NEW YORK, APRIL 25, 2023: S&P Dow Jones Indices (S&P DJI) today released the latest results for the S&P CoreLogic Case-Shiller Indices, the leading measure of U.S. home prices. Data released today for February 2023 show a modest increase in our national composites, although eight of the 20 major metro markets reported lower prices. More than 27 years of history are available for the data series and can be accessed in full by going to www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller.

YEAR-OVER-YEAR

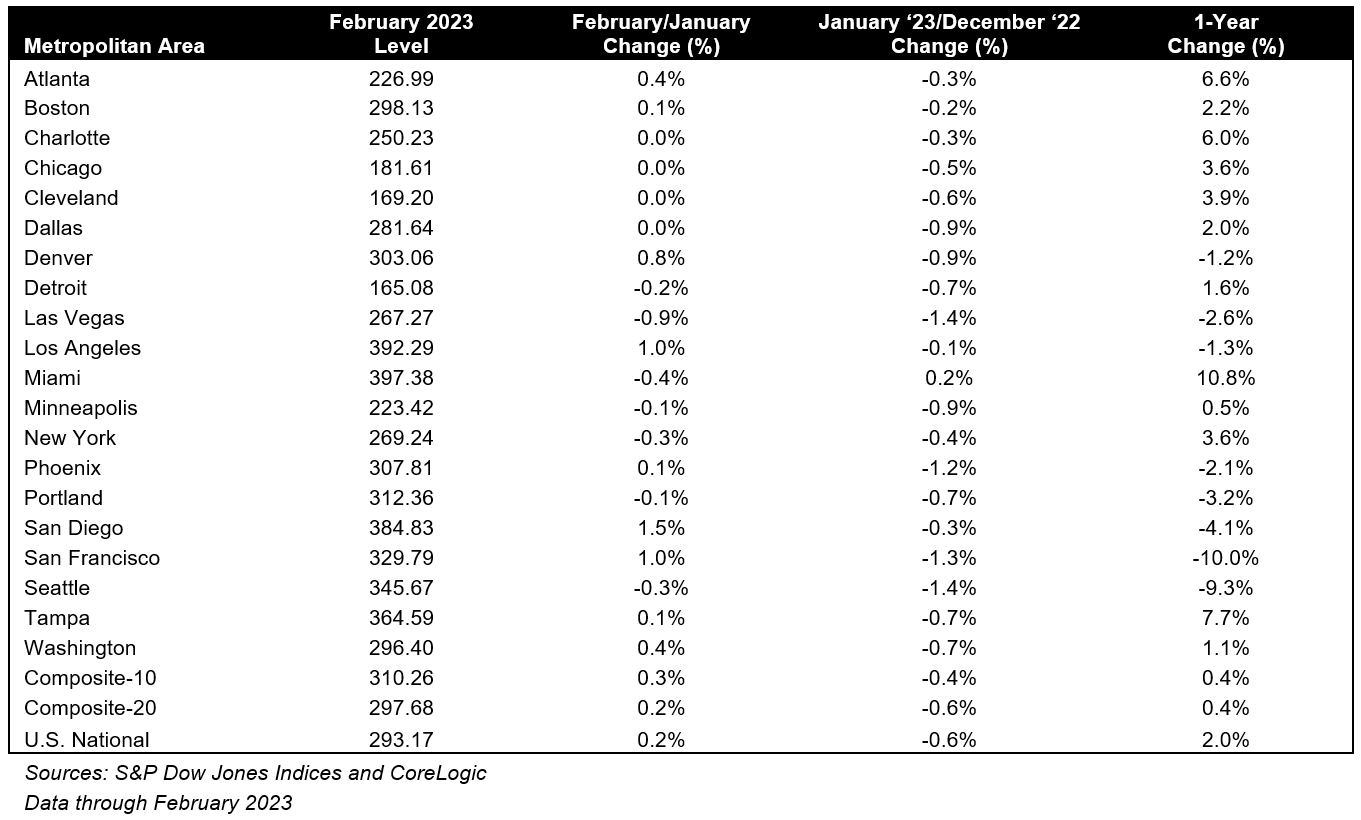

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month.

Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February. The order remained the same with Miami leading the way with a 10.8% year-over-year price increase, followed by Tampa in second with a 7.7% increase, and Atlanta in third with a 6.6% increase. All 20 cities reported lower prices in the year ending February 2023 versus the year ending January 2023.

MONTH-OVER-MONTH

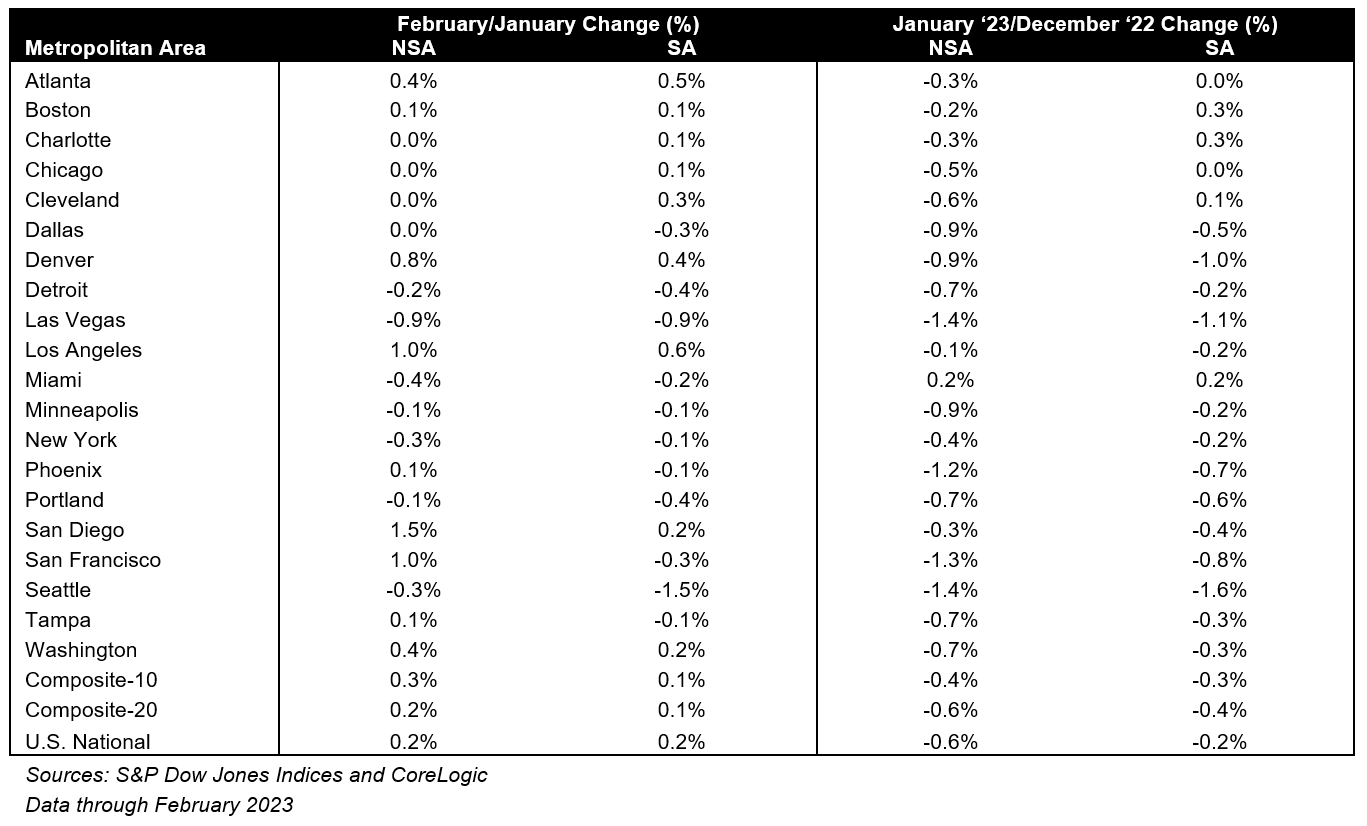

Before seasonal adjustment, the U.S. National Index posted a 0.2% month-over-month increase in February, while the 10-City and 20-City Composites posted increases of 0.3% and 0.2%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 10-City and 20-City Composites posted increases of 0.1%.

