Part 1: Index and Pricing

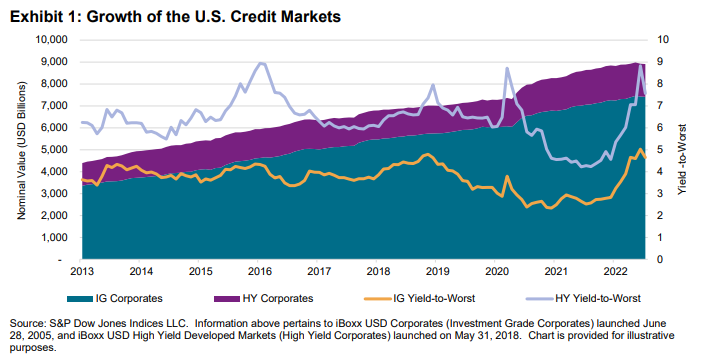

The iBoxx USD Liquid High Yield Index has served as the leading benchmark for the high yield market since its debut in 2006. Designed to track the most liquid instruments in the high yield market, the index supports a broad trading ecosystem via ETFs and derivatives. Though they have been generally excluded from traditional aggregate-type fixed income benchmarks in the past, high yield bonds remain a growing asset class that has historically offered yields that exceed investment grade debt (see Exhibit 1). In exchange for incremental yield are typically heightened credit and liquidity risk. In this article, we examine the components of the iBoxx USD Liquid High Yield Index (“IBOXHY”) that have demonstrated potential mitigation of liquidity risk. Contrasting other broad benchmarks to IBOXHY helps explain why liquid index construction matters, not just for the indices, but for the broader corporate bond ecosystem. We estimate the size of the ecosystem currently supported by IBOXHY to be in the hundreds of billions of U.S. dollars, and liquidity is measured as its underlying bond bid offer spreads. Because of the index design, it has been able to achieve the liquidity objective for over 15 years.

Promoting transparency with an emphasis on liquidity, the indices are constructed to serve as a basis for tradable instruments like ETFs, swaps and futures. In a follow up to this paper, we will explore the fund, derivative and securities lending markets that propagate liquidity in various forms.

The iBoxx Liquidity Ecosystem in Different Markets

ETFs have been used to access high yield markets since the first ETF tracking the iBoxx USD Liquid High Yield Index launched in 2007. We will detail how index construction plays a pivotal role in identifying the optimal mix of bonds to track the performance of the overall high yield market. Beyond ETFs, total return swaps on IBOXHY are often used to express short positions, or to hedge a long position. We will discuss how volumes in that market have exceeded assets in the funds several times over, perhaps due to use as a means to hedge risk. For example, in 2021 iBoxx Standardized Total Return Swaps and futures volumes linked to the iBoxx USD Liquid High Yield Index were USD 57.3 billion and USD 40.6 billion, respectively. Given the USD 21.4 billion in ETF AUM tracking the iBoxx USD Liquid High Yield Index at year-end 2021, derivative trading volume-to-ETF AUM was 4.6x. Lastly, holders of funds tracking the iBoxx USD Liquid High Yield Index are seeing increased demand for their shares in the securities lending market, highlighting the growing opportunity set that has evolved around the iBoxx HY ecosystem. Thus, by comparing liquidity of eligible and ineligible bonds in the securities lending market of the iBoxx USD Liquid High Yield Index, we see new ways to independently measure liquidity. Each of these areas shines a light on how together they contribute to the index liquidity ecosystem.