Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 15, 2023

By Chris Kennett and Laurence Bird

Since the offshore discoveries in the 1960s the North Sea has been an important source of energy, wealth and employment for Europe. Even though production peaked in the 1990s the North Sea remains a significant oil and gas producing region accounting for 3% of global supply in 2022. Most of the North Sea reserves fall under the jurisdiction of Norway and the UK, with both countries accounting for the majority of production. In addition to being oil and gas producing nations, Norway and the UK are both seen as being climate conscious nations with both signatories to the World Bank's zero routing flaring by 2030 initiative. Norway is at the forefront of upstream emissions reduction having introduced a ban on routine flaring in the 1970s and a carbon tax in the 1990s. As a result, the North Sea has become an important region for the implementation of technologies and policies designed to cut upstream oil and gas emissions. Our 2022 emissions analysis allows us to investigate the year-on-year changes in the North Sea and the impact emissions reduction technologies and regulations have had.

To gain insight into the greenhouse gas (GHG) intensity for the North Sea oil and gas production, the Scope 1 emissions profiles of all major producing North Sea assets in 2022 were analyzed using data from S&P Global Energy Vantage. For this study, assets for Norway and the United Kingdom were grouped into major hubs, where a hub defines a production area or facility that is central to one or more surrounding fields. Emissions of carbon dioxide, methane, and nitrous oxide (CO2, CH4 and N2O) and the contribution to each from fuel gas combustion, diesel combustion, flaring, and fugitive and venting emissions were modeled for each hub across its production lifetime. Methane and nitrous oxide were converted using global warming potentials from the UN Intergovernmental Panel on Climate Change's Fourth Assessment Report (AR4), which are 25 for methane and 298 for nitrous oxide.

