S&P Global Offerings

Featured Topics

Featured Products

Events

Our Services

Investment Themes

Explore new territories with greater confidence

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Education

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Governance

Methodologies

SPICE

Your Gateway to Index Data

Our Services

Professional Resources

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Digital Assets

Indicators

Other Strategies

By Region

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Research & Insights

Education

Performance Reports

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Methodologies

SPICE

Your Gateway to Index Data

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

The S&P/TSX Indices

For two decades, S&P Dow Jones Indices and the Toronto Stock Exchange (TMX) have partnered to bring local and global investors the most-relied-upon benchmarks of Canadian market performance. Today, we offer a full suite of indices spanning a range of asset classes and strategies that underlie numerous ETFs and other index-linked investment products.

Celebrating 25+ Years of the S&P/TSX Index Series

Flagship Indices: The S&P/TSX 60 and S&P/TSX Composite

At the forefront of the expansive S&P/TSX Index Series are the S&P/TSX 60 and S&P/TSX Composite. As the most widely quoted benchmark for the Canadian equity market, the S&P/TSX Composite is the broadest index in the S&P/TSX family and serves as the basis for a wide variety of sub-indices including, but not limited to, income trust indices, capped indices, GICS® sector indices, and factor indices. On the other hand, the S&P/TSX 60 is designed to be representative of the sector composition of the broad Canadian equity market, while including a limited number of large and liquid constituents.

S&P/TSX Composite Performance Through the Years

Fostering Transparency, Market Efficiency and Investor Confidence

Liquidity is important to gain access into a market, but it is most vital when looking to exit the market. The S&P/TSX Index ecosystem has proven to remain tradable even in times of volatility and duress. Such a robust and active trading ecosystem benefits asset owners and investment managers by fostering transparency, market efficiency and investor confidence. By enabling market makers to recycle their risks elsewhere, a large and active ecosystem helps to limit mispricing and improve price transparency. The trading volumes and investor reach of the index-linked products connected to the S&P/TSX Index Series have made it an integral part of investing in Canadian equities.

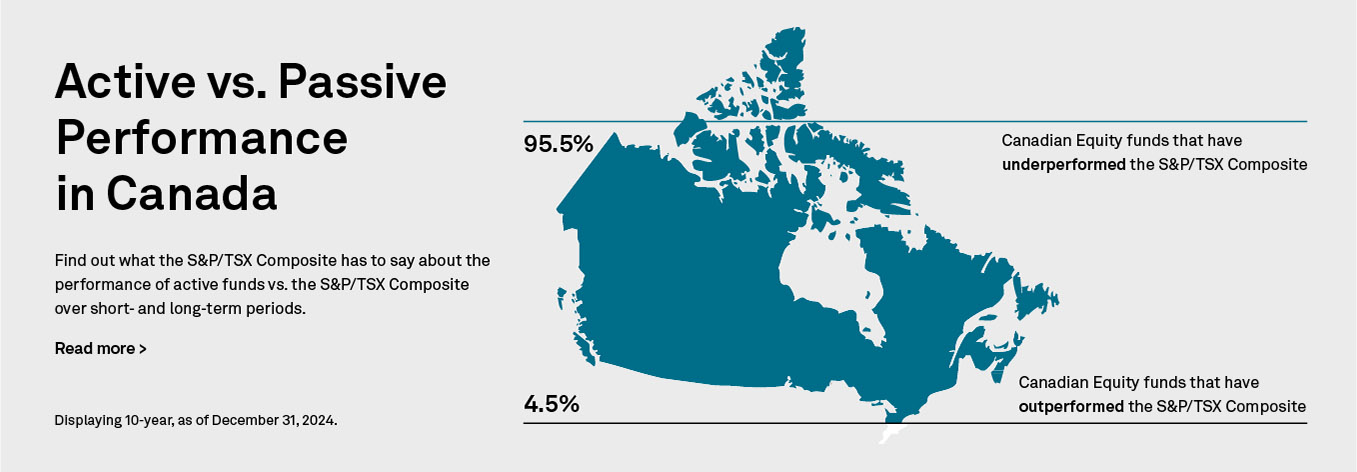

The Active vs. Passive Debate in Canada

Index investing is gaining traction around the world in large part thanks to growing evidence that it’s difficult for active managers to outperform their benchmarks over long periods. The trend has held true in Canada, where 93% of Canadian equity funds underperformed their benchmark over the 10-year period ending June 2024.

Find out what the SPIVA® Canada Scorecard has to say about the performance of active funds vs. the performance of their S&P/TSX benchmarks, including the S&P/TSX Composite and S&P/TSX 60, over short- and long-term periods.

Spotlight on the

S&P/TSX SmallCap Select

The S&P/TSX SmallCap Select provides an investable index for the Canadian small-cap market. The index is float-adjusted and market-cap-weighted, and was developed with industry input to serve as a benchmark for those with small-cap exposure in the Canadian equity market. TMX serves as the distributor of both real-time and historical data for this index.

Learn moreIndices

Equities

In addition to the S&P/TSX Composite and S&P/TSX 60, the S&P/TSX equity index series spans a wide variety of indices including the S&P/TSX Completion, S&P/TSX 60 EWI, S&P/TSX Capped Composite, and S&P/TSX SmallCap—all reflecting different facets of the Canadian equity market.

Sectors

S&P/TSX sector indices make it possible to target areas of interest in the Canadian market such as information technology, mining, and real estate.

Fixed Income

The S&P/TSX Preferred Share Index is a leading measure of Canadian preferred stock market performance.

Strategy

The S&P/TSX strategy indices track Canada’s VIX® counterpart, S&P/TSX VIX, as well as low volatility, dividend, risk control, and buyback strategies.

Index-Linked Products Tracking the S&P/TSX Indices

Make connections between sought-after market exposures and licensed products linked to S&P/TSX Indices.

ETFs and Index Managed Funds

These products are widely available, easy to buy and sell, and designed to meet a variety of investment goals. The funds’ issuers, sometimes referred to as sponsors, are financial services companies. Some of these firms concentrate on either ETFs or index managed funds, while others offer both types of products. While index managed funds have been on the market almost twice as long as ETFs, there are now almost twice as many ETFs as index managed funds globally. Even with the rapid expansion of ETFs in Canada, the first ETF listed in the world in 1990—which now tracks the S&P/TSX 60—remains the largest ETF in Canada with over CAD 8.5 billion in assets under management.

View the list of ETFs based on S&P/TSX indices.

Index-Linked Options and Futures

Options exchanges and futures exchanges offer contracts on market indices, such as S&P/TSX 60 Index Options and S&P/TSX 60 Futures. While these derivative products differ in some important ways, they are similar in that they allow investors—both retail and institutional—to hedge or to speculate on the level of the underlying index on the date when the contract expires, which is specified in the contract.

Structured Products

Structured products pay interest only at maturity, subject to terms that vary substantially from product to product. Commercial and investment banks issue a variety of index-linked structured products based on the S&P/TSX indices.

Structured products can range from the fairly conservative to the highly speculative and extremely complex. At one end of the scale, there are structured products that offer principal protection and income generation, though limited return. At the other end, some of the products offer the potential for greater return but at the risk of being exposed to significant leverage.

This variety makes structured products potential diversification tools for high-net-worth investors and asset managers. Structured products are also seen as tools for enhancing returns.

More Resources

Learn more about how we work with the TMX to produce Canadian indices for local and international investors.

Explore the monthly performance of our Canadian offerings, including sector, factor, and fixed income indices.