Executive Summary

From short-term traders to long-term passive investors, a healthy trading ecosystem benefits market participants by promoting price transparency, market efficiency and confidence. Updating our analysis from 2019, this paper conducts a survey of the observed volumes and implied holding periods for a global and cross-asset range of listed products tied to indices produced by S&P Dow Jones Indices (S&P DJI). The results offer perspective on the use of indices as the basis for active and passive investment strategies.

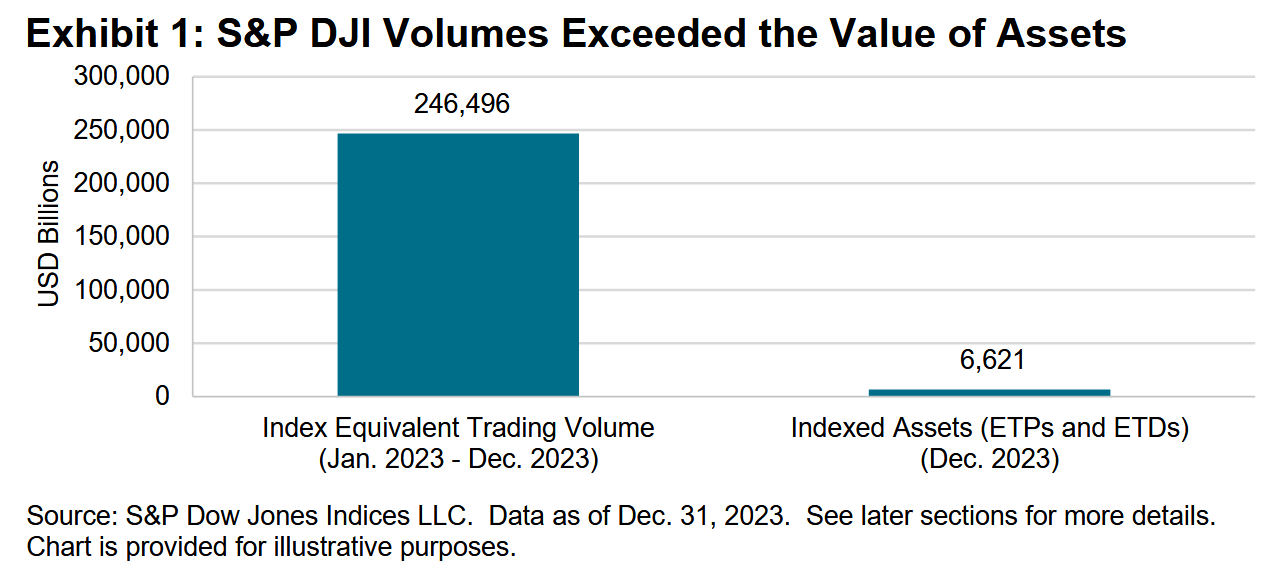

- Reported volumes across a range of products tied to S&P DJI’s indices evidence highly active usage of index-linked products.

- A globalized network of trading is associated with the S&P 500® and related indices, with potential liquidity network effects.

- We emphasize the impact and relevance of trading in S&P 500-linked products across time zones and also spotlight Australia’s growing S&P/ASX 200

The Value of Volumes

Index funds, which hardly existed 50 years ago, now play a prominent role in global financial markets, and the growth in aggregate assets under management in “passive” or index-tracking funds and portfolios may be one of the most important developments of modern financial history. As of the end of 2023, approximately USD 13 trillion of assets were in products or portfolios tracking indices provided by S&P DJI. However, while estimates of the value of assets tracking (or benchmarked to) indices are prevalent in the media, comprehensive estimates of secondary market volumes in passive vehicles can be more obscure.

This is unfortunate, because volumes can tell us how active some of the users of passive investment vehicles truly are. As well as indicating the presence of higher-frequency market participants, volume data can also give us an indication of how well a market is “policed” by arbitrageurs. Long-term passive investors may benefit from the presence of more active traders. For example, consider a hypothetical investor who purchased an exchange-traded fund (ETF) tracking the S&P 500 10 years ago expecting to earn a return that would be representative of the overall U.S. stock market and simultaneously closely comparable to the performance of an index that is reported widely in the media. Such confidence depends on two factors:

- At the time of entering or exiting their position, the investor relies on the existence of arbitrageurs who constantly monitor the relationship between the value of the ETF and the value of the fund’s holdings, with the intention to purchase or sell both simultaneously to exploit (and thereby diminish) any misalignments. If the ETF portfolio closely matches the composition of an index, and that index is associated with related liquid instruments, then this arbitrage is easier to implement. Thus, for example, liquid futures tracking the S&P 500 can help ETFs tracking the S&P 500 trade closer to their fair value.

- In between entry and exit, the investor hopes to depend on the fact that the S&P 500 and popular products based on that index receive a great deal of scrutiny from the press and the investment community. Every change in the underlying index, including adds, drops and changes to the methodology, is subject to close inspection from market participants around the globe, as are the portfolio compositions of popular ETFs tracking the same index. Such scrutiny acts to both police the ongoing link between the underlying index and its stated objective, and the link between the ETF and the index it aims to track.