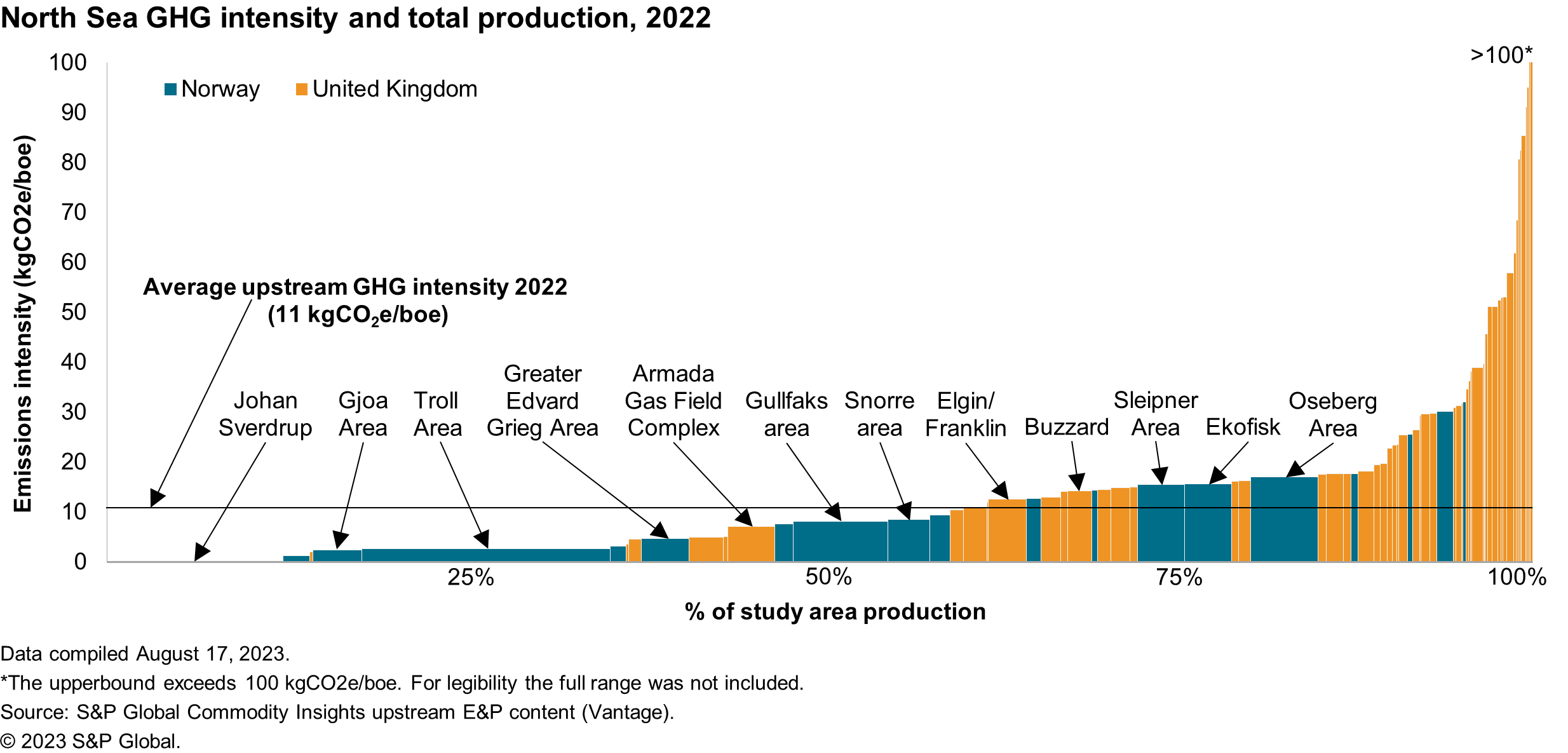

A total of 18.1 million metric tons of CO2 equivalent (MMtCO2e) was emitted from upstream activity in the UK and Norwegian North Sea in 2022. Norway emitted 7.2 MMtCO2e while producing 1,072 million barrels of oil equivalent (boe) from 20 hubs. The UK's 64 North Sea hubs emitted 10.9 MMtCO2e but were only able to achieve roughly half the production level of Norway, with 541 million boe. Our analysis found that the production weighted average GHG emissions intensity for the North Sea was 11 kilograms of CO2 equivalent per barrel of oil equivalent (kgCO2e/boe) in 2022. This was down slightly from 12 kgCO2e/boe in 2021 but still larger than the production weighted average emissions intensity of 7 kgCO2e/boe for the Gulf of Mexico. As observed in 2021, there was considerable variation in this basin wide average with the emissions intensity for individual hubs, ranging from less than 1 kgCO2e/boe to over150 kgCO2e/boe.

When Norway and the UK were examined separately we found Norwegian hubs had a lower weighted average emissions intensity of 7 kgCO2e/boe, similar to the US Gulf of Mexico. Some of the largest Norwegian hubs managed to achieve emissions intensities that were well below the Norwegian average, with the Johan Svedrup and Troll hubs both having emissions intensities that were significantly lower. Even though individual UK hubs had lower absolute emissions than Norwegian hubs, their production weighted emissions intensities tended to be larger, with an average of 20 kgCO2e/boe. Absolute emissions can be misleading as on initial examination the Troll Area was one of the largest emitters in the North Sea, however its emissions intensity was significantly lower than the UK average at 2.7 kgCO2e/boe. This means if the average UK hub were to have the same production levels as the Troll Area, absolute emissions would be significantly larger. The same factors that were identified in 2021 drive the difference in emissions intensity: larger production, power from shore and stricter controls on venting and flaring in the Norwegian North Sea. With the potential for the gap to widen as Norway brings more power from shore projects online.