ANALYSIS

“Home price trends moderated in February 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite, which had declined for seven consecutive months, rose a modest 0.2% in February, and now stands 4.9% below its June 2022 peak. Our 10- and 20-City Composites performed similarly, with February gains of 0.3% and 0.2%; these Composites are currently 6.0% and 6.6% below their respective peaks. On a trailing 12-month basis, the National Composite is only 2.0% above its level in February 2022; the 10- and 20-City Composites are both up 0.4% on a year-over-year basis.

“The moderation we observed nationally is also apparent at a more granular level. Before seasonal adjustment, prices rose in 12 cities in February (versus in only one in January). Seasonally adjusted data showed nine cities with rising prices in February (versus five in January). With or without seasonal adjustment, most cities’ February results showed improvement relative to their January counterparts.

“February’s results were most interesting because of their stark regional differences. Miami’s 10.8% year-over-year gain made it the best-performing city for the seventh consecutive month. Tampa (+7.7%) and Atlanta (+6.6%) continued in second and third place, with Charlotte (+6.0%) close behind. Results were different in the Pacific and Mountain time zones. Last month, four West Coast cities (San Francisco, Seattle, San Diego, and Portland) were in negative year-over-year territory. In February they were joined by four of their western neighbors, as Las Vegas (-2.6%), Phoenix (-2.1%), Los Angeles

(-1.3%), and Denver (-1.2%) all tipped into negative territory. It’s unsurprising that the Southeast (+7.8%) remains the country’s strongest region, while the West (-4.2%) continues as the weakest.

“The results released today pre-date the disruptions in the commercial banking industry which began in early March. Although forecasts are mixed, so far the Federal Reserve seems focused on its inflation-reduction targets, which suggests that interest rates may remain elevated, at least in the near-term. Mortgage financing and the prospect of economic weakness are therefore likely to remain a headwind for housing prices for at least the next several months.”

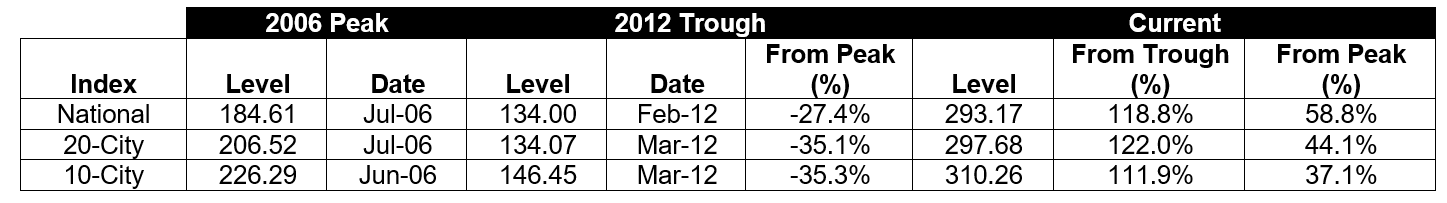

Table 1 below shows the housing boom/bust peaks and troughs for the three composites along with the current levels and percentage changes from the peaks and troughs.

Table 2 below summarizes the results for February 2023. The S&P CoreLogic Case-Shiller Indices could be revised for the prior 24 months, based on the receipt of additional source data.

Table 3 below shows a summary of the monthly changes using the seasonally adjusted (SA) and non-seasonally adjusted (NSA) data. Since its launch in early 2006, the S&P CoreLogic Case-Shiller Indices have published, and the markets have followed and reported on, the non-seasonally adjusted data set used in the headline indices. For analytical purposes, S&P Dow Jones Indices publishes a seasonally adjusted data set covered in the headline indices, as well as for the 17 of 20 markets with tiered price indices and the five condo markets that are tracked.

For more information about S&P Dow Jones Indices, please visit www.spglobal.com/spdji.