Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 01, 2024

By Alex Wyer, Hugh Ewan, and Sergio Pedraza

Decarbonization and Norway Power from Shore Projects

Decarbonization has become a critical objective for the global energy sector, with Norway taking a leading role through its growing number of Power from Shore (PFS) projects. By replacing traditional gas and diesel-powered generators at offshore oil and gas platforms with cleaner onshore electricity, PFS projects contribute to a substantial decrease in greenhouse gas emissions, aligning with Norway's ambitious climate goals.

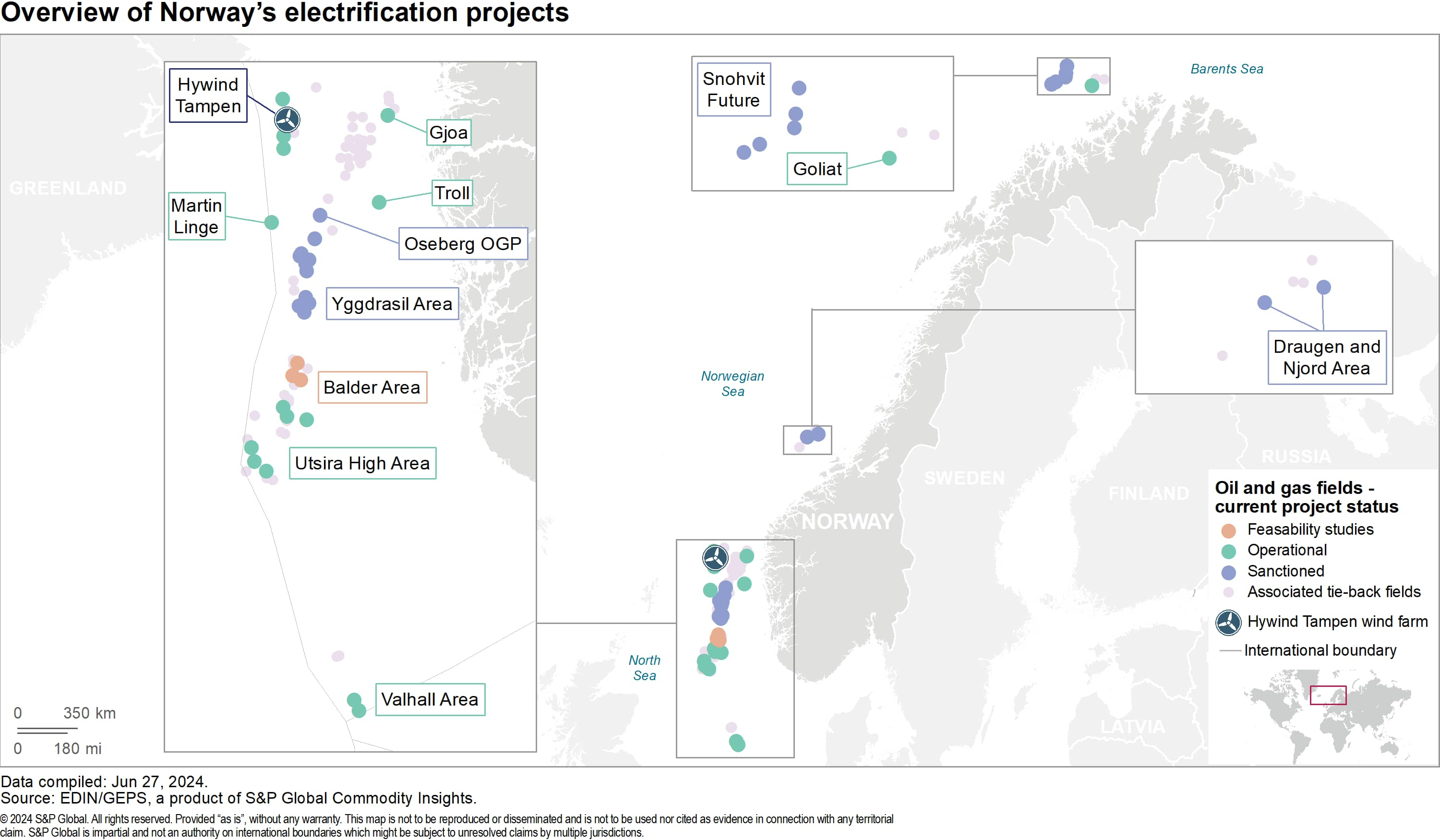

The PFS involvement on the Norwegian Continental Shelf (NCS) is significant, with 72 assets (25 hosts and 47 associated tiebacks) either being partially or fully electrified, of which 75% are in the North Sea. They are split across 12 developments with seven operational, four sanctioned and one project under feasibility analysis. PFS remains the dominant development concept, with only the Hywind Tampen (floating offshore wind) and Snohvit Future (onshore electrification) projects using alternative development scenarios.

