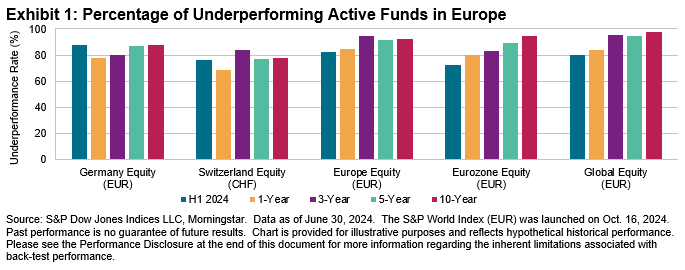

As highlighted in the SPIVA Global Scorecard, the first half of 2024 proved to be a challenging market environment for active managers across developed equity markets. The performance of European-based actively managed funds evidenced this trend, with 82.3% of Europe Equity funds and 72.7% of Eurozone Equity funds underperforming the S&P Europe 350® and S&P Eurozone BMI, respectively.

Managers of Germany Equity funds faced a particularly difficult six months, with 87.8% failing to beat the S&P Germany BMI’s total return of 7.9%. Meanwhile, those in the Switzerland Equity fund category fared slightly better, with an underperformance rate of 76.4% versus the S&P Switzerland BMI’s total return of 9.4%. Although this is a comparatively better result within the European region, this outcome is notably worse than expected when compared to the 48.5% underperformance rate observed in 2023.

Over H1 2024, European active bond managers did well to capture generally favorable tailwinds from drivers of credit, liquidity and term. In all three EUR-denominated fixed income categories, managers posted outperformance rates, at 66.5%, 64.8% and 73.1% for Government, Corporate and High Yield Bond categories, respectively.

Market Context: H1 2024 and Beyond

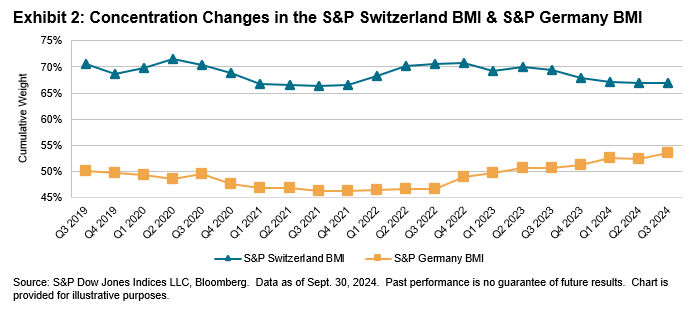

European equity markets in the first half of 2024 demonstrated that the widely discussed trend of mega-cap dominance was not unique to U.S. equities. Outperformance of the very largest names led to increased concentration in most major markets, particularly in Germany, which saw a nearly 5% increase in the weight of its 10 largest constituents between Dec. 31, 2023, and June 30, 2024. Switzerland was an exception, seeing instead a decrease of 0.3%. The latter trend looks set to continue in the second half of the year, having fallen nearly 2% as of the end of Q3 2024. Exhibit 2 provides the average cumulative weights of the 10 largest constituents across previous quarters for both the S&P Switzerland BMI and S&P Germany BMI.

European equities started the year generally slow compared to global markets and lost further momentum entering the second half of the year, with the S&P Europe 350 and S&P Eurozone BMI returning 2.4% and 3.2% in Q3 2024, versus 9.8% and 8.2% in H1 2024, respectively. From a constituent perspective, the odds for active managers of Switzerland Equity funds appeared to have improved, with only 54.9% of the category’s benchmark constituents underperforming its total return over the quarter (versus 68.6% in H1 2024). However, the environment for German “stock pickers” remained challenging, with 67.3% of S&P Germany BMI constituents underperforming in Q3 2024, compared to 69.1% in the first half of the year.