Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Central Banks Signal Strikes To Come

In the aftermath of the coronavirus crisis potentially having permanently altered the global economy, the current ongoing geopolitical shocks and shifting market dynamics may solidify the high inflationary environment for some time.

Leaders of the world’s most influential central banks—including European Central Bank President Christine Lagarde, Federal Reserve Chairman Jerome Powell, and Bank of England Governor Andrew Bailey—warned this week at the ECB’s annual conference in Portugal that more aggressive monetary policy actions may be needed to stop elevated inflation from becoming cemented in the global economic environment.

President Lagarde acknowledged that “I don’t think that we’re going to go back to that environment of low inflation.” Chairman Powell said that “we’re living with different forces now and have to think about monetary policy in a very different way.” Governor Bailey stated that “there will be circumstances in which we will have to do more.”

Their warnings come as macroeconomic conditions dramatically shift and the outlook for the rest of the year begins to darken. Along with the inflationary, geopolitical, and market pressures, S&P Global Ratings believes that signs of softening are rising in the global macroeconomic outlook—and generally revised downwards its GDP growth forecasts over 2022-2025.

“With the wisdom of hindsight, central banks are now viewed as having waited too long to raise rates, putting too much weight on supply-side explanations, or putting too much weight on labor market outcomes, or both. A swath of central banks, most notably the U.S. Federal Reserve, have brought forward their rate-hike timetables,” S&P Global Ratings Chief Global Economist Paul Gruenwald said in his third-quarter outlook this week. “The overriding challenge for central banks is whether they can rein in and re-anchor expectations without causing a recession.”

“With perseverance, monetary policy can be effective in anchoring inflation expectations and preventing an upward spiral in prices and wages from taking root,” S&P Global Market Intelligence Executive Director of Economic Research Sara Johnson said in recent research. “Absent new supply shocks, the outlook is sanguine.”

