Introduction

Launched in October 2011, the S&P/ASX Australian Fixed Interest Index provides a broad measure of the performance of the Australian bond market. Since its inception, the index and its subindices have been widely utilized among asset managers, including serving as benchmarks for Australian-focused ETFs.

Evolution of the Market

In 1983, the Australian dollar was moved to a floating exchange rate, which led to its internationalization. Trading activity in the Australian dollar grew significantly and it is now one of the most actively traded currencies globally. This has played an important role in the development of the AUD bond market, which is a key market for investors both domestically and internationally.

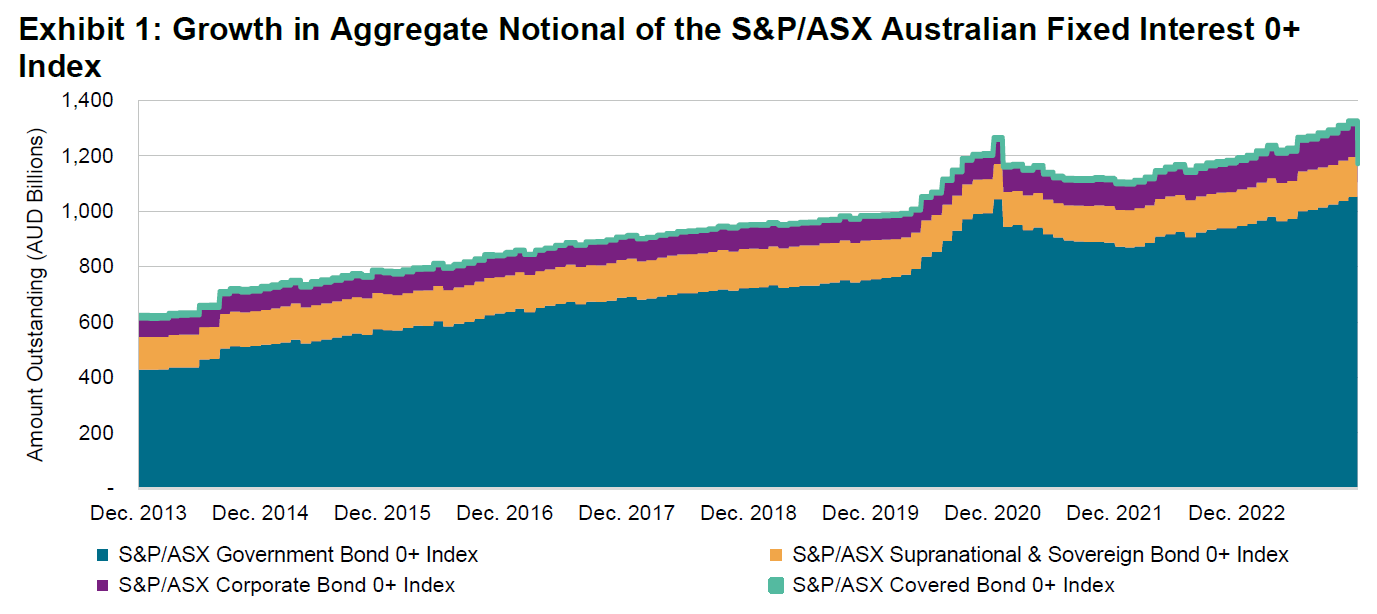

Over the past 10 years, the overall size (by notional outstanding) of the AUD bond market—as represented by the S&P/ASX Australian Fixed Interest 0+ Index—more than doubled, increasing from AUD 615 billion in late 2013 to AUD 1,327 billion at the end of 2023 (see Exhibit 1). The outstanding notional of AUD-denominated Australian government bonds grew at a faster pace than corporate bonds during the past decade, increasing 127.3% and 82.5%, respectively.

As the market grew, Australian government and semi-government bonds remained the cornerstone of the bond market, representing close to 90% of the overall notional outstanding of the index.