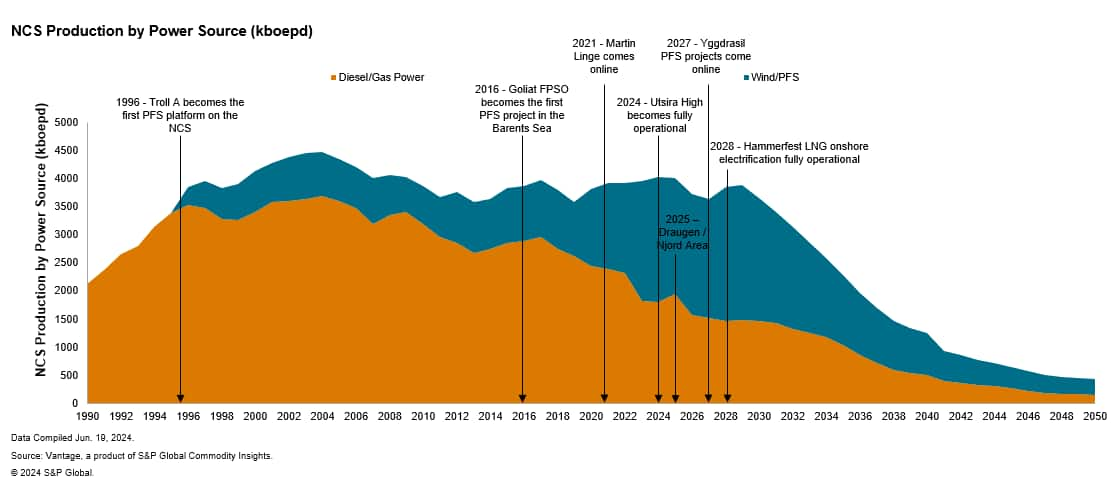

By leveraging our unique and comprehensive approach to upstream GHG emissions and asset valuation using Vantage and Energy upstream emissions capabilities, we can model abated emissions and determine the cost-effectiveness of these projects in terms of capital expenditure versus carbon taxes avoided. Based on our analysis, 2023 marked the first year ever in which over 50% of Norway's production was through PFS facilities. This milestone was driven by record production from Johan Sverdrup and the completion of the Utsira High PFS project which became fully operational in first quarter 2024. The crossing of this key 50% threshold underscores the rapid growth of decarbonization solutions in the NCS, and its continued importance to future emission reductions and sustainable energy practices.

