S&P Global Offerings

Featured Topics

Featured Products

Events

Our Services

Investment Themes

Explore new territories with greater confidence

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Education

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Governance

Methodologies

SPICE

Your Gateway to Index Data

Our Services

Professional Resources

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Digital Assets

Indicators

Other Strategies

By Region

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Research & Insights

Education

Performance Reports

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Methodologies

SPICE

Your Gateway to Index Data

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG index

The iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG index aims to meet and exceed the standards for EU Paris-aligned Benchmarks (EU PABs) under Regulation (EU) 2019/2089 amending Regulation (EU) 2016/1011 (link).

The regulation proposes the definitions of minimum standards for the methodology of any "EU Paris-Aligned" benchmark indices that aim to be aligned with the objectives of the Paris Agreement.

The index also incorporates factors that seek to manage transition risk and climate change opportunities in alignment with the recommendations of the Financial Stability Board's Task Force on Climate related Financial Disclosures (TCFD) 2017 Final Report, covering transition risk, climate change opportunities, and stranded assets.

The index, administered by S&P Global Benchmark Administration Limited, measures the performance of eligible corporate bonds from the iBoxx EUR Corporates parent index. The corporate bonds are selected and weighted to be collectively compatible with a 1.5ºC global warming climate scenario at the index level.

The index applies exclusions based on company involvement in specific business activities, company violations against the principles of the United Nations Global Compact (UNGC), and involvement in relevant controversies, all outlined in the ESG criteria section. The index rules aim to efficiently track the EUR investment grade corporate bond universe, whilst upholding minimum standards of investability and liquidity. The index optimisation process ensures close alignment to the maturity, rating, industry, option adjusted duration (OAD), and duration times spread (DTS) profile of the parent index while improving yield-to-worst (YTW) analytics.

Download iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG Index Guide

Download iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG Index Fact Sheet

-

VIEW S&P PACT™ INDICES

Learn More about S&P PACT™ Indices

-

DATA AND CHARTS

View Index Charts and Data

-

VIEW BLOG

How to Bring Paris Agreement Goals to Fixed Income Indices

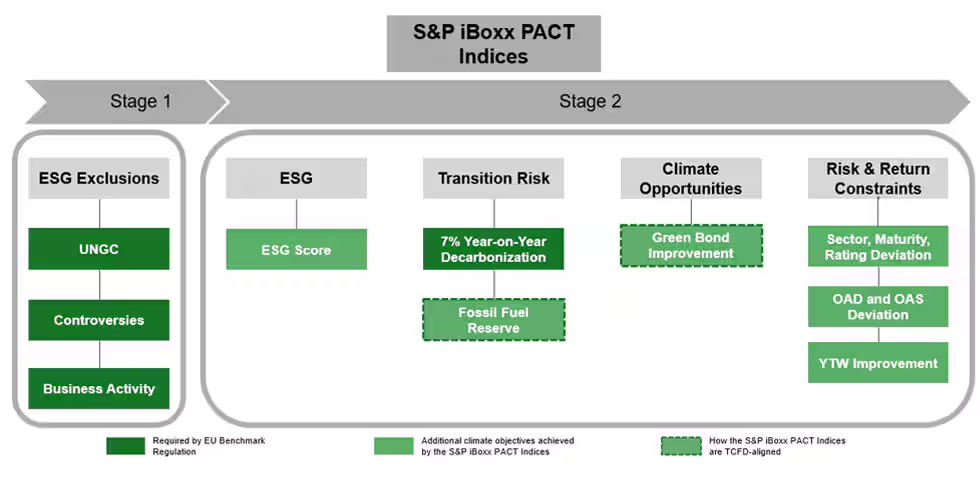

iBoxx S&P Pact Index Framework for Fixed Income Indices

Source: S&P Dow Jones Indices LLC. Data as of Aug.31, 2022. Chart is provided for illustrative purposes.

Thought Leadership

Global Indices

As a global index provider, S&P Dow Jones Indices’ award winning indices cover a wide range of asset classes and instruments from fixed income to credit derivatives to equities across the Americas, Europe, Middle East, Africa and Asia Pacific in developing, emerging and frontier markets.

Learn More

News & Information

Important notifications and public information about our indices, including changes to upcoming series following index rolls, corporate actions on constituents and issuance of new indices.

View

Documentation

Publicly available documentation relating to our indices, including methodologies, annexes and educational guides, as well as legal documents for tradable indices.

View

Environmental Solutions

S&P Global Environmental Solutions provides innovative infrastructure solutions and services to grow environmental and commodity markets and to address climate risk. Learn more.