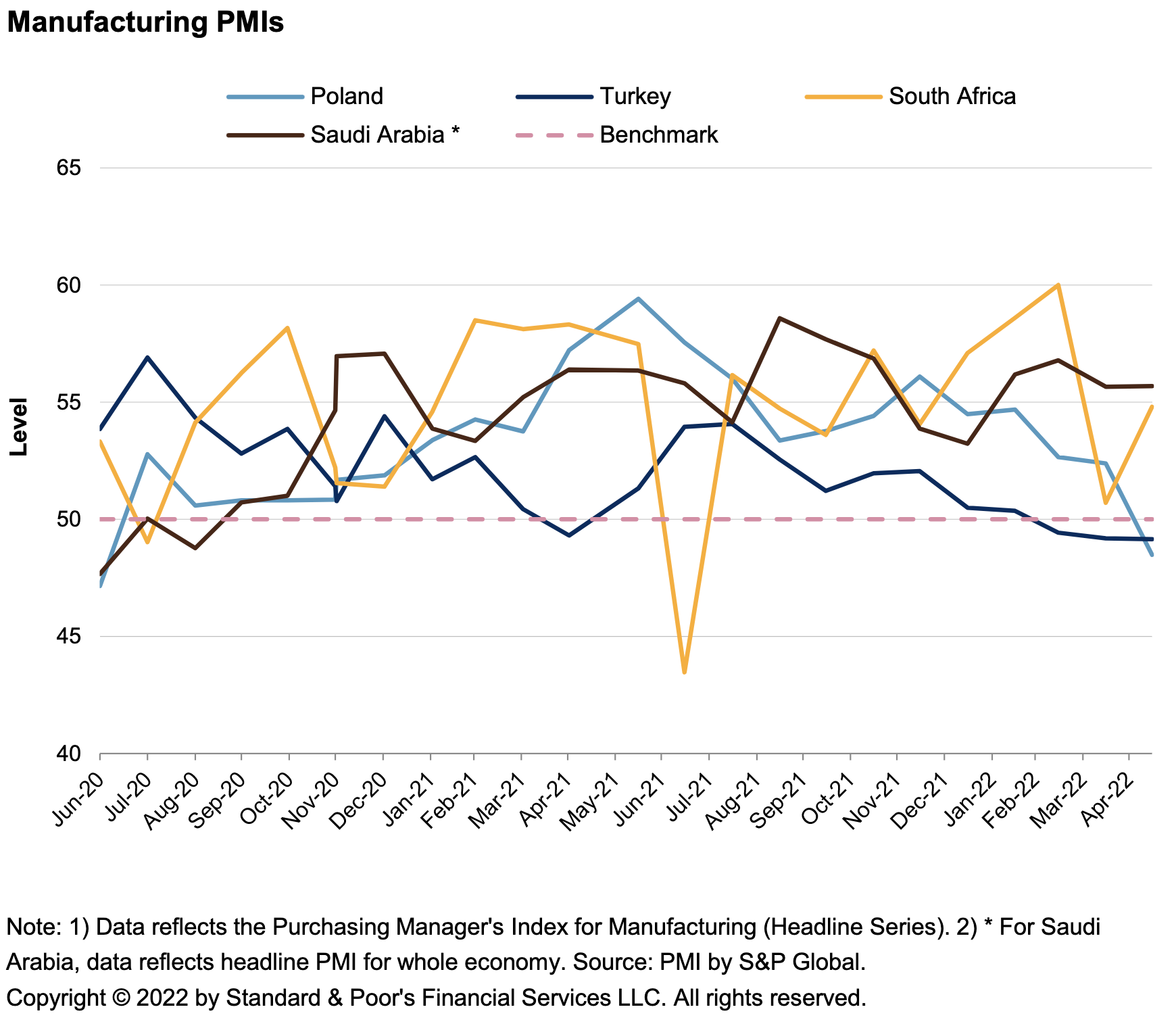

The global economy is confronting “unchartered territory” in regard to central bank policy as business activity slows due to notable worsening in demand, according to S&P Global’s Purchasing Managers’ Index survey data. The latest PMI survey data, published last week, signaled an increased risk of global stagflation. Tightening monetary policy also poses global financial dislocation risks, according to S&P Global Market Intelligence.

“Should inflation stay higher for longer than expected, real rates will remain correspondingly lower and central banks will need to do more. This runs the risk of more financial pain as well as a sharp decline in output and employment,” Dr. Gruenwald said. “In an extreme case of stagflation, inflation could remain elevated even if the economy is slowing sharply. In this case, supply-side-driven price pressures spill back into broader inflation pressure, requiring an even stronger policy response.”

Today is Wednesday, June 29, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Economic Outlook EMEA Emerging Markets Q3 2022: Slower Growth Ahead Amid Mounting Risks

After a solid first quarter that surprised on the upside, S&P Global Ratings expects slower GDP growth in emerging market economies within EMEA in the coming quarters, amid stronger headwinds from a prolonged Russia-Ukraine conflict, accelerated tightening of monetary policy by the U.S. Federal Reserve and other major central banks, and weaker global growth prospects.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Sberbank Firesale Provides Boost for Local Lenders in Former Yugoslavia

Local lenders in the former Yugoslavia have swooped in as Sberbank of Russia unravels amid international sanctions, snapping up units of the Russian bank at knock-down prices.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

