Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

If Stagflation Sweeps The Global Economy

As the risk of recession rises, talk now turns to the prospects for stagflation. A global economy beset by persistently high inflation, rising unemployment, and diminished demand could see a surge in potential corporate defaulters.

Concerns over central banks’ ability to avoid recessions while controlling inflation are growing to include fears of near-term stagflation, according to S&P Global Market Intelligence’s analyses of recent flash Purchasing Managers’ Index data.

If stagflation strikes, lower global growth, nagging inflation, and higher interest rate spreads could see potential corporate defaulters rise 2.4x to 17% by 2023—with China’s loss-makers tripling to 22% under a severe scenario and corporate sectors that haven’t fully recovered from the COVID crisis seeing loss-makers rise by more than half, according to S&P Global Ratings’ latest stress test. The stress test was applied to a sample of 20,000 corporates (93% unrated) with debt totaling $37 trillion, representing 41% of total global corporate debt.

“2022 has proven to be challenging with the risk distribution already shifting right even in our base case—we project loss-makers will rise to 10% by end-2022 from 7% in 2021. With such a high percentage of borrowers in the ‘high’ risk category (already hitting 44% for the 2022 projected base case), additional shocks easily tip borrowers into the loss-maker category,” S&P Global Ratings said in its global debt leverage research published yesterday. “Consequently, in the intermediate scenario, we project loss-makers rise twofold to 14% by 2023 from the 7% level in 2021, and in the severe scenario, more than double to 17%.”

Inflationary pressures, central banks’ rate hikes, and slowing economic growth are weighing on markets. The global macroeconomic outlook is darkening and the prospect of markedly deteriorating credit conditions is heightening—with the second half of this year likely be to characterized by a limited access to and a higher cost of credit, according to S&P Global Ratings.

These circumstances follow the benchmark S&P 500 equities index suffering its worst first half in more than 50 years during the first six months of 2022, and its 15th bear market since 1928, according to S&P Dow Jones Indices. Energy security and supply issues also dominated the first half of 2022, according to the latest update of S&P Global Commodity Insights’ Energy Security Sentinel.

Just this week, the U.S. dollar and euro reached parity for the first time since 2002 due to roaring energy costs and recession fears. And looking ahead, companies are likely to prioritize the economic outlook in their second-quarter earnings reports against the backdrop of the rising recession risk, according to S&P Global Market Intelligence.

“Should inflation stay higher for longer than expected, real rates will remain correspondingly lower and central banks will need to do more. This runs the risk of more financial pain as well as a sharp decline in output and employment. In an extreme case of stagflation, inflation could remain elevated even if the economy is slowing sharply,” S&P Global Ratings Chief Global Economist Paul Gruenwald said in his third-quarter economic outlook. “In this case, supply-side-driven price pressures spill back into broader inflation pressure, requiring an even stronger policy response.”

Today is Wednesday, July 13, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

