Introduction

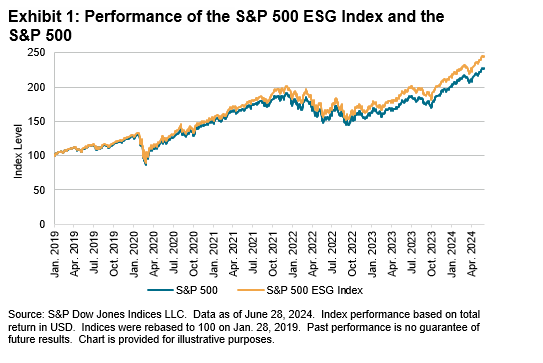

The investment landscape has witnessed a significant shift toward sustainability in recent years, with growing emphasis on ESG considerations without sacrificing performance. In this environment, the S&P 500 ESG Index has emerged as a remarkable benchmark, improving ESG scores while also performing similarly to or even better than the S&P 500 since its launch, more than five years ago (see Exhibit 1).

In this reflective analysis, we embark on a journey to dissect the underpinnings of performance for the S&P 500 ESG Index, demonstrating that its success is not solely attributable to sector selection, but is also driven by factors such as selection among higher and lower ESG-scoring constituents, ESG momentum, as well as the Social pillar within ESG.

Exploration beyond Sector Weights

Launched on Jan. 28, 2019, the S&P 500 ESG Index measures the performance of securities that met certain ESG criteria, while maintaining similar overall industry group weights as the S&P 500, using S&P Global ESG Scores as the defining constituent selection characteristic.

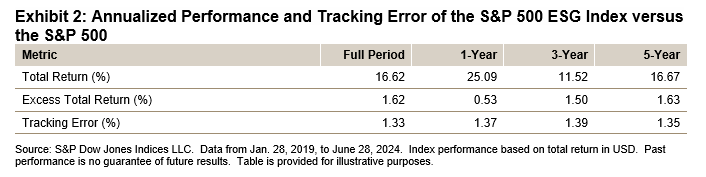

Exhibit 2 details the long-term performance and tracking error of the S&P 500 ESG Index relative to the S&P 500.

This live performance data covers an extraordinary period of contrasting market regimes, which on an almost annual basis over the five years since the index’s launch alternated between bull and bear markets. The S&P 500 ESG Index outperformed the S&P 500 over 1, 3 and 5 years while maintaining a tracking error of 1.33%, in annualized terms, since its inception. What intricate tapestry of factors contributed to this performance?

One common critique of sustainability indices is that their tendency to underweight or overweight certain sectors potentially skews performance outcomes. However, a closer examination of the S&P 500 ESG Index reveals that its outperformance has been driven by stock selection rather than sector weighting. This is illustrated in Exhibit 3 using a Brinson attribution analysis to measure the contribution of sector weighting and stock selection effects to the S&P 500 ESG Index’s excess return relative to the S&P 500. To emphasize the relative impact of sector weighting and stock selection effects, Exhibit 3 shows the proportion of the total impact (so that their absolute values sum to 100%); actual return impact is shown in the labels.