S&P Global Offerings

Featured Topics

Featured Products

Events

Our Services

Investment Themes

Explore new territories with greater confidence

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Education

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Governance

Methodologies

SPICE

Your Gateway to Index Data

Our Services

Professional Resources

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Digital Assets

Indicators

Other Strategies

By Region

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Research & Insights

Education

Performance Reports

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Methodologies

SPICE

Your Gateway to Index Data

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Environment & Real Assets

Environment & Real Assets

Our environment and real asset indices focus on a range of sustainability themes, from clean power and natural resources to infrastructure, the way we move, and green real estate.

Index Name

All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. Back-tested performance reflects application of an index methodology and selection of index constituents with the benefit of hindsight and knowledge of factors that may have positively affected its performance, cannot account for all financial risk that may affect results and may be considered to reflect survivor/look ahead bias. Actual returns may differ significantly from, and be lower than, back-tested returns. Past performance is not an indication or guarantee of future results. This back-tested data may have been created using a “Backward Data Assumption”. For more information on “Backward Data Assumption” and back-testing in general, please see the Performance Disclosure.

Index Name

Product Name

Country/Region

Ticker

No index-linked product details are currently available.

This list includes investable products traded on certain exchanges currently linked to this selection of indices. While we have tried to include all such products, we do not guarantee the completeness or accuracy of such lists. Please refer to the disclaimers here for more information about S&P Dow Jones Indices' relationship to such third party product offerings.

Indices

Natural Resources

The importance of natural resources is highlighted in this suite of indices, which includes companies involved with agribusiness, water, energy, metals, mining, forests, and timberlands.

Learn moreClean Power

Our clean power indices are designed to track companies around the world that are focused on clean energy, including the technology and products that make it possible. This also includes companies that specialize in the production of hydrogen, storage and transportation of hydrogen, and fuel cell design and manufacture.

Learn moreBroad Environmental Sustainability

Our broad environmental sustainability indices focus on companies that are driving toward a sustainable future, including companies that are in ecology-related industries, that do not own fossil fuel reserves, and that issue bonds whose proceeds are used to finance environmentally friendly projects. Some indices reweight constituents depending on their levels of carbon emissions, their carbon efficiency, the potential specific impact of 2030 carbon prices on constituents' stock prices, or to be collectively compatible with a 1.5ºC global warming climate scenario at the index level.

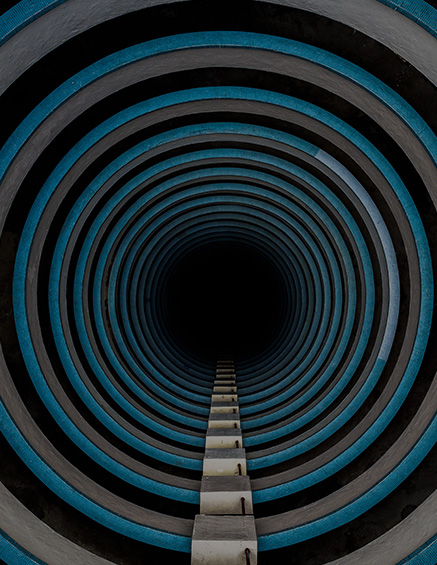

Learn moreInfrastructure

Our infrastructure indices are designed to track more traditional pure-play infrastructure companies in energy, transportation, and utilities, as well as companies focused on building the next generation of infrastructure systems, including the full range of developments from smart buildings and road networks to smart grids that use sensors and intelligent meters to manage power lines and optimize power consumption.

Learn moreMobility

S&P DJI's mobility indices are designed to track companies that are changing how people and goods are transported. These companies are focused on autonomous and electric vehicle technology, commercial drones, and advanced transportation systems.

Learn moreGreen Real Estate

Our ESG real estate indices seek to track more sustainable opportunities in real estate by overweighting those companies with relatively high GRESB scores and underweighting those with lower or zero scores.

Learn moreIndex-Linked Products

SEE ALL| Index Name | Product Name | Product Type |

|---|---|---|

| S&P Global Clean Energy Transition Index | BMO Clean Energy ETF | ETF |

| DJ Brookfield Global Infra NA-Listed | BMO Global Infrastructure ETF | ETF |

| S&P Oil & Gas Explrtn & Prodctn Select | Direxion Dly S&P Oil&Gs Ex&Prd Bl 2X ETF | ETF |

| S&P Oil & Gas Explrtn & Prodctn Select | Direxion Dly S&P Oil&Gs Ex&Prd Br 2X ETF | ETF |

| S&P Oil & Gas Explrtn & Prodctn Select | E-mini S&P Oil & Gas Exploration & Production Select Industry Index | Future |

| S&P 500 Net Zero 2050 Paris-Aligned ESG Index | Franklin S&P 500 Paris Aligned Clmt ETF | ETF |

| S&P Global Clean Energy Select Index | Franklin Templeton SinoAm GblClnEngy ETF | ETF |