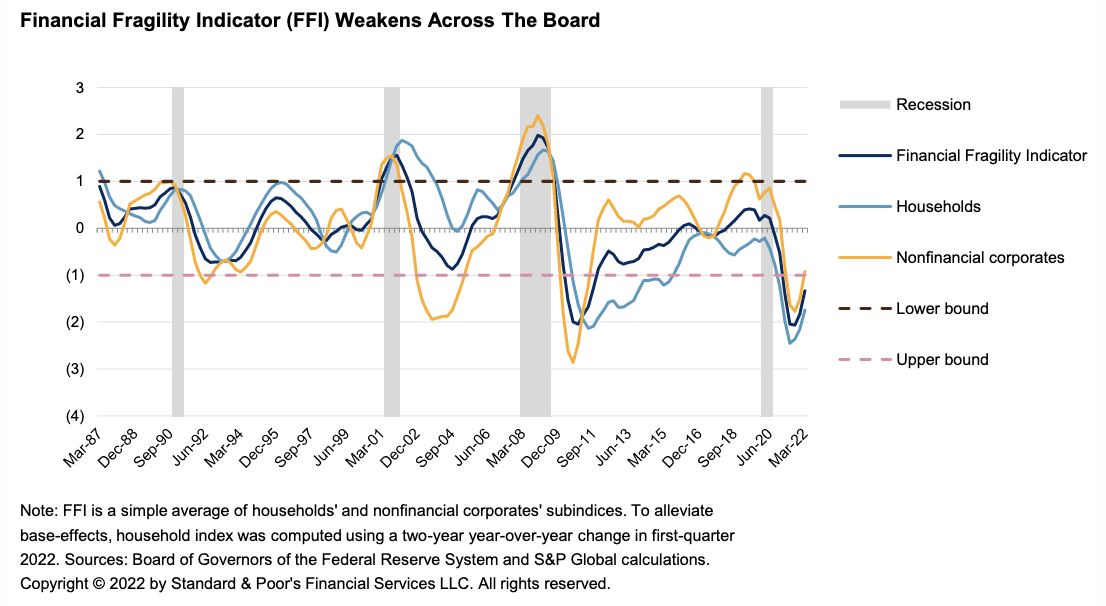

Economic Research: Financial Fragility Of U.S. Households And Businesses: On The Rise While Still Below Its Historical Average

The Financial Fragility Indicator weakened to -1.34 in March from -1.83 at the end of 2021. It's still below its historical average, suggesting near-term risks are modest, but as the Fed aggressively tightens policy through mid-2023, conditions will likely worsen. The nonfinancial corporate sector saw the biggest jump into riskier territory--the FFI was -0.92 in first-quarter 2022, almost half its reading of -1.52 in the previous quarter.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

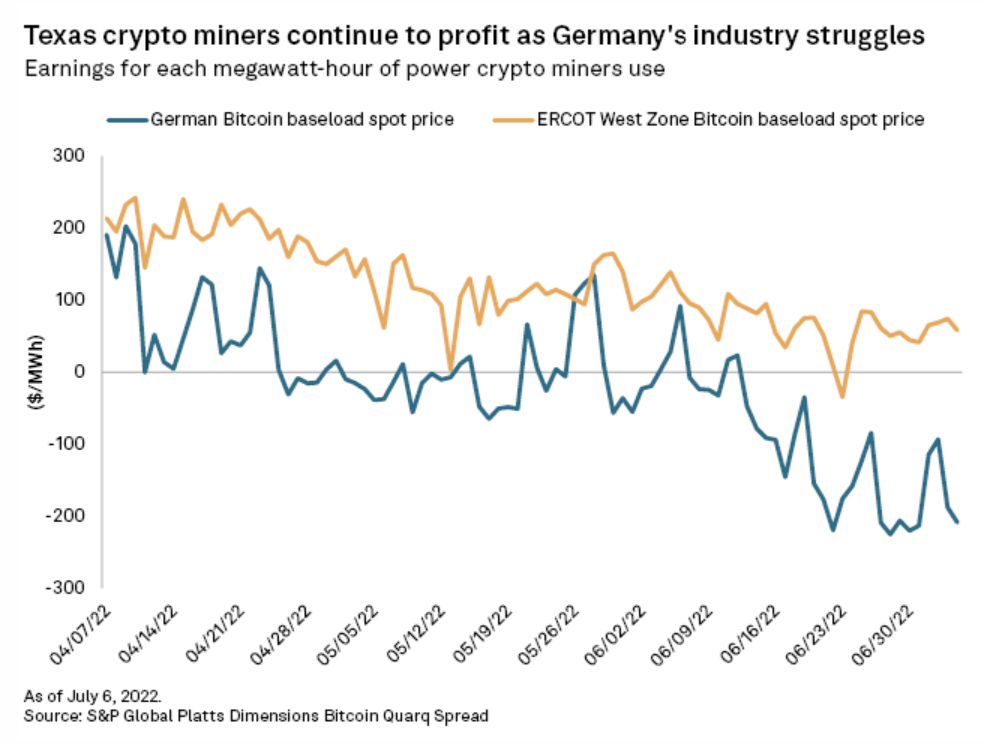

Digital Mining In Texas Booms As Global Crypto Industry Losses Mount

With electricity demand in Texas hitting record levels amid critically high temperatures this summer, the state continues to be a prime destination for cryptocurrency mining companies hungry for electricity. Whatever trouble the emerging industry faces in other markets, the Lone Star State continues to lure cryptocurrency miners with inexpensive power and few regulatory hurdles.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