Martin Linge case study

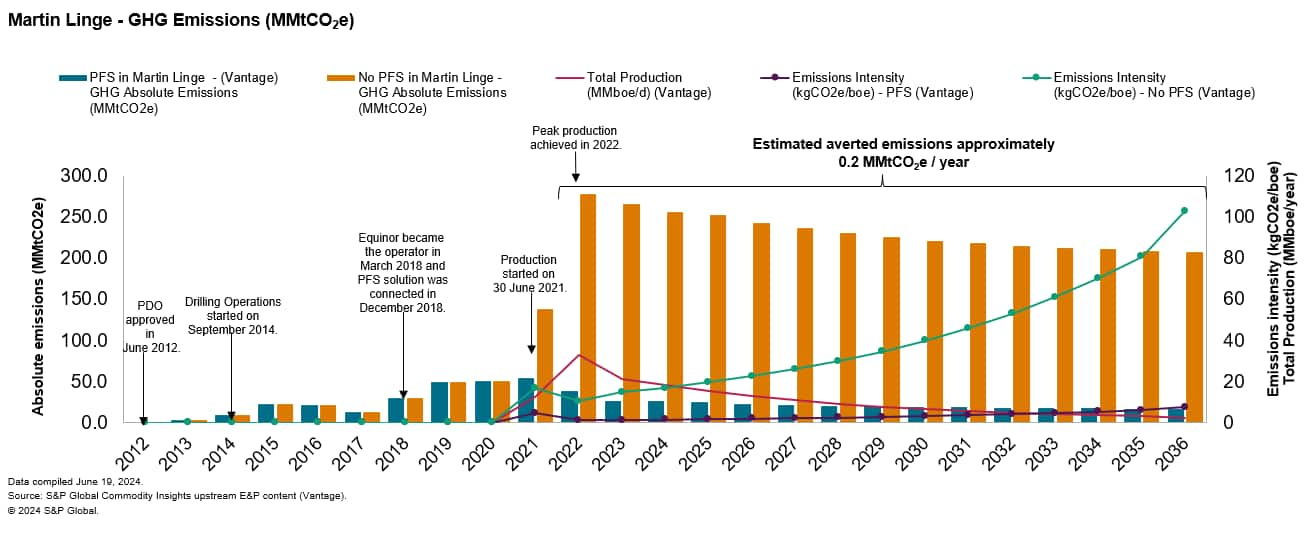

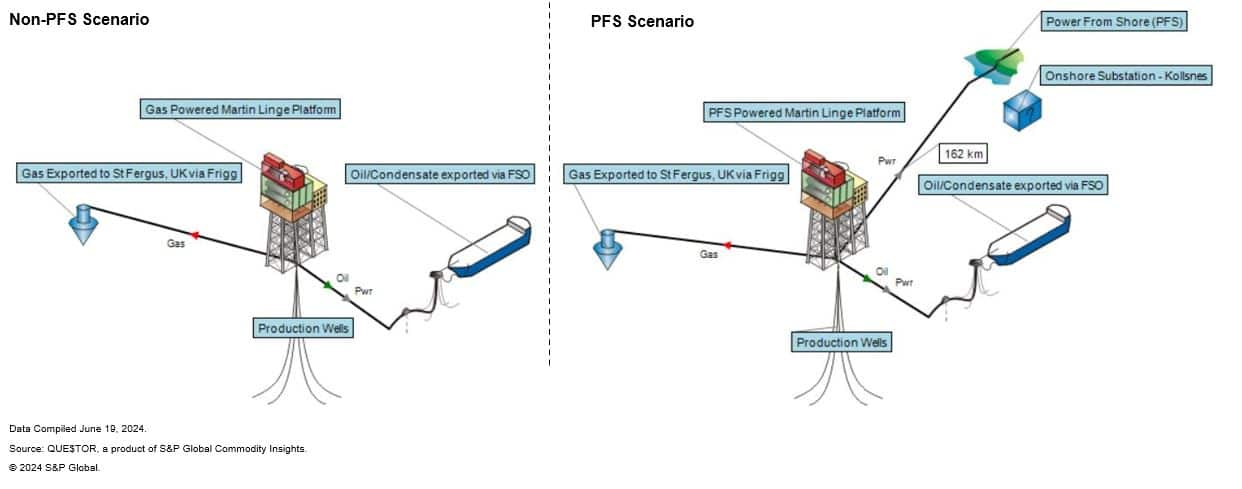

Located in the Norwegian North Sea approximately 42 km west of the Oseberg field, Martin Linge is an offshore oil and gas field operated by Equinor (with 51% working interest) that has undergone a remarkable transformation towards sustainability. The project's key objective was to reduce carbon emissions by transitioning to PFS, making it a significant step towards achieving Norway's ambitious climate goals. The Martin Linge project achieved electrification by powering the entire facility, including the floating storage, and offloading (FSO) unit, through a 162-kilometer subsea cable from shore. This innovative approach not only makes Martin Linge the longest PFS cable at inception but also the world's first storage vessel receiving PFS. The electrification significantly reduces annual emissions by approximately 200,000 metric tons of CO2e as stated by the operator. This reduction in emissions is a direct result of replacing traditional gas and diesel power sources with renewable energy. The total amount of abated emissions for the PFS solution (this is the base case scenario) since production started in 2021 is approximately 3.24 million metric tons of CO2 equivalent with a resulting emissions intensity of nearly 3 KgCO2e/boe. However, when modelling a non-PFS scenario, the emissions intensity is in the range of 35-40 KgCO2e/boe. The non-PFS emissions profile was obtained by estimating fuel gas consumed volumes using expected abated emissions. The emissions intensity for 2024 is approximately 1.5 KgCO2e/boe, the second lowest after Utsira High Area compared to other operational PFS projects such as Troll, Gjoa, Valhall, Goliat and Hywind Tampen, while production weighted average GHG emissions intensity for Norway was 7 kgCO2e/boe in 2022.

