1. What innovations have you seen in fixed income, and what’s the role of indices?

Fixed income markets have evolved tremendously over the last decade and continue to do so. Changes in fixed income market structure and constraints on bank balance sheets after the Global Financial Crisis both contributed to a more transparent and transactable bond market, with fixed income indices at the core. The growth of fixed income ETFs, bond portfolio trading, electronic trading and algorithmic trading have all occurred alongside the increased utility for fixed income indices and index-linked products. The resulting fixed income ecosystem has become the new marketplace for practitioners on both the sell-side and buy-side to source liquidity, gain exposures and manage risk. Fixed income indices have been, and continue to be, the instruments at the core of these vehicles.

S&P Dow Jones Indices’ (S&P DJI’s) index offerings have played a critical role in the evolution of the fixed income ecosystem, supporting greater access and democratization of fixed income instruments in the form of ETFs or index-linked securities. The bond markets have traditionally been difficult to access for many market participants. Indexation in fixed income has contributed to greater liquidity, transparency and accessibility for investors far and wide, providing access to an asset class that was inaccessible decades ago.

2. How is S&P DJI innovating in the fixed maturity indexing space?

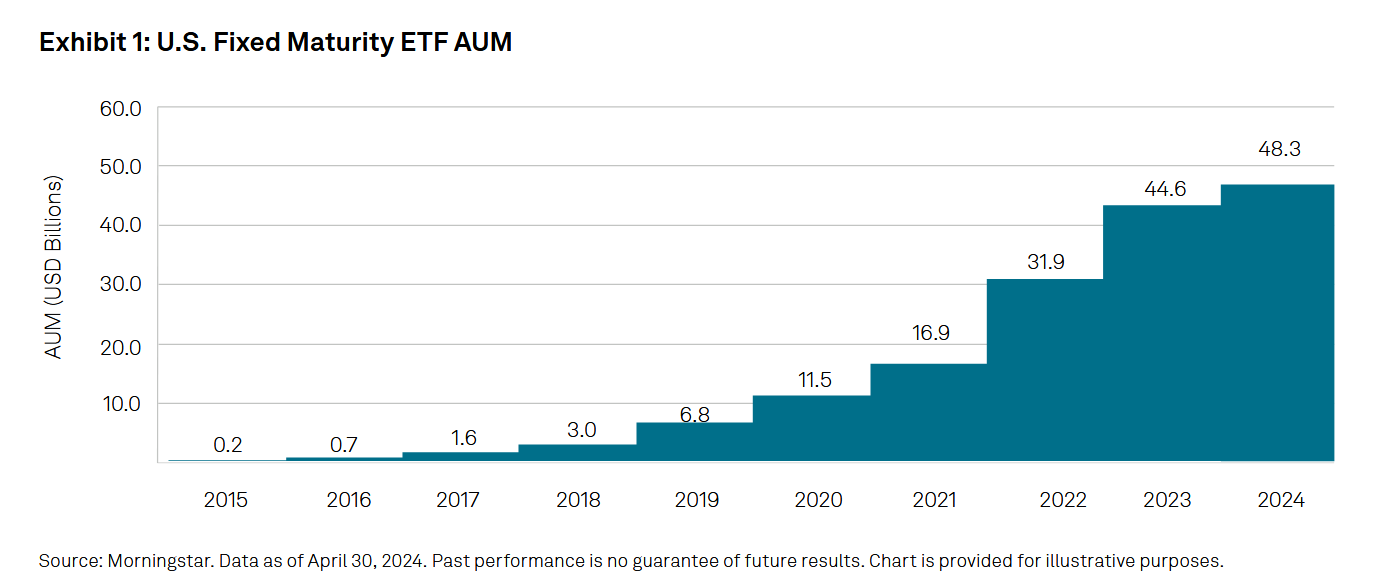

Another recent product innovation has been the development of fixed maturity indices. We’ve seen the growth in the U.S. occur over the last 10 years, and it has begun this past year in Europe. Fixed maturity indices are an interesting concept that may provide investors with greater visibility into maturity and potential income, with a ‘fixed’ year in which the index will expire. This is important for many practitioners who have cash flow needs with a specific time schedule. In the U.S., where the market has already existed, we’ve seen an uptick in interest and growth in the last five years. In Europe, where the market is new, the number of asset managers launching fixed maturity vehicles has been notable.

Sign up to receive updates via email

Sign Up

For example, in the U.S. market, S&P DJI has carried a U.S. Municipal Bond Fixed Maturity Suite for over a decade and was one of the early adopters of this index construct as practitioners began utilizing indices to construct bond ladders. Our suite, the S&P AMT-Free Municipal Series, includes indices in consecutive maturity years from 2024 to 2030. As interest in European markets is newer, we have seen interest across corporate credit and sovereigns, both of which S&P DJI has capabilities in.

The utility and use case of the fixed maturity index is the main driver of this growing popularity. These indices are typically launched as a suite of consecutive years, and one can construct a bond index ladder with the maturity years that are applicable to that investor. Cash flow needs that are required for specific years can be mapped to the respective years of the fixed income index.

3. What impact has fixed income indexing had on the bond market?

Fixed income indexing has been a core instrument in the democratization that the bond market has experienced over the last decade. Indexing and index-linked products enhance the ability to transact in basket or portfolio form. The ETF wrapper, with a fixed income index as the backbone, has opened access to the traditional bond market in a way that did not previously exist. The innovation and comfort in ETF creation/redemption protocols have also influenced how the bond market transacts and the growth of bond portfolio trading. What we’ve seen is this broader liquidity ecosystem emerge, with fixed income ETF trading, bond portfolio trading and bond algorithmic trading all intertwined, enhancing liquidity and redefining bond trading protocols from the past.

It’s incredible to think that 10 years ago, global fixed income ETF assets were less than USD 500 million, and today they are over USD 2 trillion,1 a testament to foundational shifts in the ecosystem. Indexing solutions that narrow in on liquidity or try to minimize transaction costs have played a key role in this growth. Our iBoxx® USD Liquid High Yield Index and iBoxx EUR Liquid High Yield Index, which seek to select a liquid subset of bonds from the broader universe, are prime examples of liquidity-focused indices that practitioners have used to navigate the changing landscape of fixed income.

The utility of ETFs and index-linked products has also emerged as a vehicle of choice in stressed markets, where accessibility, transparency and liquidity take center stage. In March 2020, we saw index-linked products like ETFs and credit default swap indices (CDX indices) serve as the go-to instruments for market participants who needed to transact, choosing these instruments over single bonds that were difficult and costly to access in an environment of poor liquidity. As the index-based product became the vehicle of choice during this period of stress, it also became the leading price indicator for the portfolio or index of constituents, a transparent representation of fair value for the individual bonds.

The growth of certain markets, such as leveraged loans, may also be connected to the proliferation of index-linked products in this asset class. The U.S. leveraged loan market as a whole has grown significantly over the last 10 years, from about USD 400 million to USD 1.2 trillion, as defined by the iBoxx USD Leveraged Loan Index, now rivaling the U.S. high yield bond market. This has been alongside the growth of the broader loan ecosystem, which includes index-linked products and derivatives in the loan space.