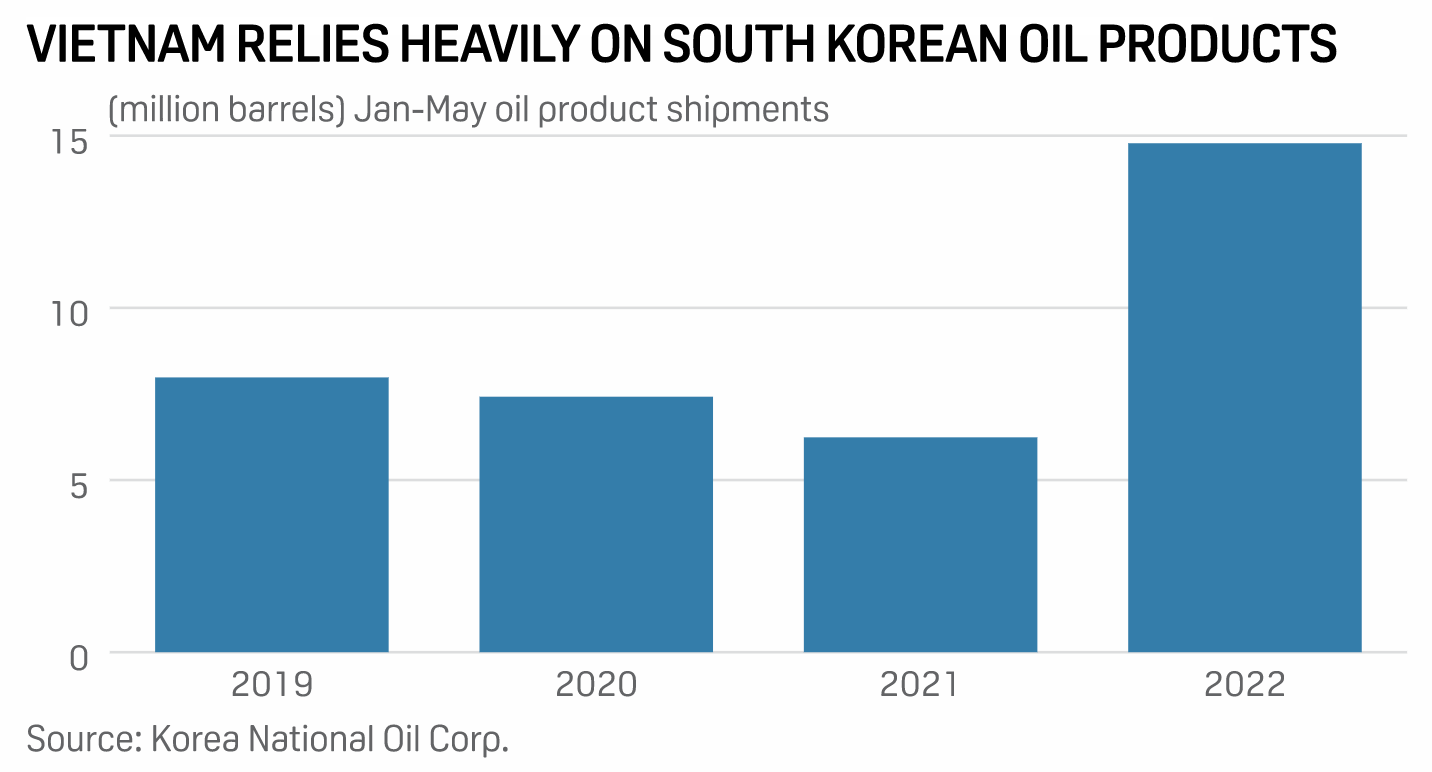

Vietnam Accelerates Efforts To Lower Retail Fuel Prices, Diversify Middle Distillate Supply Sources