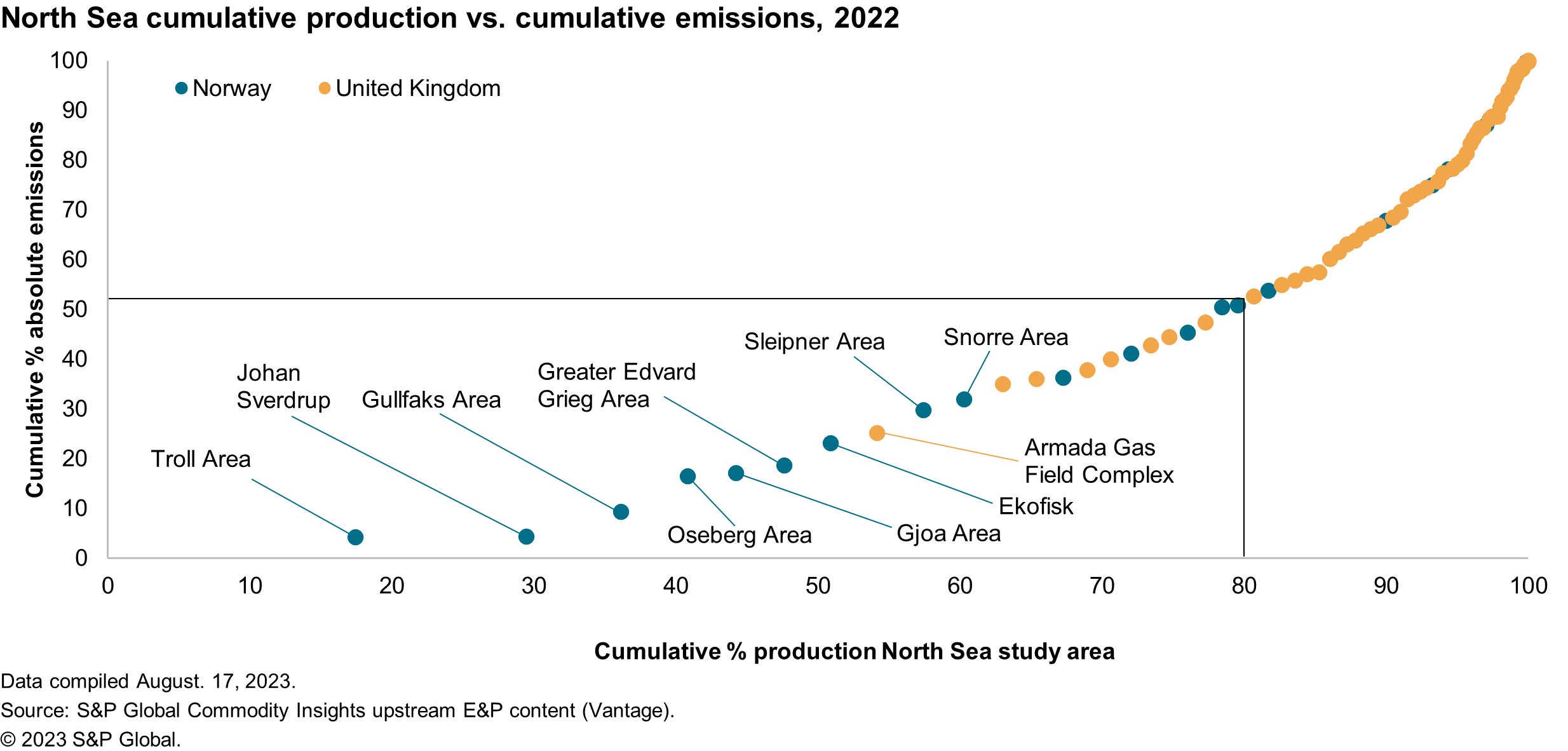

The differences between individual Norwegian and UK hubs becomes clear when cumulative absolute emissions and cumulative production are plotted against each other. Norwegian hubs, generally, had larger production and smaller emissions intensities than the UK hubs resulting in Norway contributing less to cumulative emissions per percent of cumulative production. The three largest producers, Troll Area, Johan Sverdrup and Gullfaks, accounted for 38% of production but only 10% of emissions, highlighting how efficient these hubs are compared to the rest of the North Sea. We found that 80% of North Sea production accounted for only 52% of emissions, with the final 20% of production contributing 48% of emissions. Most of this 48% came from UK hubs with a clear distinction between the cumulative emissions of the Norwegian and UK hubs. This shows that the measures taken by Norway to lower upstream emissions, banning routing flaring, taxing emissions, and encouraging power from shore, have had a significant effect.

Cumulative Norway and UK North Sea absolute emissions fell from 19.3 MMtCO2e in 2021 to 18.1 MMtCO2e in 2022. This trend was expected as emissions are linked to production, with production from the North Sea declining year-on-year. When individual hubs were examined, we found emissions decreased for 52 hubs with a higher proportion of the hubs Norwegian. Emissions increased for 32 hubs with most of these UK hubs. However, both the Troll Area and Johan Sverdrup, the two largest Norwegian producers, had increasing emissions. For Johan Svedrup this was due to phase 2 which started in later 2021, with the increase for Troll due to the start of phase 3 and increased production to support UK and European gas markets. Due to their emissions intensities being lower than both the North Sea and Norwegian average, any increase in production for Troll or Johan Sverdrup results in a smaller change to absolute emissions than if another hub were to increase production.

