NEW YORK, JULY 30, 2024: S&P Dow Jones Indices (S&P DJI) today released the May 2024 results

for the S&P CoreLogic Case-Shiller Indices. The leading measure of U.S. home prices shows the upward trend continued to decelerate in May 2024. More than 27 years of history are available for the data series and can be accessed in full by going to https://www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller/.

YEAR-OVER-YEAR

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.9% annual gain for May, down from a 6.4% annual gain in the previous month. The 10-City Composite saw an annual increase of 7.7%, down from an 8.1% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 6.8%, dropping from a 7.3% increase in the previous month. New York reported the highest annual gain among the 20 cities with a 9.4% increase in May, followed by San Diego and Las Vegas with increases of 9.1% and 8.6%, respectively. Portland once again held the lowest rank for the smallest year-over-year growth, notching a 1.0% annual increase in May.

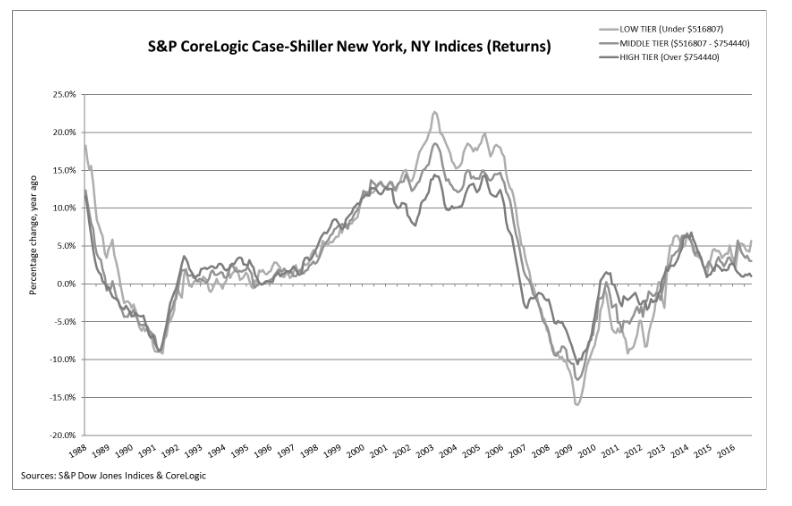

The chart below compares year-over-year returns for different housing price ranges (tiers) in New York.

MONTH-OVER-MONTH

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends continued to decelerate from last month, with pre-seasonality adjustment increases of 0.9%, 1.0%, and 1.0%,respectively.

After seasonal adjustment, the U.S. National Index posted the same month-over-month change of 0.3% as last month, while the 20-City and 10-City Composite reported a monthly change of 0.3% and 0.4%,respectively.

ANALYSIS

“While annual gains have decelerated recently, this may have more to do with 2023 than 2024, as

recent performance remains encouraging,” says Brian D. Luke, Head of Commodities, Real & Digital

Assets. “Our home price index has appreciated 4.1% year-to-date, the fastest start in two years.

Covering the six-month period dating to when mortgage rates peaked, our national index has risen the past four months, erasing the stall experienced late last year. Collectively, all 20 markets covered continue to trade in a homogeneous pattern. Coming into the 2024 presidential election, traditional red states are in a dead heat with blue states, both averaging 5.9% gains annually.

“The Big Apple returned to the top of the leader boards, toppling San Diego from i ts six-month perch. New York’s 9.4% annual return outpaced San Diego and Las Vegas, by 0.3% and 0.7%, respectively. All 20 markets observed annual gains for the last six months. The last time we saw that long a streak was when all markets rose for three years consecutively during the COVID housing boom. This rally pales in comparison in both duration and annual gains, with above trend growth of 6.2%. The waiting game for the possibility of favorable changes in lending rates continues to be costly for potential buyers as home prices march forward.”