Introduction

In our previous study titled "Exploring China A-Share Dividends and High Yield Strategy Performance," we delved into the Chinese dividend market. We found that historically, portfolios composed of high dividend yield stocks in China A-shares have consistently outperformed hypothetical broad market portfolios and those comprised of low dividend yield stocks. In this paper, we aim to show how indexing methods can be employed to harness opportunities presented by high dividend yield strategies in the China A-shares market.

The Importance of Dividends

Dividends play a pivotal role in China A-shares equity investments for three reasons: 1) They constitute a substantial portion of total return in the equity market; 2) Dividend strategies can offer an alternative source of income; 3) Empirical research has shown that dividends as a factor have historically generated excess returns.

Dividend Contribution to Total Returns

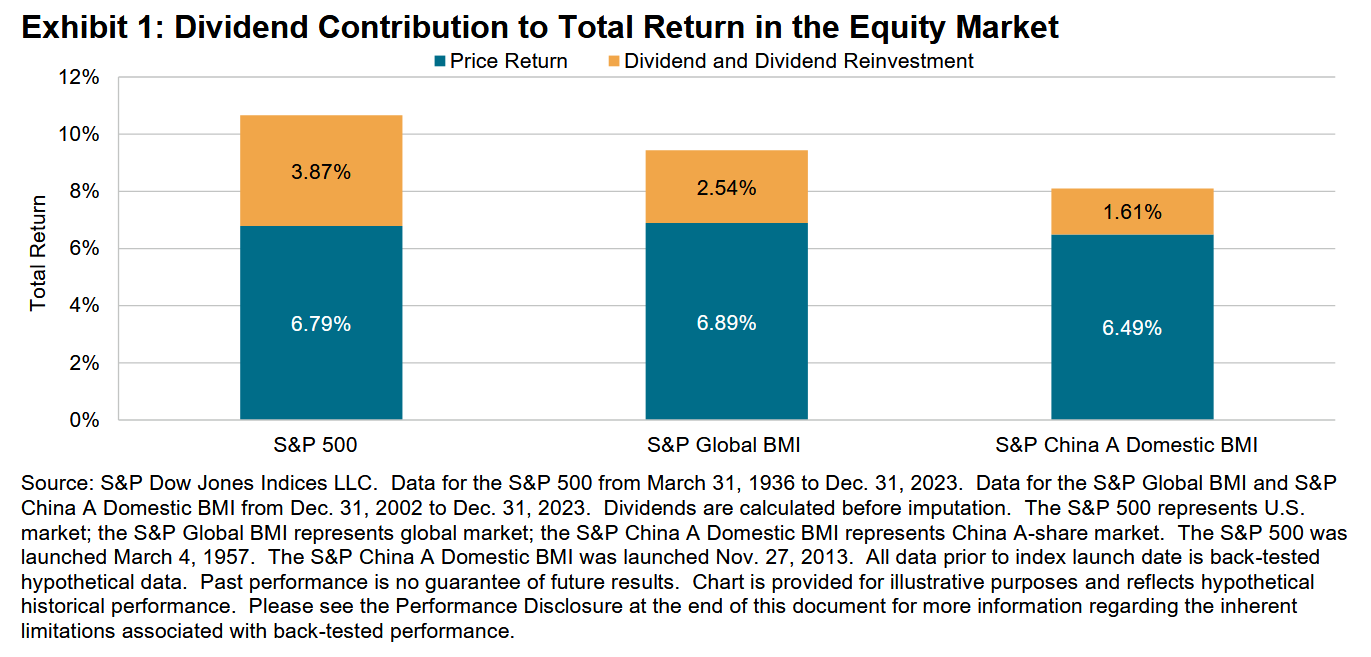

While the significance of dividends in contributing to equity total return is widely acknowledged globally, particularly in the U.S. market where dividends and dividend reinvestment have accounted for over one-third of the S&P 500® total return since 1936, the situation in the China A-shares market differs. Here, dividends contribute to almost 20% of the total returns, a notable but comparatively smaller proportion compared to the U.S. stock market. Interestingly, despite similarities in the long-term price return between the China A-shares market, the U.S. and the global market, differences in dividend contributions play a crucial role in the variance of total returns. This suggests significant potential for growth in dividend payments within the China A-shares market (see Exhibit 1).

Alternative Income Strategy

Traditionally, fixed income has been the primary asset class for income-seeking investors. However, from 2008 to 2022, we witnessed a prolonged period of declining interest rates, especially in the U.S., posing challenges for investors aiming to generate income. In response, some market participants have turned to dividend strategies within the equity market to explore yield opportunities. Since 2022, led by the U.S. Federal Reserve, major markets like the U.S. have transitioned into a new phase of rising interest rates, with the federal funds rate exceeding 5% as of February 2024. In contrast, China has experienced a downward trend in interest rates, making dividend strategies more relevant in the China A-shares market. Further insights into the yield comparison will be provided in a following