning and demand softening, this summer has been anything but easy on the U.S. metals complex. At the same time, prices for a number of headline products—from hot-rolled steel to primary aluminum, ferrous scrap to pig iron—have been in a steady decline following a rapid runup in the early part of the year.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

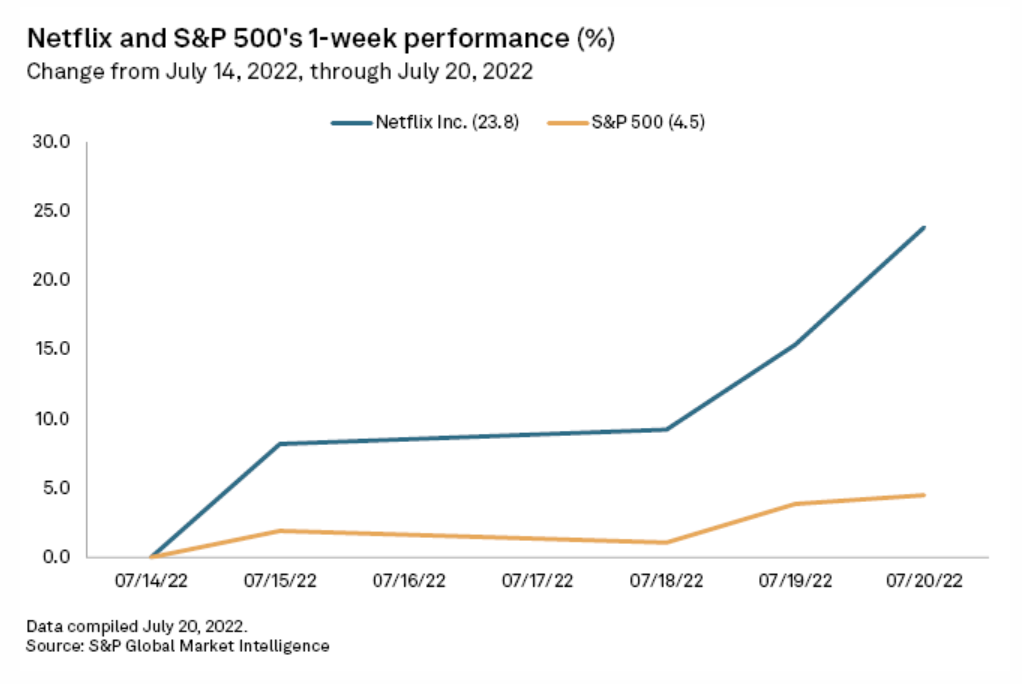

Netflix Shares Soar Above Subscriber Growth Headwinds

While investors rewarded Netflix Inc. for its lower-than-expected subscriber losses in the second quarter, analysts remain concerned about the streaming company's long-term growth prospects. Netflix reported a loss of 970,000 paid members globally during the quarter against guidance of a 2 million drop. More, it forecast membership growth of 1 million in the third quarter.

—Read the article from S&P Global Market Intelligence