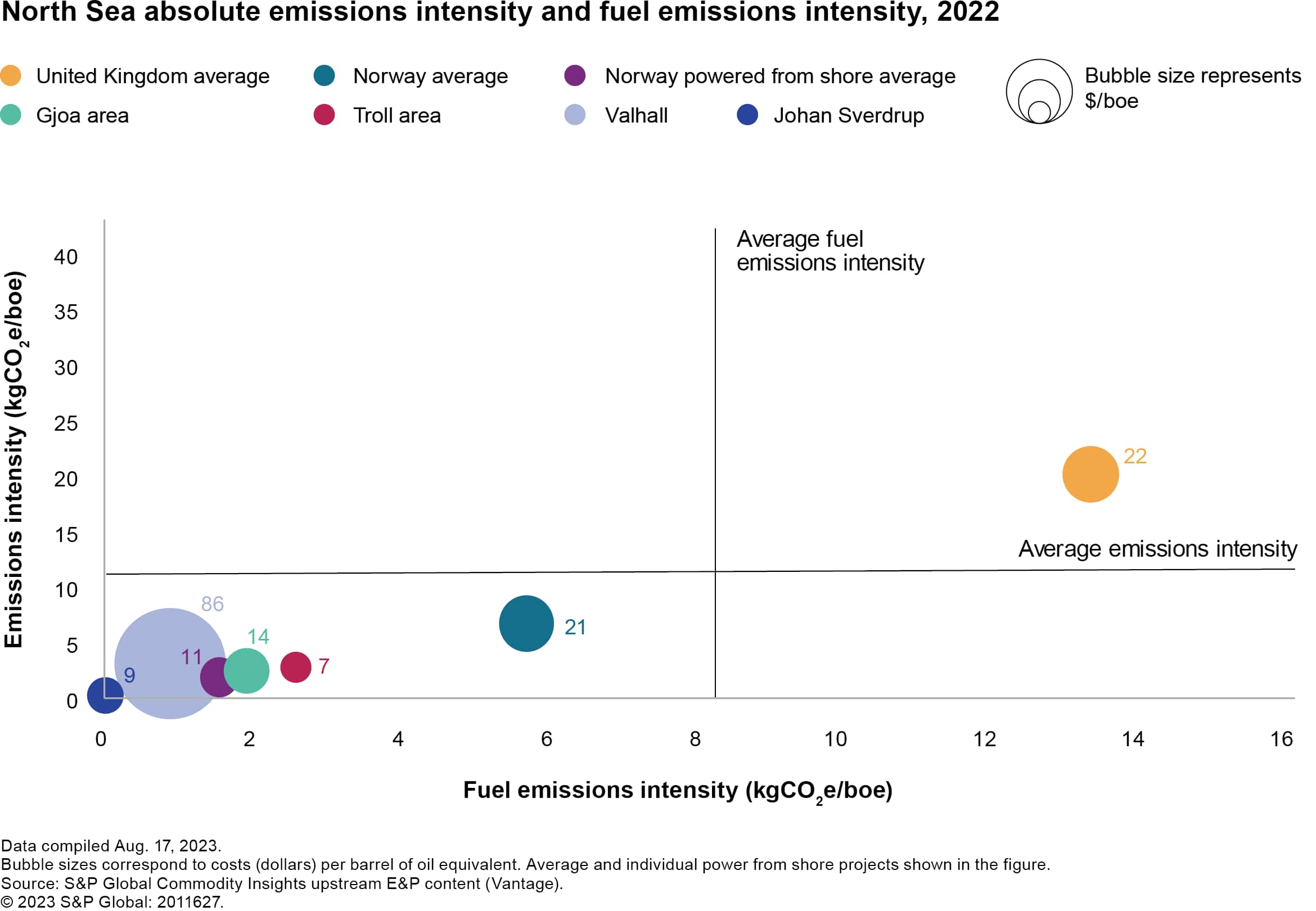

Throughout our analysis, we have found Norwegian and UK hubs to be distinct from each other with Norwegian hubs having lower emissions intensities than UK hubs. This is primarily driven by the larger size of production for Norwegian hubs, for example the Troll area deposit is one of the largest North Sea discoveries. There are also additional factors that have resulted in lower emissions intensities for Norway, such as power from shore, carbon capture and storage, and a ban on all routine flaring. All these additional factors will have a financial impact that could increase development and production costs. Total costs per barrel of oil equivalent (US$/boe) were on average 21 US$/boe for the Norwegian hubs and similar to the UK hub average of 22 US$/boe. This average was lower for the Norwegian power from shore projects at 11 US$/boe. The upfront cost of power from shore can be expensive with the cost to power Johan Sverdrup phase one from shore estimated to have cost NOK 6 billion (560 million US$) in 2015. Higher upfront costs are the likely reason why the larger Norwegian hubs have been selected for powered from shore, with the size of these hubs likely helping to lower the cost/boe.

The UK is yet to implement any power from shore projects, but along with stricter controls on flaring and venting it is part of the North Sea Transition Authority's (NSTA) plan to reduce upstream emissions. A challenge for the implementation is the smaller production size of UK hubs and the higher emissions intensity of the UK power grid. Given the large upfront costs of power from shore it is likely that only the largest UK hubs would be economical for development, limiting its implementation. Limited power from shore projects for the UK are likely to make it difficult to achieve targeted cuts to upstream emissions and similar emissions intensities to Norway. As Norway continues to bring more power from shore projects online the difference in emissions between Norway and the UK is likely to increase. Taxing upstream emissions is not currently mentioned by the NSTA as part of their plans to cut emissions to meet the UK's net-zero targets. However, it might be needed to encourage electrification on the UK side of the North Sea.

Energy comprehensive and rapidly evolving GHG modeling capabilities enabled analysis of the Scope 1 emissions profiles of all major producing North Sea assets in 2022, providing timely insight into the GHG intensity of Europe's most productive region. This insight is part of a continuing series of analyses from Energy upstream GHG dataset. Find out how we can help guide you on your emissions journey here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.