S&P Dow Jones Indices (S&P DJI) and the Japan Exchange Group (JPX) have jointly developed the S&P/JPX Prime Market 250 Index—the first index focused on companies that are members of the Tokyo Stock Exchange (TSE) Prime Market that is designed for global investors. Launched Dec. 9, 2024, the index comprises a broad range of 250 Japanese large- and mid-cap companies that meet size, liquidity, profitability and sector diversification requirements.

Incorporating many of the same key methodology principles as the widely followed S&P 500, the S&P/JPX Prime Market 250 Index could well be seen as a “Japanese version” of The 500™.

What is the Prime Market?

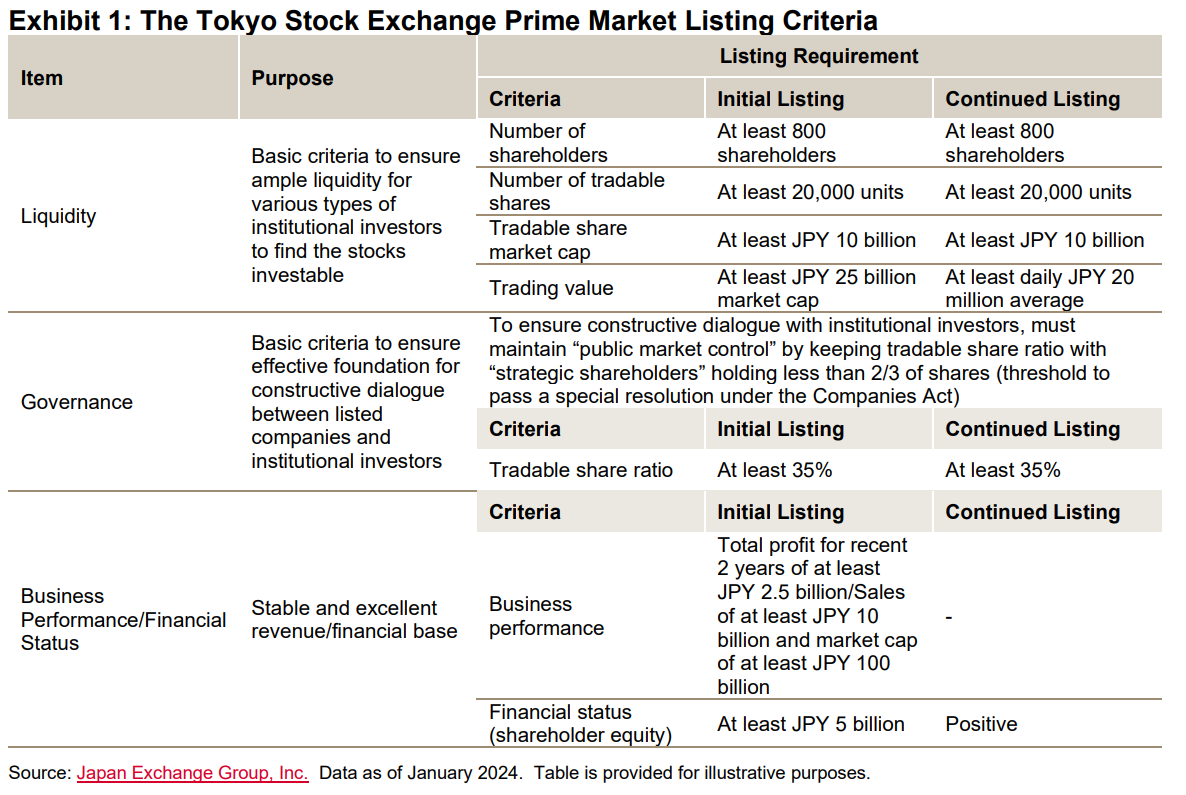

The Japanese stock market was restructured in 2022, shifting from four market divisions to three, now including the newly formed Prime Market, as well as Standard and Growth Markets.

This restructuring aimed to better define the concept of each market division, reduce overlap between the markets and provide incentive for companies to sustainably increase corporate value.

As of Dec. 31, 2024, there were 1,636 companies that met this Prime Market listing criteria. These companies are included in the TSE Prime Market Index, which serves as the selection universe for the S&P/JPX Prime Market 250 Index.

S&P/JPX Prime Market 250 Index Methodology Summary

The S&P/JPX Prime Market 250 Index is intended for foreign market participants and foreign-registered investment-linked products. The index is weighted by float market capitalization, which includes adjustments for foreign ownership restrictions. The S&P/JPX Prime Market 250 Index constituents are leading companies in the Japanese equity market, selected on the basis of size, liquidity and GICS® sector representation.

As well as being a member of the TSE Prime Market, eligible constituents in the index universe must achieve a positive quarterly earnings per share (EPS) at least once in the past four quarters.