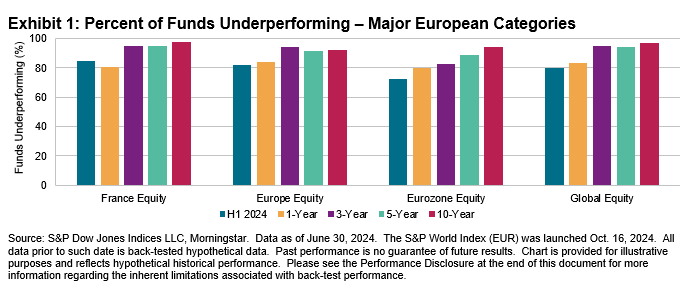

As highlighted in the SPIVA® Global Scorecard, the first half of 2024 proved to be a challenging market environment for active managers across developed equities. Within Europe, 80.2% of Global Equity funds failed to beat the S&P World Index—partially driven by the challenge of outperforming the U.S. component, a trend evidenced by the 75.0% underperformance rate of European-domiciled U.S. equity focused funds against the S&P 500®’s total return of 18.8%.

There were also challenging headwinds more locally, with 82.3% of Europe Equity and 72.7% of Eurozone Equity funds underperforming the S&P Europe 350® and S&P Eurozone BMI, respectively. Active managers in the France Equity category fared particularly poorly, posting an asset-weighted average return of -1.0% versus the S&P France BMI’s total return of 1.7%, and an underperformance rate of 84.5%. While still disappointing, this result was marginally better than expected compared to the category’s 89.5% underperformance rate over 2023.

Over H1 2024, European active bond managers successfully leveraged generally favorable tailwinds from drivers of credit, liquidity and term (given the benefit of reaching for shorter durations in the presence of an inverted yield curve). In all three EUR-denominated fixed income categories reported, managers posted majority outperformance rates of 66.5%, 64.8% and 73.1% for Government, Corporate and High Yield Bond categories, respectively.

Market Context: H1 2024 and Beyond

In the first half of 2024, European equity markets showed that the widely discussed trend of mega-cap dominance was not unique to U.S. equities. Outperformance of the largest names led to increased concentration in most major markets, including France, where the market capitalization tilt ratio of the S&P France BMI increased by 0.19 versus the end of 2023.

European Equities started the year generally slow compared to global markets and lost further steam heading into the second half of the year, with the S&P Europe 350 and S&P Eurozone BMI up 9.8% and 8.2% in H1 2024, versus 2.4% and 3.2% in Q3 2024, respectively. In contrast, the S&P France BMI’s modest 1.7% total return over H1 2024 increased to 3.6% in Q3 2024, driven largely by names in the Industrials and Health Care sectors.