Mid-Year 2024 Highlights

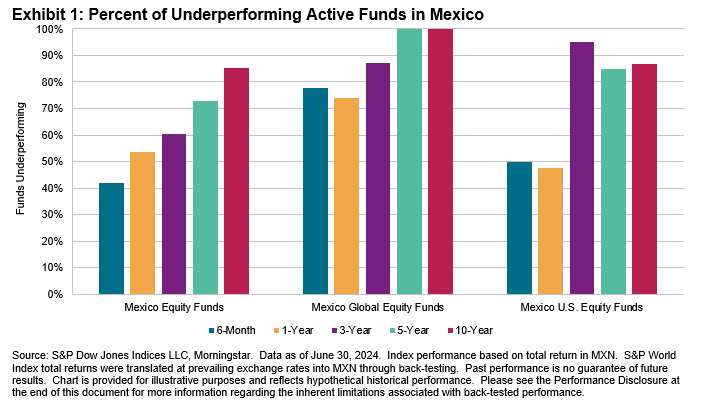

While our SPIVA Global Scorecard illustrated the challenging market conditions for active managers around the world in the first half of 2024, Mexico was an exception over the short term. Funds in the Mexico Equity category underperformed at a rate of 41.9% over the first six months of 2024, rising to 85.4% over a 10-year period (see Exhibit 1 and Report 2).

In addition to Mexico Equity, this report presents inaugural SPIVA analyses of two new categories of Mexico-domiciled funds: U.S. Equities and Global Equities. In the first six months of 2024, 50.0% of MXN-denominated U.S. equity funds underperformed the S&P 500®, with the underperformance rate rising to 85.0% and 86.7%, respectively, over the 5- and 10-year periods. Global Equity (MXN) funds had a more difficult first half of 2024, with 77.8% underperforming and a full 100% falling behind the benchmark over the 5- and 10-year periods.

Market Context: H1 2024 and Beyond

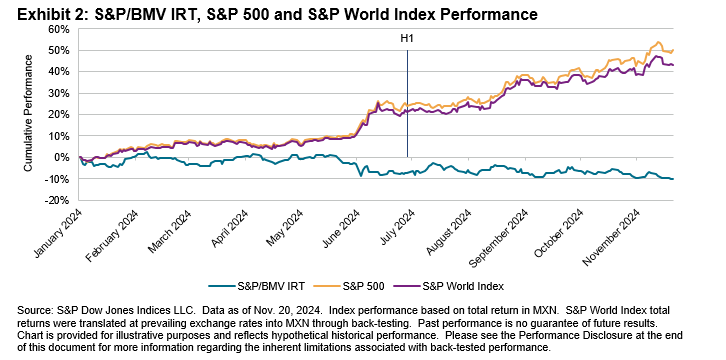

In Mexico, the flagship S&P/BMV IRT began the year in negative territory and ultimately finished the first half of 2024 down 7.2%. Meanwhile, the S&P 500 rose 24.2% and the S&P World Index was up 21.2% in MXN during H1, outperforming local equities (see Exhibit 2).

Mexico’s equity market offered ample opportunities for outperformance, and fewer than one-half of local equity funds failed to surpass the benchmark in the first half of 2024. The performance of the S&P/BMV IRT was led by a few major contributors, resulting in mildly positive skewness of stock returns, with the average constituent falling 5.1% compared to a median decrease of 6.0%. However, 56.8% of stocks outperformed the index during the first six months of the year. In a period when the majority of stocks beat the benchmark, most Mexico Equity funds took advantage of market conditions favorable to stock-picking, with underperforming funds comprising just 41.9% of the total during H1 2024.

Looking beyond H1, Mexico equities continued on a negative trajectory through the first four months of H2, ending down 10.2% YTD through Nov. 20, 2024. The proportion of stocks outperforming the S&P/BMV IRT slightly declined, to 47.4%. The S&P 500 and S&P World Index continued their strong performance, rising 50.2% and 43.3%, respectively, YTD through Nov. 20, 2024. As the months keep rolling past, only time will tell how well Mexico’s active equity managers navigate the challenges and opportunities remaining in 2024.