Take a look at how the S&P New China Sectors Index helps market participants see China’s changing economy in a novel way.

- What is the rationale behind the construction of the index?

Historically, China’s growth has been driven by companies in the banking, natural resources, and manufacturing sectors—many of which are state-owned enterprises. However, as China’s economy matures, consumption and service-related industries are becoming structurally more important. Because the country’s stock market continues to have significant exposure to these “old economy” sectors, many market participants are seeking alternative index solutions to participate more directly in China’s fastest growth areas. We believe the S&P New China Sectors Index meets this need in the marketplace, given its focus on companies operating in industries poised to benefit from China’s transition to a consumer- and service-oriented economy.

- How does the index work?

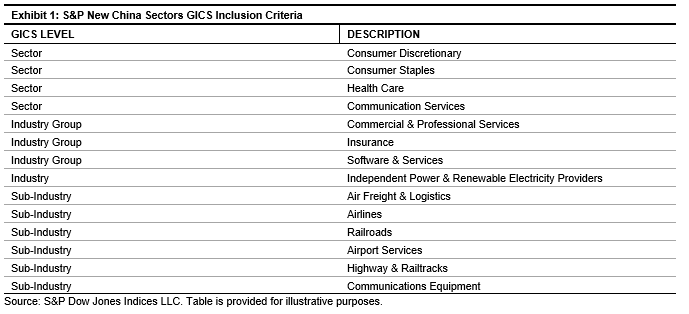

Subject to meeting minimum size and liquidity requirements, all companies domiciled in China and Hong Kong are eligible, including A-shares and offshore listings in Hong Kong, the U.S., and Singapore. Companies classified within the Global Industry Classification Standard® (GICS®) sectors and industries listed in Exhibit 1 are then selected for inclusion.

If more than 300 companies are selected, only the largest 300 by float-adjusted market cap are included. The index is weighted by float-adjusted market cap, subject to a single-stock cap of 10%, and it is rebalanced semiannually in June and December.

/>