Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

28 Mar 2025 | 06:22 UTC — Insight Blog

By Staff

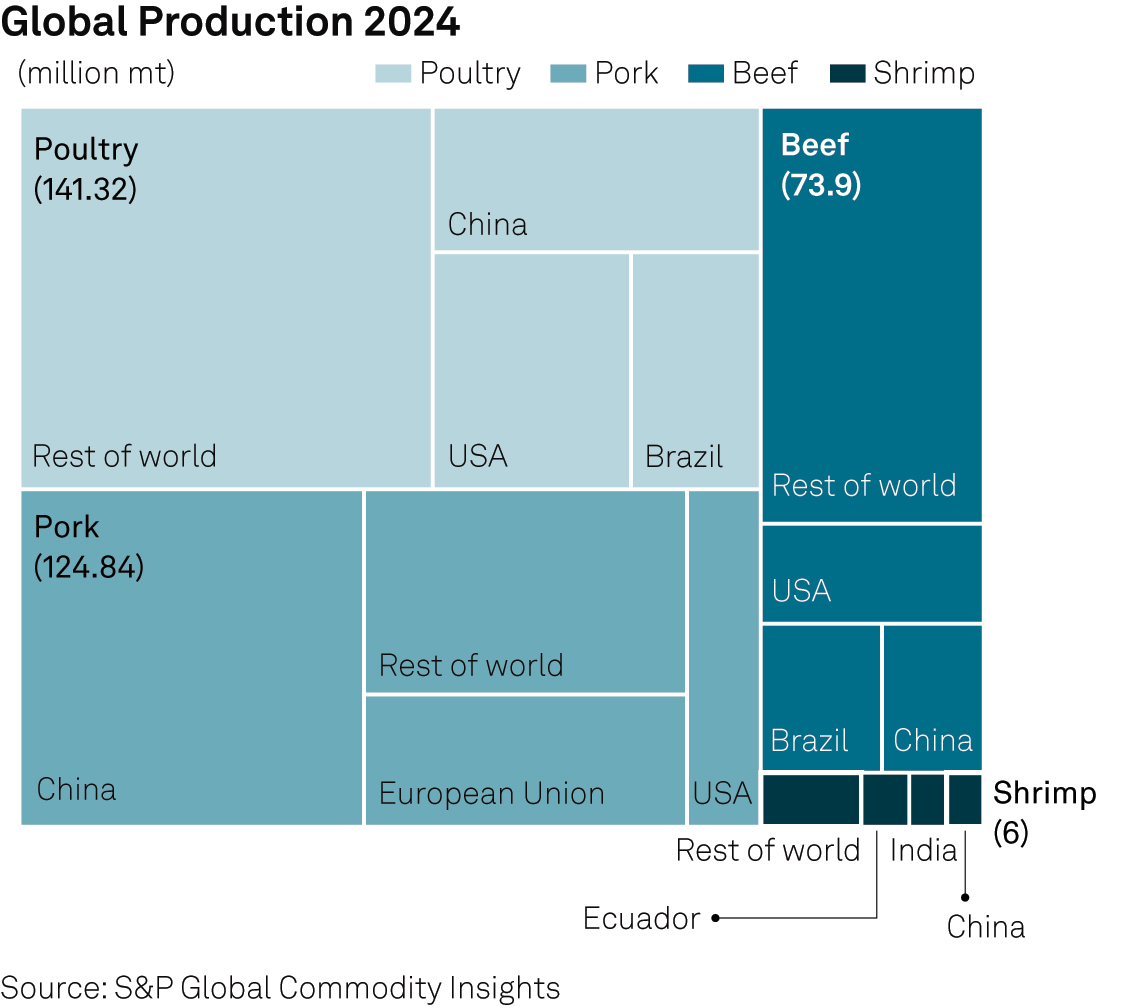

The global markets for chicken, beef, pork and shrimp are experiencing significant developments driven by geopolitics, disease outbreaks and economic factors.

Geopolitics stands out as the most impactful factor. Since US President Donald Trump took office, the markets have been in a state of constant flux, with tariffs being imposed and lifted unpredictably. This has led to retaliatory tariffs from affected countries, which will result in new trade flows as global protein buyers and sellers adapt to the shifting geopolitical landscape.

Chicken and pork are the world’s most consumed meats. Chicken production is expected to reach 116 million mt in 2025, a 2.42% increase from 2024, according to our analysts. In January and February, the spike in avian influenza (HPAI) drove US egg prices to record highs leading to memes. Some joked that for Valentine’s Day, they made three-egg omelets! The disease primarily affected layer chickens, but meat exports also felt the sting as restrictions imposed led to higher chicken leg prices in the UAE.

The UAE is a key chicken importer. In the first quarter of 2024, UAE imports totaled approximately 170,000 mt, 35% higher than in Q1 2023. Annual imports of fresh and frozen chicken meat reached 604,000 mt in 2024, marking a 7% year-on-year rise.

In January, cold storage facilities in the UAE were nearly empty as distributors ramped up purchases ahead of Ramadan, driving prices to a record $3,070/mt.

Similarly in Asia, chicken prices are trending higher. Platts CFR North Asian chicken leg prices surged to an all-time high of $2,300/mt on March 12, marking a 12% rise since the assessment was launched on June 3, 2024. Strong demand from Japan and the labor availability crisis in Brazli’s processing plants are causing supply constraints.

Finally, the threat of Trump’s policy on immigrants may add further stress to the supply chain. US farms depend heavily on immigrant labor and the administration’s plan to deport foreign workers could restrict supply and translate to higher prices although there has not been any report of actual deportations yet.

The US, Brazil and China are major beef producers. Brazil led exports at 27.6% market share in 2024, followed by Australia at 14.4%.

The Platts Brazil Beef Marker reached a record of $5,510/mt FCA Santos on March 13, the highest since Platts started price assessments a year ago. It is up almost 10% from January.

Strong demand from China and the US drove up the price but buyers have started to pull back, leading to a $100/mt price drop on March 20. High cattle purchase costs and a stronger Brazilian currency against the US dollar may limit price decline, market sources said.

US imported beef price has also climbed. Despite being a large producer, the US imports significant volumes of lean beef trimmings to meet its ground beef demand for burgers. Imports hit a record 608 million lbs in January, up 21% year on year.

Platts 90CL Beef CIF US reached a high of $6,989/mt on March 12, supported by demand and tight supply.

The US cattle herd is the smallest since 1951, with Energy analysts predicting cattle inventories have reached the bottom of their liquidation cycle. Experts believe the reduction in cattle numbers will stop and the domestic herd size is expected to stabilize as cow-calf sector profitability signals rebuilding.

Global beef trading is further complicated by ongoing US-China tariff disputes, delays in renewing US processor licenses in China and potential US tariffs on Australian beef. Despite these challenges, Australian beef exports rose 24% from 2023 to a record 1.34 million mt in 2024, according to the Australian Department of Agriculture, Fisheries and Forestry.

The EU is the most significant pork exporter globally, with pork belly being the most traded cut. North Asia, which includes China, South Korea and Japan, are the biggest importers, representing about 25% of global import volumes.

The EU faced a second case of foot-and-mouth disease in February, detected on a dairy farm in Hungary -- the first since 1973. This follows Germany's first FMD case in nearly four decades, reported in January. Neighboring countries, especially Slovakia, are on high alert.

The UK is concerned, recalling the devastating FMD outbreak in 2001. The US and UK have temporarily banned imports of meat and livestock from Hungary and Slovakia, similar to restrictions on Germany.

Hungary and Slovakia's exports mainly go to other EU countries, both countries are already excluded from key Asian markets, like China and Japan, due to the African Swine Fever.

China's pork imports in January and February jumped by 13% year on year. Supplies from North America surged by 37% while volumes from Canada were up by 21%. However, things could get tougher for Canada as China decided in March to slap a 25% tariff on Canadian pork imports. On top of that, Beijing also added a 10% tariff on pork from the US.

Ecuador’s climate and geography make it the world’s leading shrimp producer, accounting for more than 25% of global trade while China and the US are key destinations. China’s 2024 imports were 7% lower year on year and the trend persisted in the first two months of 2025, with imports 16.1% lower from the same period last year.

However, when comparing import levels from November 2024 to February 2025 with the same timeframe from the previous year, the current import levels are actually higher. With macroeconomic indicators suggesting a recovery in services and enhanced consumer confidence, 2025 seems set for a comeback in shrimp import demand after a decline in 2024, according to Energy analysts.

Inflows from Ecuador rose 16% year on year in February but could have boosted stocks, making Chinese importers more hesitant on new purchases.

Consequently, Ecuadorian exporters have been seeing China's shrimp prices at levels lower than before and depressed compared with other markets.

The Platts Ecuador Shrimp Marker for head-on, shell on Vannamei shrimp price assessment fell 4.7% or $250/mt from Jan. 2, to $5,100/mt on March 21.

The US, the second biggest buyer of shrimp, saw imports drop 4% in 2024 from 2023. Sentiment there is bearish as US buyers are facing "tariffs PTSD" and slow economic growth.

In 2024, India had a 39% share of the US market but faced the highest duties compared with other exporting nations.

The US Department of Commerce imposed countervailing duties on shrimp imports in October 2024, where Indian exporters have to pay 5.63%-5.87% in countervailing rates compared to 3.57%-4.41% for Ecuadorian exporters.

Many Indian exporters fear that higher tariffs might lead to a loss of the US market to other origins like Ecuador.

India’s main crop in the East Coast states is due for harvest in April. Supply in 2025 is expected to be healthy as prices in 2024 were strong following weather shocks.

Recovering supply and sluggish retail demand have weighed on the Indian shrimp prices.

Farmgate prices of head-on, shell-on shrimp in the major shrimp producing state of Andhra Pradesh fell by at least Rupees 50/kg ($573/mt) month on month March 3.

Although prices have displayed a modest recovery in the second half of March, the fall in shrimp prices ahead of the new crop harvest is of great concern to many producers.

A version of this article was initially published in the February 2025 edition of Energy Magazine