Introduction

The S&P/ASX 200 High Dividend Index seeks to measure the performance of 50 companies with the highest 12-month forecast dividend yield from the S&P/ASX 200. From July 2011 to December 2023, the index had an average trailing 12-month dividend yield of 5.6% and an annual excess return of 2.2% compared with the S&P/ASX 200.

The Australian equity market is well known for its high dividend yield and well-cultivated dividend culture. With over AUD 5 billion AUM in exchange-traded products (ETPs), dividend income has become one of the most popular factor strategies in Australia.

However, strategies chasing the highest-yielding stocks could be vulnerable to “dividend traps.” High dividend yield may come from decreasing stock prices rather than increasing dividend payments. In addition, selecting stocks based on historical dividend payments may not reflect a company’s prospects.

The S&P/ASX 200 High Dividend Index seeks to mitigate common risks faced by high dividend yield strategies using two tactics. First, it applies momentum screens. Excluding stocks with low price momentum could avoid high-yield stocks driven by deteriorating prices, thus may help to eliminate the dividend trap. Second, it uses forecast dividend data. Selecting stocks based on 12-month forecast dividend data that is forward-looking may help to reflect the latest market expectations on a company’s future dividend payments.

Over the 12-year back-tested period, the S&P/ASX 200 High Dividend Index has shown significant outperformance, with higher dividend yield and cheaper valuation than the broad market benchmark. For market participants seeking high yield and diversification benefits, the S&P/ASX 200 High Dividend Index could help to complement broad market allocation as well.

Index Construction

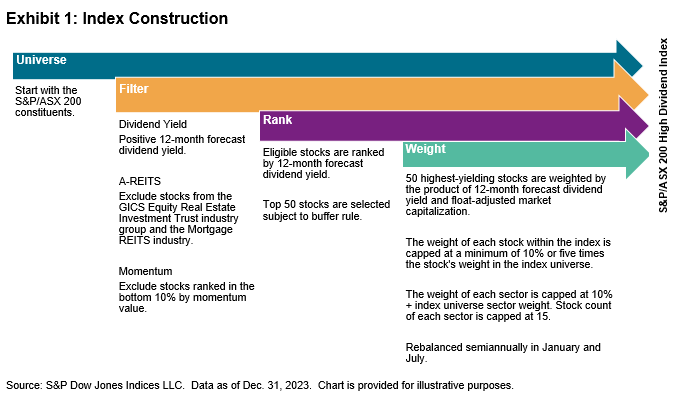

First, starting from the S&P/ASX 200 universe, all A-REITs and stocks without a positive 12-month forecast dividend yield are excluded. Second, eligible stocks ranked in the bottom 10% by momentum value are screened out. Finally, the 50 constituents with the highest 12-month forecast dividend yield are selected.

To balance between the index yield and index capacity, the 50 selected names are weighted by the product of the 12-month forecast dividend yield and the float market capitalization. To avoid stock concentration risk, the weight of each stock within the index is capped at a minimum of 10% or five times the stock’s weight in the index universe. In terms of sector diversification, each sector can have maximum of 15 stocks, and its weight cannot exceed the sector weight in the index universe plus 10%. The index is rebalanced semiannually in January and July.