Vietnam has further cut taxes on transport fuels for the second half of 2022 and encouraged fuel traders to diversify their middle distillate import sources in an extended effort to help domestic consumers cope with surging retail oil prices, industry and government sources said July 11. Under a resolution passed by the Standing Committee of Vietnam's National Assembly, the duty for gasoline will be trimmed to Dong 1,000/liter (4 cents/liter) from Dong 2,000/l (8 cents/l) from July 11, the Ministry of Finance said in a statement.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Insight Conversation: Kitack Lim, IMO

The International Maritime Organization adopted its Initial GHG Strategy in 2018, envisaging a reduction in the carbon intensity of international shipping as well as a cut in total annual greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008. Today, a revision of the strategy is being pursued, with signals indicating a strong commitment to navigate towards a carbon-neutral future. IMO Secretary-General Kitack Lim was recently interviewed by S&P Global Commodity Insights Senior Editor Surabhi Sahu on shipping's decarbonization challenges and opportunities, progress made so far at the 78th session of the Marine Environment Protection Committee, and other issues impacting the shipping industry amid COVID-19.

—Read the article from S&P Global Commodity Insights

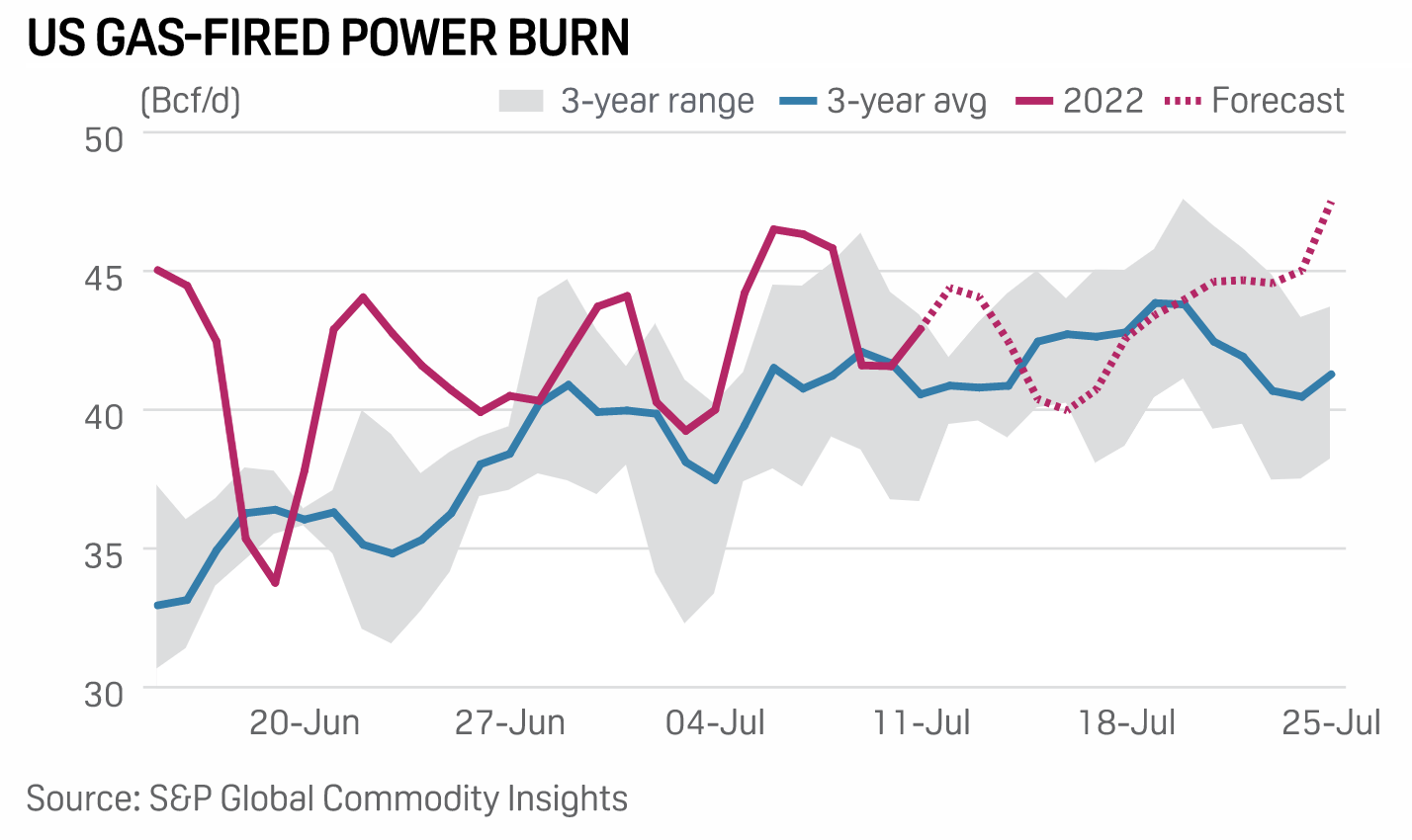

Gas Demand From U.S. Power Generators Continues At Record Pace In July

Gas demand from U.S. power generators continues to trend at record levels this summer, with sweltering temperatures forecast across the central U.S. from mid- to late July promising more of the same. Month to date, gas-fired power burn has averaged 43 Bcf/d matching record levels recorded in summer 2020 and outperforming last July's average by 5.8 Bcf/d, or about 15.5%. Last month, demand from U.S. generators outpaced its June 2020 average by some 2.8 Bcf/d, or about 8%, setting a new record for the month at 38.6 Bcf/d, data from S&P Global Commodity Insights shows.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

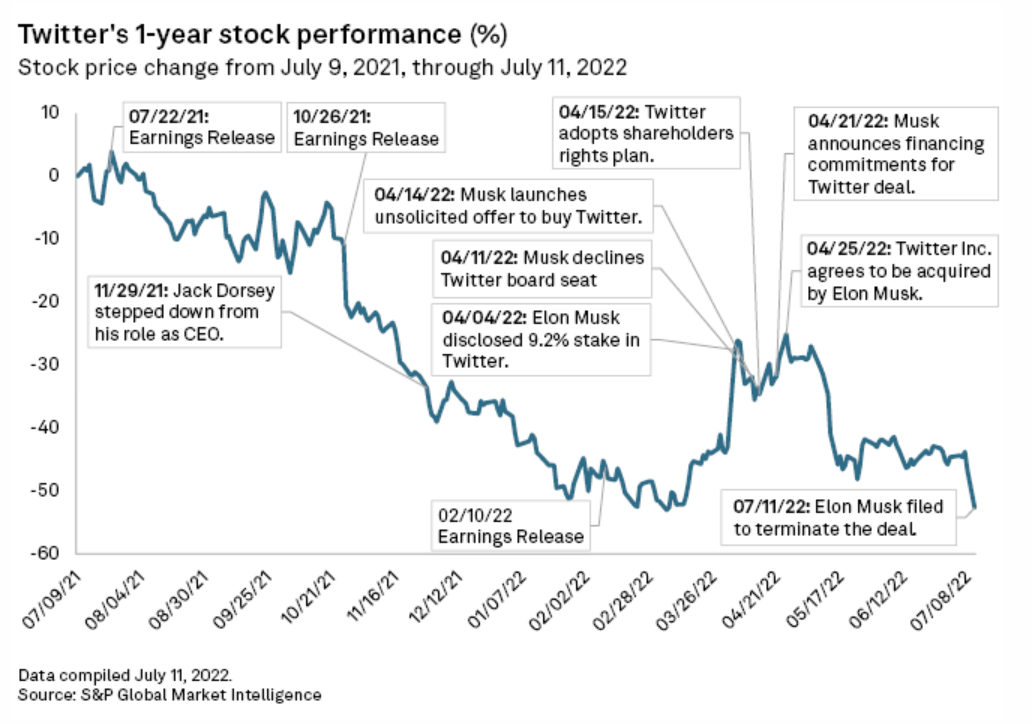

Twitter Faces Uncertain Future Amid Legal Showdown With Elon Musk

As Twitter Inc. and billionaire tech mogul Elon Musk lawyer up for a court battle over the company's sale agreement, analysts said Twitter's challenges are mounting, with or without the deal. The company's stock is falling and economic headwinds are coming. Analysts said Twitter will likely need an infusion of cash—either from Musk himself or from new bargain-hunting suitors.

—Read the article from S&P Global Market Intelligence