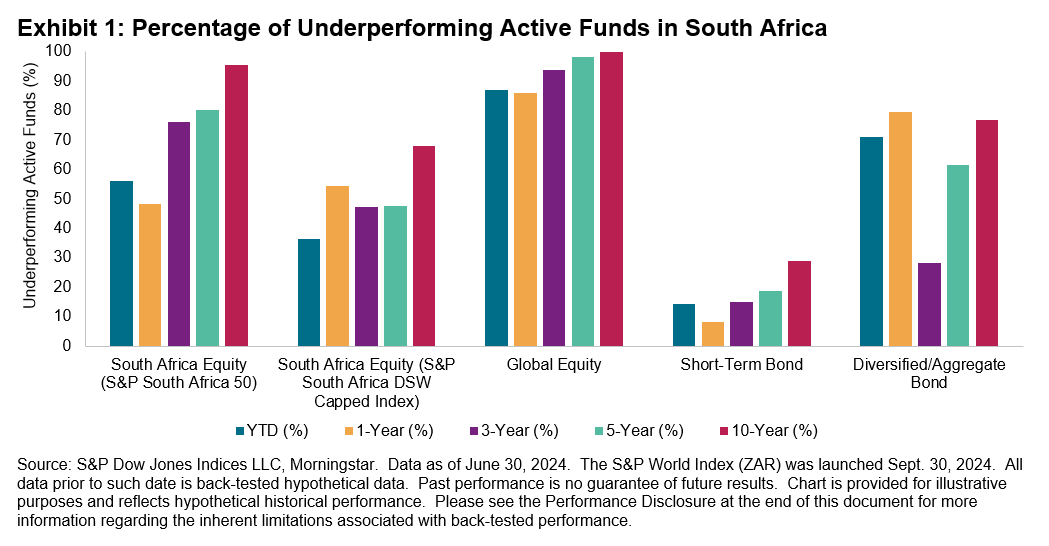

Our SPIVA Global Scorecard highlighted the challenging market conditions for active equity managers around the world in the first half of 2024. South Africa was no exception—out of 519 total active funds across all South African fund categories, a majority (56%) underperformed their assigned benchmarks.

Rising equity markets accompanied by the outperformance of the very largest companies provided difficult stock-picking grounds for South African equity managers in H1 2024. Over half (56%) of all South Africa Equity funds failed to keep up with the S&P South Africa 50’s total return of 6.2%.

Non-domestic equity funds domiciled in South Africa struggled even more, with the underperformance rate as high as 87% in the Global Equity category in H1 2024. This is in line with the long-term trend of relatively higher underperformance rates; over a 10-year period, 100% of funds in the Global Equity category underperformed the S&P World Index (see Exhibit 1).

Market Context: H1 2024 and Beyond

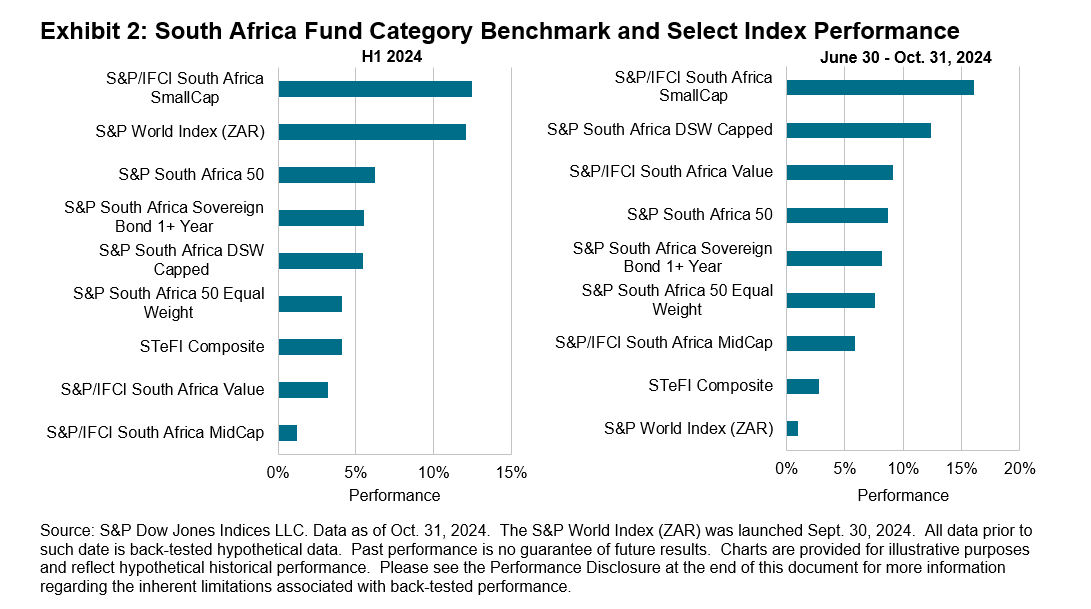

Along with most other emerging markets, South African equities had a good start to the year, with the S&P South Africa 50 and the S&P South Africa DSW Capped Index up 6.2% and 5.4%, respectively, in H1 2024. Gains in the following four months were even stronger, and the S&P South Africa 50 and the S&P South Africa DSW Capped Index were up 13.3% and 18.6%, respectively, YTD as of Oct. 31, 2024 (see Exhibit 2).

As noted in the SPIVA Global Mid-Year 2024 Scorecard, the first half of the year was characterized by increased concentration (and the associated challenges for actively managed funds) within both the S&P South Africa 50 and the S&P South Africa DSW Capped Index. The S&P South Africa 50 Equal Weight Index accordingly lagged the S&P South Africa 50 by 2.1% in H1 2024, following three straight calendar years of outperformance. The fortune of the S&P South Africa 50 Equal Weight Index seemed to have turned in Q3 2024, as it modestly outperformed the S&P South Africa 50. As market conditions evolve, we will continue to observe how South African equity managers navigate the potential challenges and opportunities remaining in 2024.