Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Agriculture, Chemicals, Non-Ferrous, Biofuel, Food

April 01, 2025

By Staff

Commodity prices are in focus this week, from lithium out of Latin America to aluminum in Japan and Asia to chicken in the US. Wheat crush margins and weak methyl methacrylate demand in Europe are also on S&P Global Energy radar.

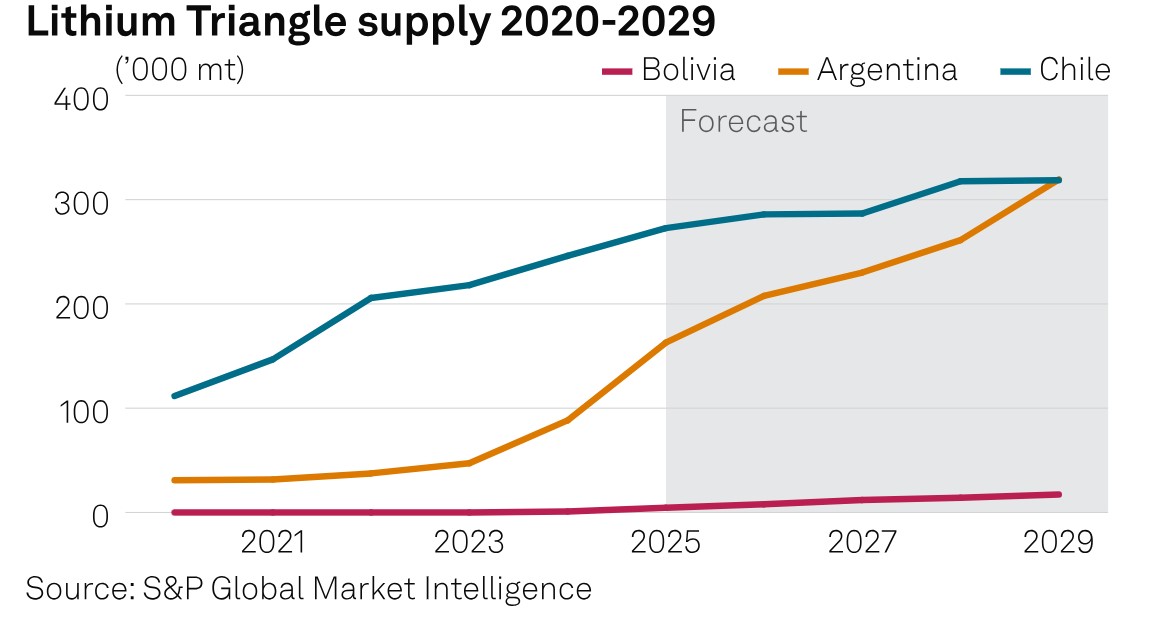

What's happening? Weak lithium prices have persisted since the market collapse in 2023, significantly affecting advancements in South America's Lithium Triangle -- Bolivia, Chile, and Argentina. Platts assessed FOB Lithium Triangle prices at $9,300/mt on March 26, reflecting a 7% decline since the start of the assessment in September 2024. Bolivia, despite having the largest lithium resources globally, operates only one low-capacity plant and struggles with project development, while Chile is projected to drop to fourth in global lithium production by 2029.

What's next? New projects will be particularly affected by the current price landscape, which may deter investment and slow progress. The outlook for lithium prices remains uncertain as Bolivia seeks to enhance its production capabilities amid legal and environmental challenges. Meanwhile, Chile's production is expected to remain strong, supported by existing producers like Albemarle and SQM, with new projects anticipated to commence in the coming years. With its more investor-friendly environment, Argentina is likely to see faster production growth, potentially influencing regional pricing dynamics as demand for lithium continues to surge due to the electric vehicle market.

What's happening? The quarterly aluminum premium contract over April-June was reported at $182/mt, plus the London Metal Exchange cash settlement average of the shipment month, CIF Japan. The reported premium for the Q2 MJP deals represents a 20% drop from the Platts Q1 2025 MJP assessment of $228/mt.

What's next? US tariffs on aluminum could lead to the rerouting of units away from the US, which in turn could lead to an oversupply situation elsewhere, according to market participants. Sentiment in Japan and the rest of Asia dampened as the US announced 25% tariffs on automotive imports effective April 2, which could further weaken aluminum demand in the region.

What's happening? US chicken prices for boneless skinless breasts have increased 66% since the start of 2025. The weighted average price for fresh BSB stood at $2.41/lb for the week ended March 28, according to US Department of Agriculture data. Strong demand for chicken against high beef costs and production losses due to bird flu have rallied prices.

What's next? The market faces ongoing production concerns headed into the seasonal peak summer months. The weekly hatchability ratio (chick placements as a percentage of lagged egg sets) six-week average was 76.7% through March 24, according to S&P Global Energy data. Breast meat in cold storage for February hit the highest level on record at 255 million lb. It will be key to watch for reductions in the upcoming March update to signal if prices will correct lower.

Related content: Global protein markets: What's shaping the future?

What's happening? European T2 ethanol wheat crush margins improved in the week ended March 28, although they have remained negative for seven months, according to Energy data. Wheat crush margins were calculated at minus Eur80.26/cu m in the week ended March 28, up Eur27.29/ cu m week over week. Platts assessed FOB CVB 11.5% and FOB Rouen low protein 11% at $244.50/mt and $241.75/mt, respectively, with little change month over month.

What's next? Given the tight supply, exporters foresee prices increasing while demand being limited to much higher protein levels above 12.5%, for example, from Turkey after the government allowed wheat imports duty-free. Winter crops in Europe are starting to grow, with spring planting already underway in parts of the Iberian Peninsula. Recent rainfall has helped both winter and spring grains. Still, concerns persist about deep subsoil dryness in Eastern Europe, emphasizing the need for more rainfall, according to a report by Energy. Platts is forecasting EU wheat production to reach 120.1 million mt for the marketing year 2024-25, down from 135.1 million mt in 2023-24.

What's happening? European methyl methacrylate, or MMA, prices fell to Eur1,790/mt on March 27, the lowest since Platts started publishing assessments on April 2, 2024. MMA is widely used for polymethyl methacrylate as well as acrylic surface coatings and adhesives, among other applications. The market remains long amid limited buying appetite, with reports of distressed material still in tanks that some players were heard to be offering at reduced prices. Buyers were also heard to postpone orders because of weak demand from end markets.

What's next? Competitive imports have been resulting in downward pressure on European prices. However, reports indicate that prices in Asia are nearing "cost level," which could prompt a capacity reduction in the region. Most players remained optimistic about a slight increase in seasonal demand from the coatings sector in April. However, some note this may fall short of expectations due to challenging geopolitical and economic conditions.

Reporting and analysis by Anne Barbosa, Louissa Liau, Luke Lundgren, Suzanna Hayek, Vivian Iroanya and Luke Warren