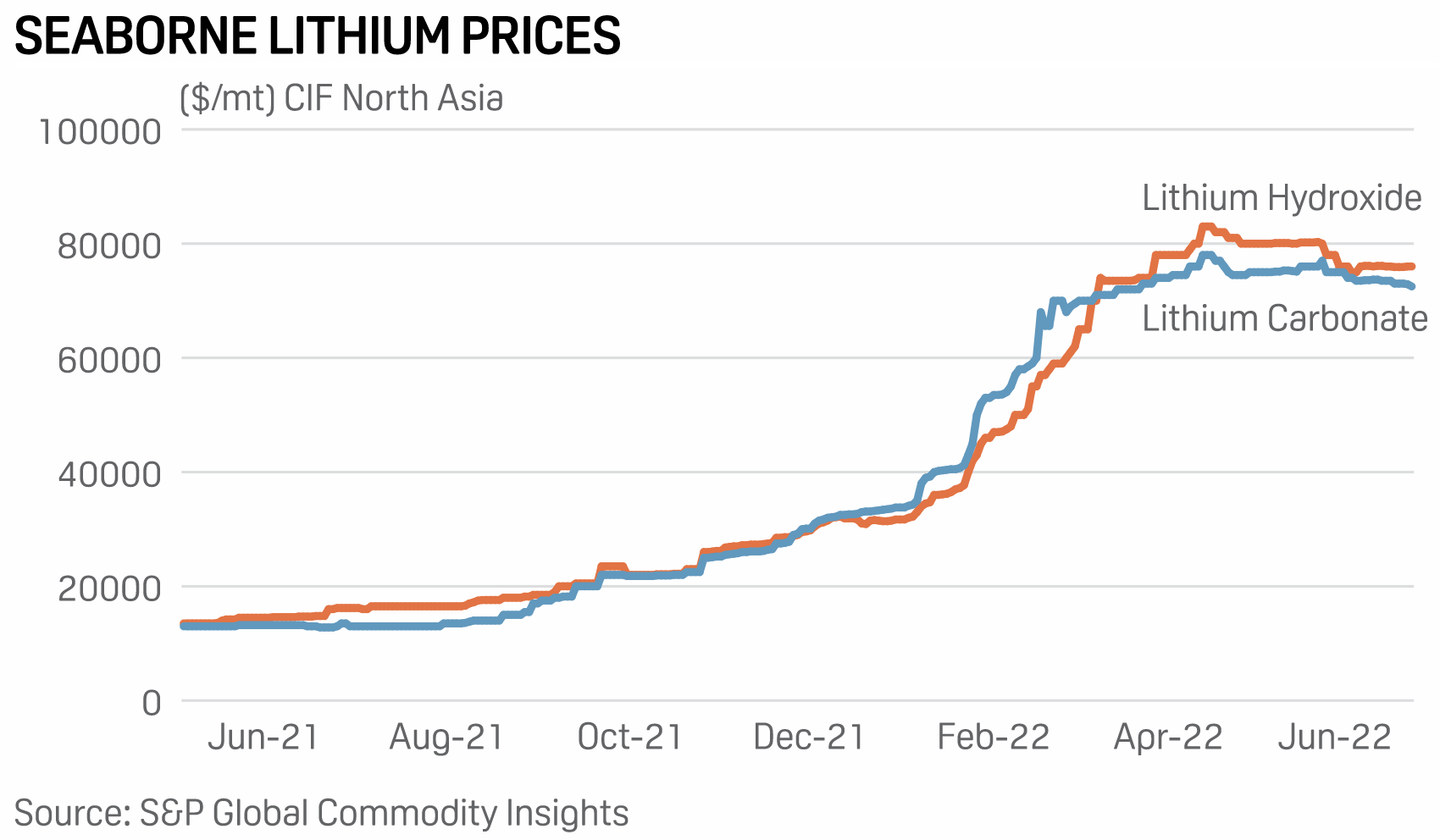

Europe Proposal to Classify Lithium as Toxic Could Hinder Battery Supply Chain

At the end of 2021, the European Chemicals Agency's Risk Assessment Committee agreed with French proposals to classify lithium carbonate, lithium hydroxide and lithium chloride as Category 1A reproductive toxicants, as they may damage fertility, unborn children and harm breastfed children. Initial proposals were presented to the EC in March and are now under review and consultation, with the first draft of an act reclassifying lithium compounds to be published between October and December.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

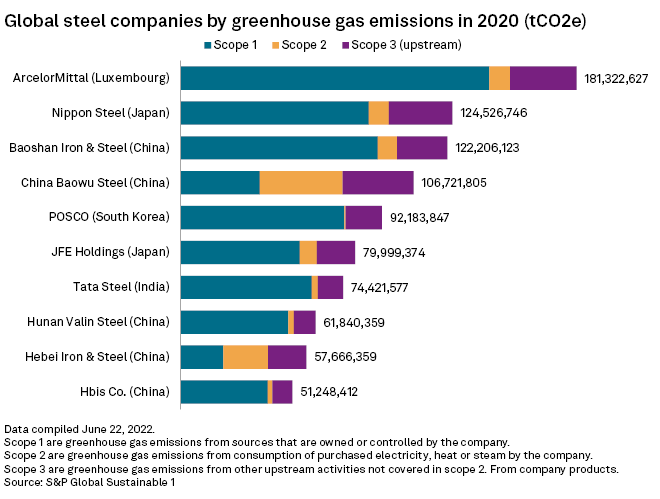

Lack of High-Quality Iron Ore Supply Threatens Steel's Green Push

A shortage of high-quality iron ore in the marketplace presents a significant hurdle for steelmakers who are trying to reduce their carbon emissions. Green hydrogen-based technologies use less carbon to produce steel, but the process requires higher iron ore grades than traditional blast furnaces. A dearth of ore with an iron content above 65%, combined with a shortage of mining projects in the pipeline, could disrupt the steel industry's climate goals, the Institute for Energy Economics and Financial Analysis, or IEEFA, concluded in a new report.

