Mid-Year 2024 Highlights

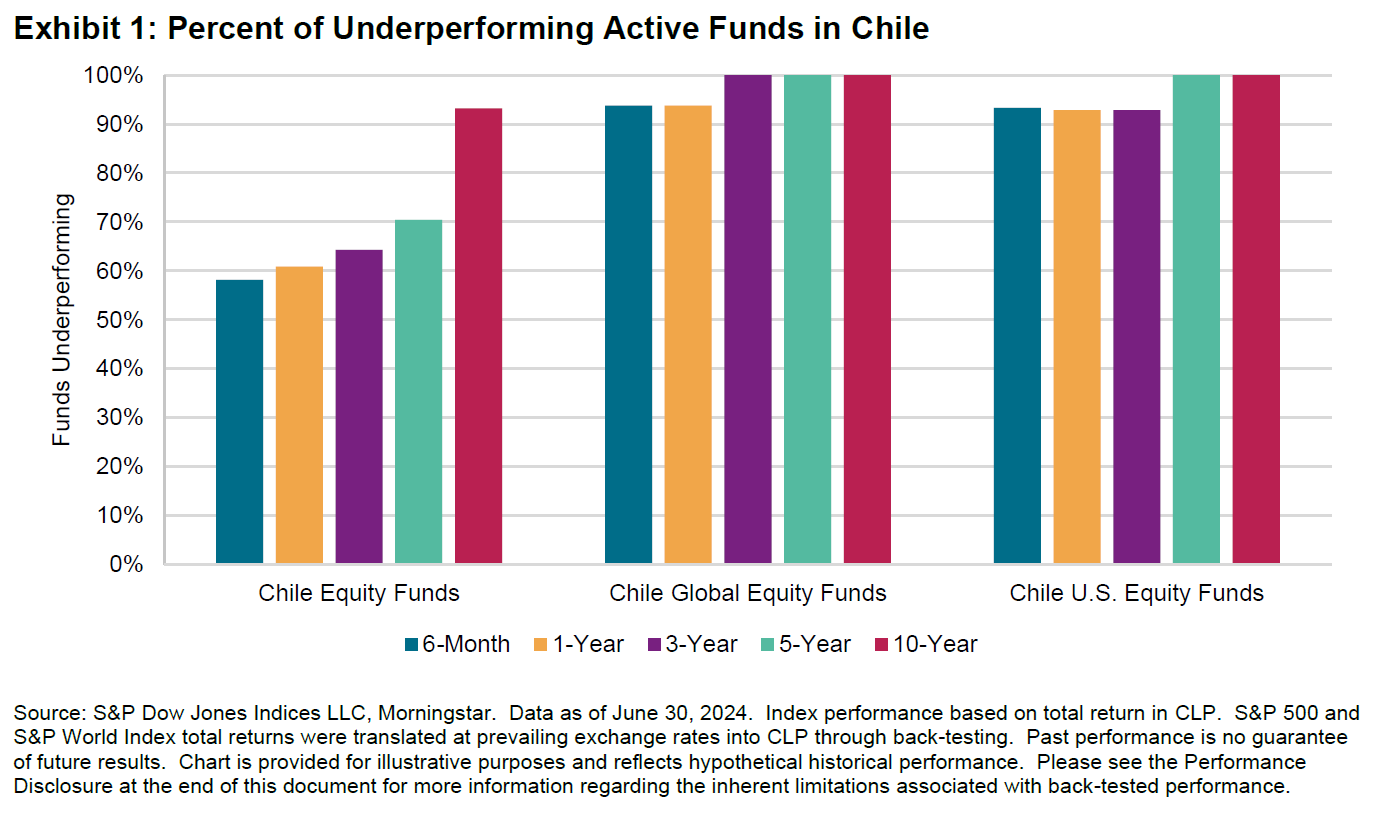

Our SPIVA Global Scorecard illustrated the challenging market conditions for active managers around the world in the first half of 2024, and Chile was no exception. Funds in the Chile Equity category underperformed at a rate of 58.1% over the first six months of 2024, rising to 93.2% over a 10-year period (see Exhibit 1 and Report 2).

In addition to Chile Equity, this report presents inaugural SPIVA analyses of two new categories of Chile-domiciled funds: U.S. Equities and Global Equities. In the first six months of 2024, 93.3% of CLP-denominated U.S. Equity funds underperformed the S&P 500®, with the underperformance rate rising to 100.0% over 5- and 10-year periods. Global Equity funds had a similarly difficult showing in the first half of 2024, with 93.8% underperforming and a full 100% falling behind the benchmark over 3-, 5- and 10-year periods.

