NEW YORK, JUNE 25, 2024: S&P Dow Jones Indices (S&P DJI) today released the April 2024 results for the S&P CoreLogic Case-Shiller Indices. The leading measure of U.S. home prices shows that the upward trend decelerated in April 2024. More than 27 years of history are available for the data series and can be accessed in full by going to www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller.

YEAR-OVER-YEAR

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.3% annual gain for April, down from an 8.3% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 7.2%, dropping from a 7.5% increase in the previous month. San Diego continued to report the highest annual gain among the 20 cities in April with a 10.3% increase this month, followed by New York and Chicago, with increases of 9.4% and 8.7%, respectively. Portland once again held the lowest rank this month for the smallest year-over-year growth, with a 1.7% annual increase in April.

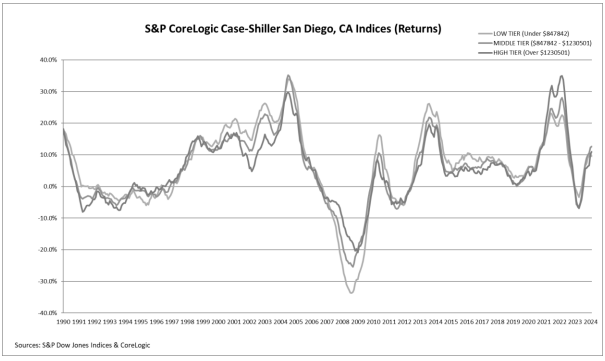

The chart below compares year-over-year returns for different housing price ranges (tiers) in San Diego.

MONTH-OVER-MONTH

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends decelerated from last month, with pre-seasonality adjustment increases of 1.2%, 1.36% and 1.38%, respectively.

After seasonal adjustment, the U.S. National Index and 10-City Composite posted the same month-over-month increase of 0.3% and 0.5% respectively as last month, while the 20-City reported a monthly increase of 0.4%.

ANALYSIS

"For the second consecutive month, we've seen our National Index jump at least 1% over its previous all-time high," says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. "2024 is closely tracking the strong start observed last year, where March and April posted the largest rise seen prior to a slowdown in the summer and fall. Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year.

"Thirteen markets are currently at all-time highs and San Diego reigns supreme once again, topping annual returns for the last six months. The Northeast is the best performing market for the previous nine months, with New York rising 9.4% annually. Sustained outperformance of the Northeast market was last observed in 2011. For the decade that followed, the West and the South held the top posts for performance. It's now been over a year since we've seen the top region come from the South or the West.

"Last month's all-time high came with all 20 markets accelerating price gains. This month, just over half of our markets are seeing prices accelerate on a monthly basis. At 6.3% annual gains, the index has decelerated from the start of the year, with only two markets rising on an annual basis."