Dow Jones Sustainability Indices Methodology

Index Objective

The Dow Jones Sustainability Indices (DJSI) are float-adjusted market capitalization weighted indices that measure the performance of companies selected with ESG (Environmental, Social, Governance & Economic) criteria using a best-in-class approach.

Highlights

S&P Dow Jones Indices partners with S&P Global Sustainable1, a specialist in ESG research and data, to provide investors with objective benchmarks for managing their sustainability investment portfolios. The DJSI allow the creation of portfolios of companies that fulfill certain sustainability criteria better than the majority of their peers within a given industry.

The DJSI index family includes sub-indices that exclude companies engaged in certain activities widely considered as unsustainable (see Ethical Exclusion Sub-Indices for details).

Index Family

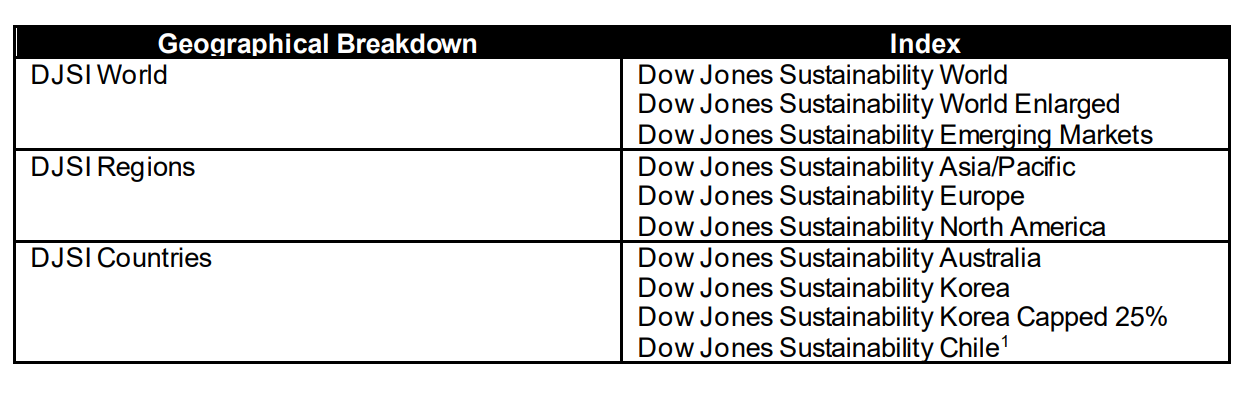

The DJSI benchmarks are comprised of three geographical breakdowns: DJSI World DJSI Regions, and DJSI Countries. Indices within these geographical divisions use different starting universes and different percentiles to mark the cutoff point in selecting the most sustainable companies (see Constituent Selection for details). This means that the emerging markets, country and regional indices are not simply sub-indices of the DJSI World, and there is no roll up of indices from country to region, to world.

The Dow Jones Sustainability Indices benchmark family consists of the following indices:

All other indices are subsets of the above benchmarks.

Please refer to Appendix II for a full outline of country allocations by benchmark.

To access the full methodology, please click on the “Download” button below.