—Read the article from S&P Global Commodity Insights

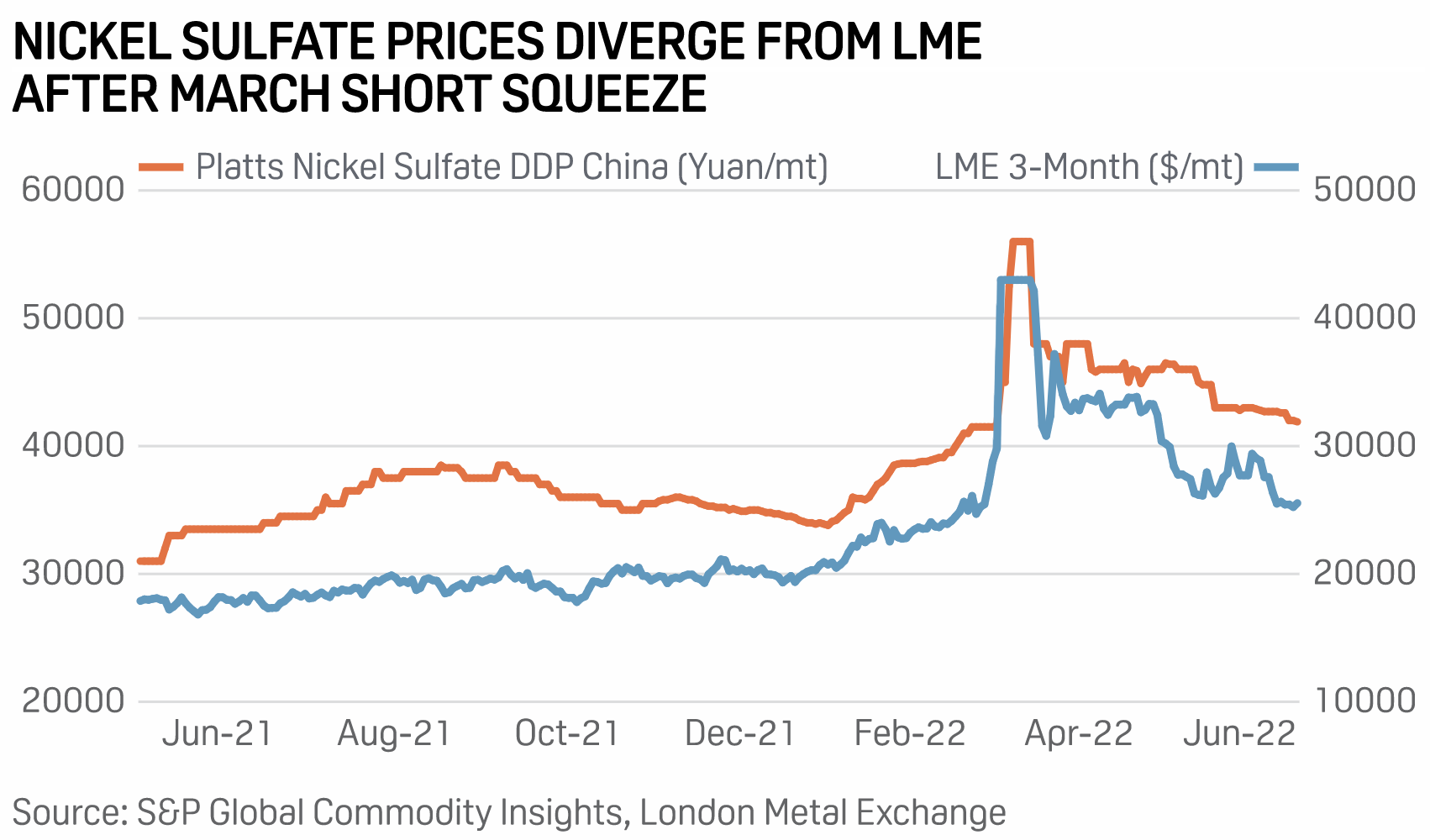

Nickel Sulfate vs Metal: Is the Market Shifting Towards New Pricing Mechanisms?

Three months after a historic short squeeze on the London Metal Exchange, which sent nickel prices soaring past $100,000/mt, the LME is back in the spotlight. This time it's facing two lawsuits, a complaint and a membership cancellation over the situation. Many market participants have openly voiced their concerns and dented trust in the exchange, with hedge funds and trading houses leading the way in reducing nickel positions or backing out entirely.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Next in Tech | Episode 71: Buy Now Pay Later: More than Modern Layaway?

Innovations in the payments world continue with the advances in Buy Now Pay Later (BNPL). It’s beloved by a new generation of online shoppers and big step from the layaway plans of old. Associate analyst McKayla Wooldridge joins host Eric Hanselman to delve into its appeal and look at recent study results that show both positive and negative angles for consumers and merchants. The latter want increased purchasing volumes, but the former are concerned about refund complexities and hidden costs.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence