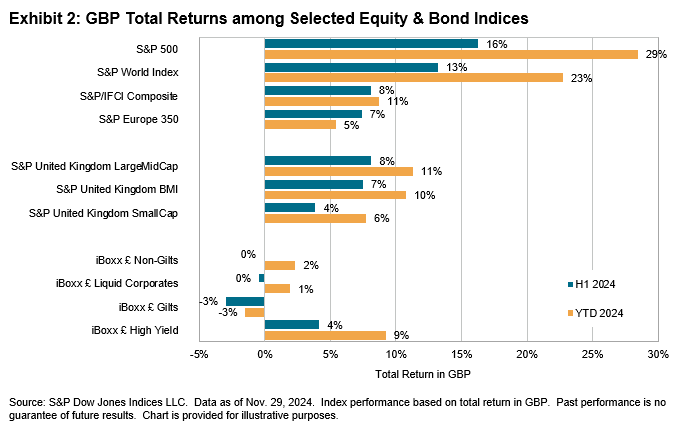

Over the six-month period ending June 2024, among GBP-denominated actively managed funds, active equity funds struggled, but many bond managers shone.

As highlighted in the SPIVA Global Scorecard, the first half of 2024 proved to be a particularly challenging market environment for active managers across major developed equity markets, with leadership by the very largest companies resulting in a high proportion of stocks underperforming capitalization-weighted benchmarks. Among GBP-denominated international active equity funds, 78% of Global Equity funds underperformed the S&P World Index, 76% of U.S. Equity funds underperformed the S&P 500® and 78% of European Equity funds underperformed the S&P Europe 350®.

In domestic U.K. equities, size played a crucial role. With larger names generally outperforming their smaller counterparts, it proved harder for large-cap focused funds to beat large-cap benchmarks than small-cap funds to beat their respective benchmarks; the latter category registering 93% of funds outperforming. Overall, a slight majority—55%—of all domestic active funds underperformed the S&P United Kingdom BMI in the first half of 2024.

Conversely, the bond markets offered easier pickings. With tailwinds for style bias in duration and credit, many active fixed income managers posted benchmark-beating returns in H1 2024. Exhibit 1 summarizes the reported underperformance rates over a range of time horizons for the largest fund categories.

Market Context: H1 2024 and Beyond

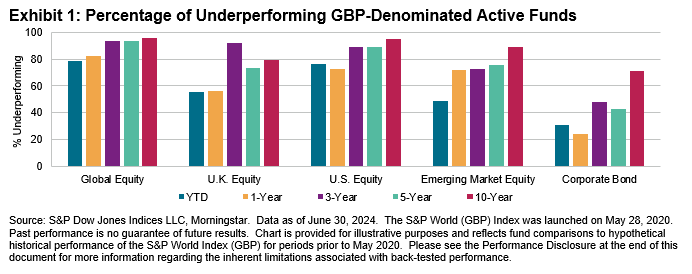

Driven by gains among the biggest companies and further flattered by a strengthening U.S. dollar, U.S. equity markets continued to dominate international peers in both the first half of 2024 and the second half YTD. European markets lagged the rest of the world on both sides of the year’s midway point, particularly after the results of the 2024 U.S. presidential election heralded a potential return of tightening cross-Atlantic trade conditions. Meanwhile, the U.K.’s stock markets delivered decent returns in absolute terms, but those returns were less impressive in comparison to broader developed equities.