NEW YORK, MARCH 25, 2025: S&P Dow Jones Indices (S&P DJI) today released the January 2025 results for the S&P CoreLogic Case-Shiller Indices. The leading measure of U.S. home prices recorded a 4.1% annual gain in January 2025, a slight increase from the previous reading in December 2024. More than 27 years of history are available for the data series and can be accessed in full by going to https://www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller/.

YEAR-OVER-YEAR

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.1% annual return for January, up from a 4% annual gain in the previous month. The 10-City Composite saw an annual increase of 5.3%, up from a 5.2% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.7%, up from a 4.5% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.7% increase in January, followed by Chicago and Boston with annual increases of 7.5% and 6.6%, respectively. Tampa posted the lowest return, falling 1.5%.

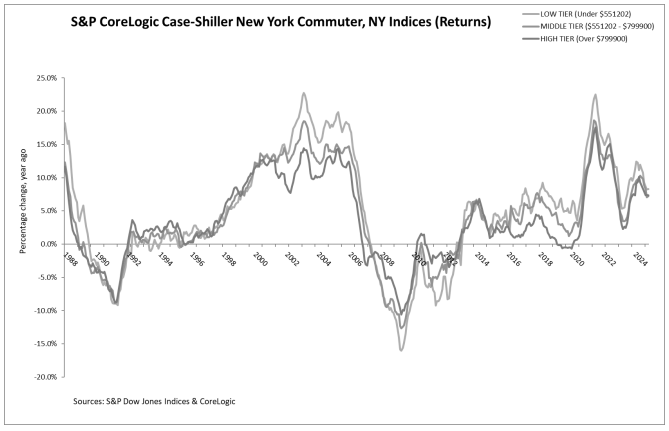

The chart below compares year-over-year returns for different housing price ranges (tiers) in New York.

MONTH-OVER-MONTH

The pre-seasonally adjusted U.S. National and 20-City Composite Indices presented slight upward trends in January, with both posting 0.1% increases. The 10-City Composite posted a monthly return of 0.2%.

After seasonal adjustment, the 20-City and 10-City Composite Indices posted month-over-month increases of 0.5%. The U.S National posted a month-over-month increase of 0.6%