Market Context: H1 2024 and Beyond

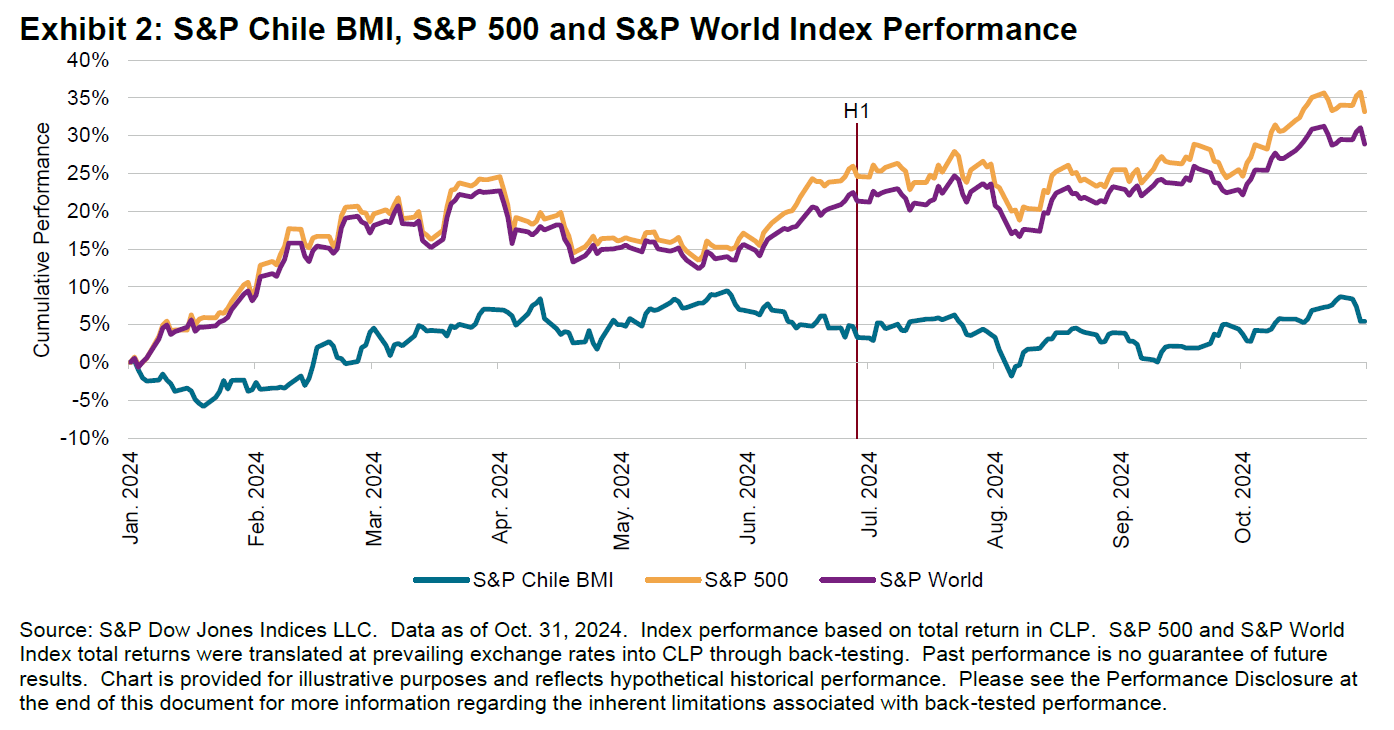

In Chile, the flagship S&P Chile BMI began the year in negative territory until recovering and finishing the first half of 2024 up 3.3%. Meanwhile, the S&P 500 rose 24.6% and the S&P World Index was up 21.3% in CLP during H1, outperforming local equities (see Exhibit 2).

Although the Chilean equity market offered ample opportunities for outperformance, the majority of managers failed to surpass the benchmark in the first half of 2024. The performance of the S&P Chile BMI was led by a few major contributors, resulting in mildly positive skewness of stock returns, with the average constituent rising 9.4% compared to a median increase of 8.1%. However, 63.6% of stocks outperformed the index during the first six months of the year. Despite the majority of stocks beating the benchmark, most Chile Equity funds trailed, with an underperformance rate of 58.1% during H1.

Looking beyond H1, Chile equities continued a relatively flat trajectory through the first four months of H2, finishing October up 5.4% YTD. The proportion of stocks outperforming the S&P Chile BMI has slightly declined, to 54.5%, but remains above half. The S&P 500 and S&P World Index continued their strong performance, rising 33.2% and 28.9%, respectively, YTD through October. As the months keep rolling past, only time will tell how well Chile’s active equity managers navigate the challenges and opportunities remaining in 2024.