Company Background

- Who is S&P Dow Jones Indices (S&P DJI)? S&P Dow Jones Indices (S&P DJI) is the largest global resource for essential index-based concepts, data and research, and is home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes, helping to define the way investors measure and trade the markets.

- Who is S&P Global Trucost? S&P Global Trucost is a leader in carbon and environmental data and risk analysis, and it assesses risks relating to climate change, natural resource constraints and broader environmental, social and governance (ESG) factors.

S&P Net Zero 2050 Carbon Budget Indices

3. Can you describe the methodology in short? The indices are based on the concept that all types of financing can replicate the remaining global carbon budget as published by the Intergovernmental Panel on Climate Change (IPCC). In the IPCC’s most recent report, the remaining global carbon budget of 300 GtCO2 in 2020 would be necessary in order to achieve a 1.5°C objective by 2050, with an 83% probability and a starting point of 31.5 GtCO2. Accordingly, there is a starting point (31.5 GtCO2), an endpoint (2050) and a budget (300 GtCO2) to spend between these two points.

In short, starting in 2022, S&P DJI will allocate a carbon budget each year (each new index will reflect a decarbonization trajectory based on the then-current remaining carbon budget) among index constituents based on their emissions. The total index carbon emissions will mirror the trajectory necessary to be carbon neutral at the planet’s level (i.e., in 2022, to meet 1.5°C climate objective, this equates to an initial 25% emissions reduction, followed by a 10.1% reduction each year until 2050).

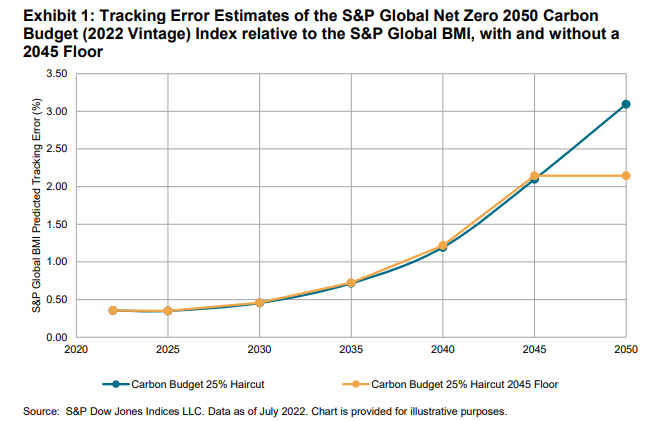

The market impacts are limited in terms of tracking error and the number of stocks at inception. The tracking error and stock count are anticipated to deviate from the underlying index over time. It becomes increasingly challenging to be carbon neutral if the world and underlying index do not decarbonize, but a decarbonization floor (which is not included in the current methodology) may reduce the impact.

As the carbon budget shrinks with time, new indices may be launched in the future for new entrants that will incorporate a decarbonization pathway using the remaining carbon budget based on then the current IPCC report.