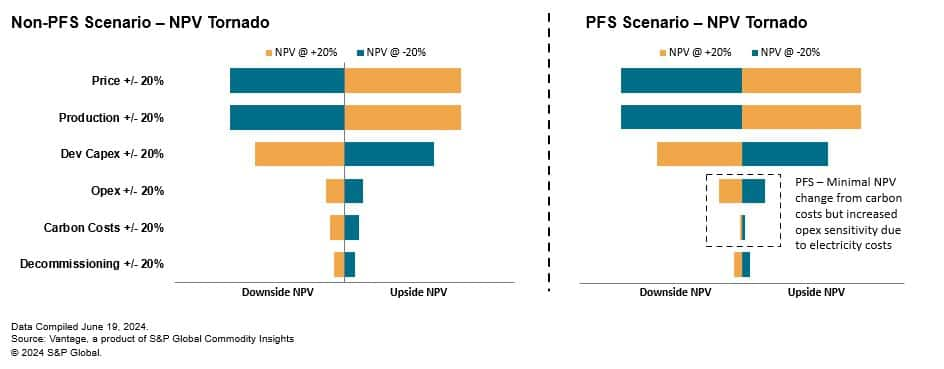

Implementing a PFS development strategy not only provides emission reductions but can also enhance commercial viability, despite an initial capital outlay. Estimates from QUE$TOR, S&P Global Energy upstream cost modeling software, indicate that the total cost for the PFS components of Martin Linge is approximately $230 million, which is 2.5 times higher than equivalent traditional offshore power facilities. This initial capital expense is one of several factors that influences the economics of a PFS development, alongside imposed carbon prices and electricity supply costs. A sensitivity analysis of Martin Linge with and without PFS highlights the impacts of each of these factors.

In the Martin Linge PFS scenario, changes to carbon costs, in the form of the Norwegian Carbon Tax, has a negligible effect on net present value (NPV) when compared to an equivalent traditionally powered development (non-PFS). Sensitivity to operational expenditure does increase slightly with PFS though due to the additional electricity costs. However, the influence of these factors on project economics is minimal when compared with capital expenditure, sales volumes, and associated oil and gas prices.

PFS increases sales volumes by reducing fuel gas utilization, which ultimately lowers unit costs ($/boe) and improves profitability. Modeling indicates fuel gas consumption from Martin Linge accounts for less than 1% of total gross gas production due to PFS. When modeled with traditional gas turbines, fuel gas consumption increases from 4% at the start of production to 25% (at the end) of gross gas production. Therefore, despite higher total project costs, the cost per unit for the PFS scenario is 1.8 $/boe lower, primarily due to higher sales volumes. This in turn results in an increase in the Internal Rate of Return (IRR) of nearly 2%.

Decarbonization projects, such as PFS and carbon capture, utilization, and storage (CCUS), are typically compared at the abatement cost level. For Martin Linge, the relatively high estimated abatement cost of $71/tCO2e is attributed to higher-than-expected costs and lower-than-expected production. However, this can still be deemed a success considering Norway's Carbon Tax is approximately $75/tCO2e and is projected to increase to about $200 /tCO2e by 2030, according to the 2021-2030 Climate Action Plan put forward by the Norwegian Ministry of Climate and Environment.

The success of Martin Linge highlights the importance of economic considerations in decarbonization projects. Norway's carbon tax, introduced in 1991, has played a crucial role in driving the transition to cleaner energy sources. With the tax rate expected to rise, companies are incentivized to invest in sustainable solutions like PFS. By analyzing the cost-effectiveness of projects in terms of capex spent versus carbon taxes avoided, stakeholders can make informed decisions that benefit both the environment and their bottom line.

Conclusion

In conclusion, decarbonization initiatives, such as the one presented in this blog, highlight the potential for significant emissions reductions and cost savings through strategic investments in technology and infrastructure. The Martin Linge case study exemplifies Norway's commitment to decarbonization and showcases the potential for sustainable energy solutions by embracing innovative technologies and leveraging economic incentives.

While the use of PFS is no 'silver bullet' in terms of decarbonizing the oil and gas industry, especially for nations that have not sufficiently decarbonized their electricity production (in 2023, approximately 98.5% of Norwegian electricity was renewably sourced). It can also present additional challenges in relation to increasing the demand for domestic electricity. However, it is still a powerful decarbonization solution, whose success on the NCS serves as a precedent for other countries and industries looking to reduce their carbon footprint and mitigate the effects of climate change.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.