Company Background

1. Who is S&P Dow Jones Indices? S&P Dow Jones Indices (S&P DJI) is the largest global resource for essential index-based concepts, data and research, and it is home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than in products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes, helping to define the way investors measure and trade the markets.

2. Who is S&P Global Sustainable1? S&P Global Sustainable1 is a leader in carbon and environmental data and risk analysis and assesses risks relating to climate change, natural resource constraints and broader environmental, social and governance (ESG) factors.

S&P Guarded Indices

3. What are the S&P Guarded Indices? The S&P Guarded Indices measure the performance of eligible securities from an underlying index, selected and weighted in an attempt to collectively enhance ESG profiles and reduce the carbon footprint with respect to the underlying index. The indices apply exclusions based on companies’ involvement in specific business activities, performance concerning the principles of the United Nations Global Compact (UNGC) and involvement in relevant ESG controversies.

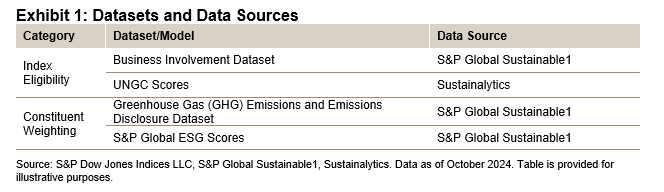

4. What ESG datasets are used in the S&P Guarded Indices Methodology? The indices use several climate, ESG and business involvement datasets, as shown in Exhibit 1.

5. Why are these datasets used in the S&P Guarded Indices Methodology? The purpose of the index methodology is to minimize the deviation in constituent index weights from their benchmark weights while satisfying multiple constraints, including those on carbon intensity, as well as S&P Global ESG Scores. The datasets help achieve that purpose and help manage the constraints. The constraints are defined using the datasets from the data sources noted in Exhibit 1.

For more information on how the indices are calculated, see the index methodology.

6. What indices are in the series? As of 16, 2024, the indices available in this series are:

7. How are ESG controversies dealt with in the S&P Guarded Indices Methodology? The S&P Global Media & Stakeholder Analysis (MSA) monitors ESG controversies, which include a range of issues such as economic crime and corruption, fraud, illegal commercial practices, human rights issues, labor disputes, workplace safety, catastrophic accidents and environmental disasters.

The Index Committee reviews constituents that have been flagged by the S&P Global MSA to evaluate the potential impact of controversial company activities on the composition of the indices. In the event that the Index Committee decides to remove a company, that company would not be eligible for re-entry into the indices for one full calendar year, beginning with the subsequent rebalancing.